NINJA loans coming and a Government Piggy Bank

News

|

Posted 23/05/2024

|

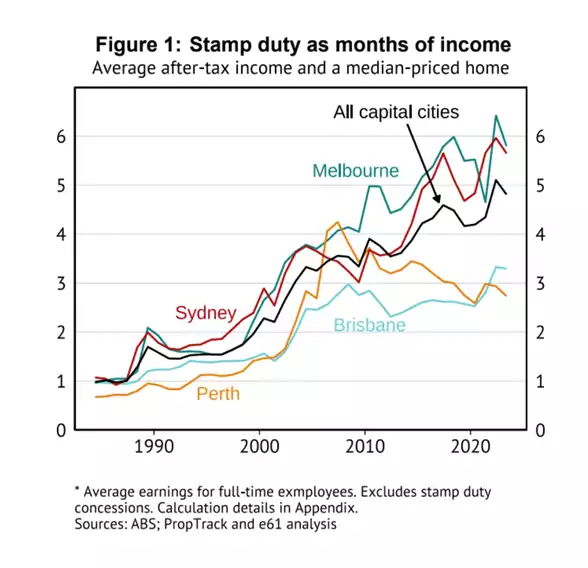

2900

The Australian property market is broken. And the more banks and governments do to try to resolve it the more broken it becomes. Taxes on property keep going up, Victoria recently increased its stamp duty and NSW added a new ‘Growth and Infrastructure Levy’. Additionally stamp duty which has been subject to bracket increases as house prices outpace inflation at a record rate now costs 6 months of average earnings compared to 1 month in the 1980s. Meanwhile the government mandate of 1.2 million new properties (a statistical impossibility) is being assisted by the banking market with the CBA allowing off the plan buyers to pay just $10,000 towards an off the plan dwelling with the remainder being financed by a property tech platform Coposit. What could possibly go wrong as the government puts on the migration brakes and unemployment shocks increasing from 3.7% to 4.1% in this month’s release?

NINJA Loans

As house prices reach the stratosphere due to migration and ever-increasing taxes, Fintech developers and banks have a new product to help keep the Ponzi scheme going, being offered to NINJAs *(no income, no job, no assets). The new product from the CBA and Coposit will allow first home buyers to break into the market with $10,000 payment on new builds allowing easier access for developers to finance the ever-growing cost of building, taxes, and compliance to get a development off the ground. It’s not just the buyers struggling for deposits – it’s the developers struggling to raise sales hurdles, as high as 80%, before developments can begin. This new product allows for the CBA to start funding the new developments without either the hurdles for the developer (presales) and the investor (deposit).

If the home buyer is unable to pay the deposit on completion the developer can decide whether to put the lot back on the market or allow for a delayed settlement. Look back to the GFC and subprime mortgage debacle for some historical context on NINJA loans.

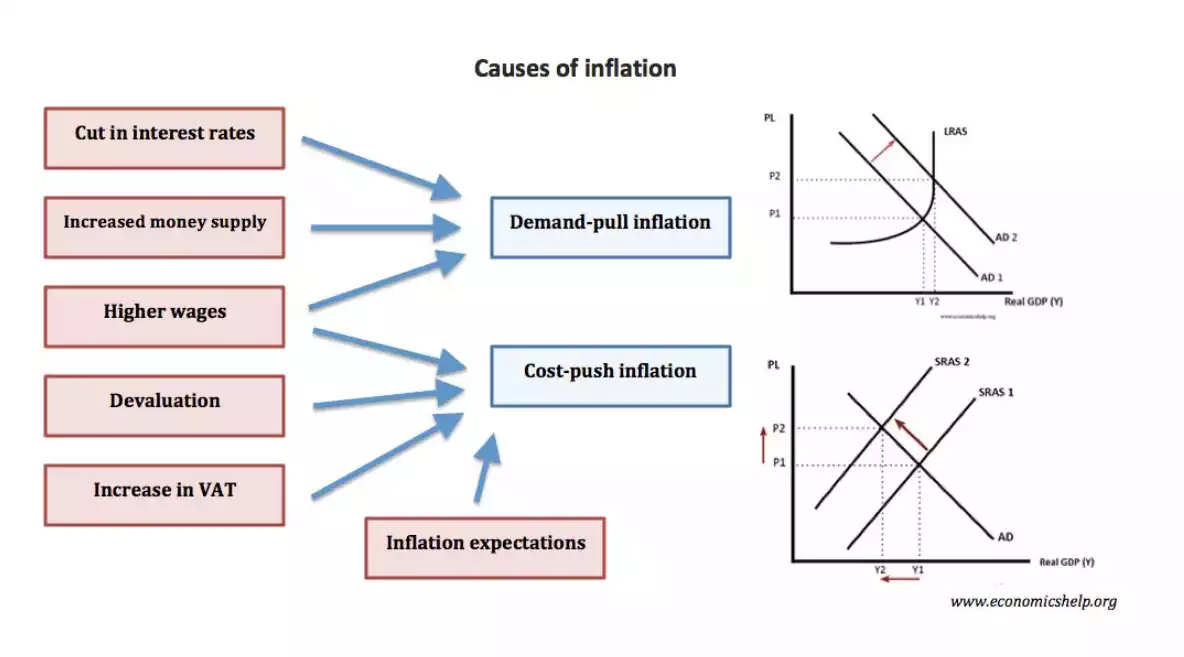

Housing - Demand Pull/Supply Push Inflation

We’ve spoken a lot about this type of inflation, and I want to pull you back to this regarding the Australian housing market, and how every government fix becomes a cost push inflation problem, without (as usual) them looking at the Demand – pull inflation issues.

Demand – Pull inflation (which can be remedied with changes in interest rates) in the housing market are increased supply (at sustainable pricing modelling) and decreased demand (aka less immigration).

The government continues to talk about how they have a 5 year 1.2million housing mandate – with scarce detail on how this impossible target can be met with a reduced pipeline and 240,000 dwellings per year as peak building capacity – this mandate seems highly unachievable. Migration, another possible demand-pull remedy, seems unlikely to be tempered before the next election or else a recession will rear its head.

So, we’ve established the demand-pull inflation won’t be tempered in the Australian market, so what about at least reducing cost push inflation? The Australian Fiscal spending will continue to put pressure on wages and increase pressure on building resources, with increased infrastructure spending taking tradespeople away from building houses. Additionally, and despite the 1.2million mandate, taxes continue to increase on housing. Firstly, through compliance and building taxes and secondly by the ever-increasing stamp duty revenue as each house is sold.

The Government Piggy Bank

So how much does the government make building new dwellings? To put these taxes in perspective we put together a non-comprehensive list for NSW for a $3 million dollar land sale and build for 8 units as below at a sale price of $8million.

- $3million land sale - stamp duty $148,000

- DA lodgement fee $15,000

- Approval 7.12 $40,000 (plus a returnable bond of $15,000)

- NSW construction levy $30,000

- NSW Growth and infrastructure levy $80,000 ($10,000 per dwelling)

- Stamp duty on sale of $1million units $320,000 ($40,000 per dwelling)

Total government take on an $8million total residential project = $603,000 or 7.9%

Stamp Duty and reduced turnover

In the 1980s, stamp duty in NSW cost 1 month of average earnings, this now sits at 5 times all capital cities, and more than 6 times in NSW.

Stamp duty has the additional cost of individuals not wanting to sell their house as the tax is a sunk cost that cannot be recovered, and they will have to pay again if they move. So, it reduces the turnover and scarcity of houses and means individuals live in houses that may be too big or too small creating a misallocation dynamic between older and younger generations. A recent study by e61 Institute and Prop Track (found here PowerPoint Presentation (rea-group.com)) determined that a 1% increase in the rate of stamp duty reduced the number of home sales by 7.2%. It also means that the cost of moving becomes so high that allocation of labour to where it is required is reduced, reducing economic productivity.

The end game

NINJA is an endgame product and might, like during the GFC, signal the end of a cycle. Ideally that cycle may be the understanding of the government that taxing 7.9% of any new project, stifling home sales through stamp duty bracket creep and mandates with no ability to achieve are not good policies, bad sadly I think it just means no one learnt their lesson during the GFC and history is about to repeat.

Topically, another real, hard asset, gold is not subject to this and is also highly divisible and liquid.