Negative Interest Rates Coming for Australia?

News

|

Posted 09/08/2021

|

10068

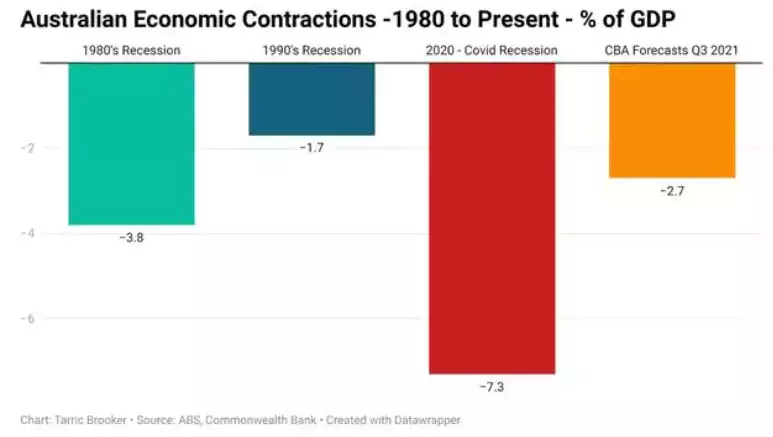

There is a growing view by economists that Australia will experience a double dip recession over Q3 and Q4 of this year with the latest from CBA calling for a 2.7% contraction in Q3. A recession is 2 consecutive quarters and with NSW expected to stay in lockdown until mid November as CBA’s base case, and the likelihood of continued but hopefully shorter lockdowns in other states, Q4 seems a real possibility after such a plunge in Q3. The chart below puts that single quarter -2.7% into context with the entire 1990’s recession being -1.7%.

Whilst most are talking Q3 & Q4, NAB last week predicted there could be a shock negative print for Q2 yet to be released. From the AFR:

“NAB’s assessment stems from a fall in export volumes over the quarter, primarily iron ore, which is unlikely to offset by an increase in inventories because the slowing stemmed from production not shipping.”

Regardless, there is no doubt about what is coming and the fact that there is debate about whether Q2 will be negative or positive tells you the extent of the misguided ‘everything is awesome’ narrative.

Indeed so poor is the outlook that our banking regulator APRA was telling our banks to prepare for negative interest rates before Sydney even went into lockdown. We have shared before the tight correlation between the gold price and negative yielding government bonds. Central bank negative rates is not a new thing. The EU has held rates negative for some time and the likes of Japan, Switzerland and Denmark for many years. Earlier this year the Bank of England also warned it’s banks to prepare to implement negative interest rates. The theory goes that if you have to pay the bank for the privilege of holding your cash then you will be more likely to want to go out and spend it in the economy or, of course, further expand the property and sharemarket bubbles by ‘investing’ it there. That Japan has been doing it so long with little benefit should warn you of it’s effectiveness. What Japan does have to show for it though is the world’s highest debt per population…. Also what has been clear from the Euro implementation is that it is damaging to banks as well as it turns their business model on its head.

Further to our article on Friday, CBA are warning of 300,000 lost jobs in Sydney alone due to the lockdown and NAB have the cost already at around $16b. However in stark contrast to that article on Friday, if we do go into negative interest rates, that could be an impetus for even higher house prices as outlined above. That we could have 2 such opposing outcomes put forward by intelligent analysts highlights the ‘unbalanced’ nature of the current economy.

The US market highlighted this on Friday night our time. The US nonfarm payrolls saw a monster print of 943,000 new jobs, way in excess of expectations. That saw gold, silver and bonds hit hard and the USD rise. That nearly 2/3 of those new jobs were ‘reopening’ jobs in hospitality and teaching just as the US starts to reel now in the face of Delta was not part of the narrative.

Probably the key takeaway is that no one seems to really know what the future holds. For us mere mortals needing to decide where to invest our hard earned wealth, that is cold comfort. You must, however, on any dispassionate assessment see one thing appears certain, and that is the monetary stimulus will continue. CBA in the above assessment don’t see rates rising now until May 2023! One of the tightest correlations despite any of the above scenarios is gold’s link to negative REAL rates. Whether official rates go negative or not, inflation subtracted from the current near zero or a future negative rate is still well and truly firmly and unprecedently negative.