NFP Does Nothing to Allay US Recession Odds – Brace

News

|

Posted 10/10/2022

|

11613

Last week we wrote to the record jobs movement in the US and explained that further in Insights afterward. This was all the prelude to the monthly Non Farm Payrolls data that came out on Friday night. Ahead of this week’s CPI inflation print, the NFP is the most eagerly anticipated data when it comes to this market’s fixation of the ‘what will the Fed do next’ game.

The data clearly did not impress the sharemarket as the S&P500 fell 2.8% and the NASDAQ plummeting again, down 3.8% in the session. In the ‘good economic data news’ means ‘bad news for a sharemarket’ wanting the US Fed to take their foot off the hiking pedal, you could think the print was amazingly good given the sharp reaction. But it really wasn’t, so what gives?

As discussed last week, the market expectation was for 255,000 new jobs for September and this was exceeded but only mildly with a 263,000 print. And so the market reacted like this was somehow ‘awesome’. In fact though, this was the weakest print since April 2021 and apart from a couple of outliers, cements a gradual decline from the peak late last year.

The much watched headline unemployment rate dropped from 3.7% to 3.5% including a dropping participation rate. Wage growth came in as expected and still a weak 5% annualized against their 8+% inflation rate. So in other words, there was little in the headline that would see the Fed ease off hiking rates and continuing with QT, and so everything sold off in despair.

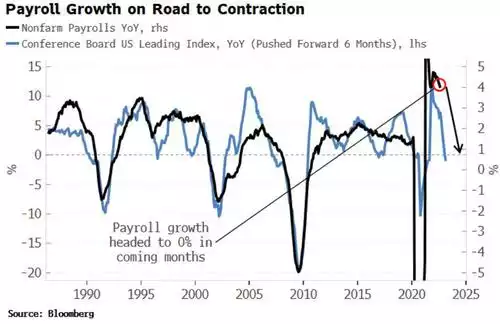

But what is becoming abundantly clear is that they will be doing so into a recession and this latest NFP does little to give any comfort of this being avoided.

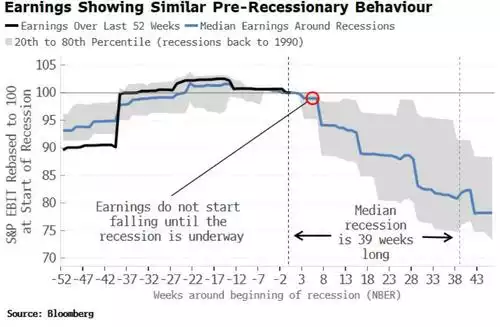

Likewise the earnings trajectory is not painting a good picture:

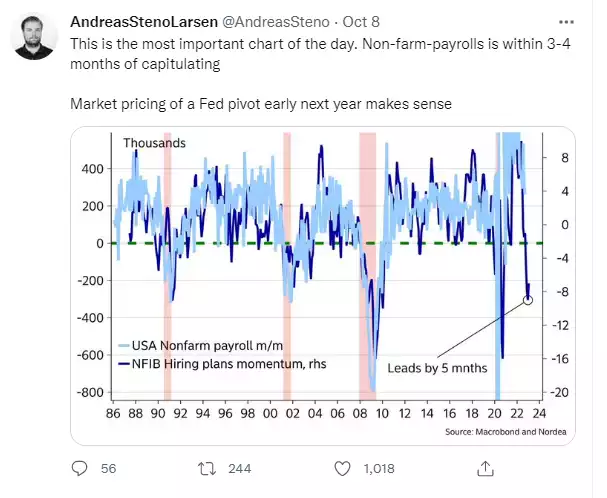

When combined with the latest National Federation of Independent Business (NFIB) survey hiring plans, you can see the correlation is clear that the employment situation is about to get ugly early next year:

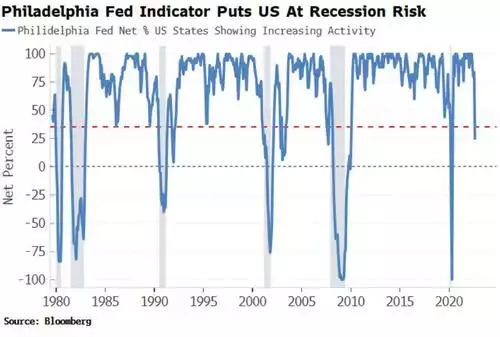

Beyond the jobs indicators there are many and varied metrics by which a recession can be predicted. According to Simon White (Bloomberg Markets Live reporter and strategist) the Philadelphia Fed State Coincident Diffusion Index is one of the best and has just dropped to a level that is seen prior to recessions:

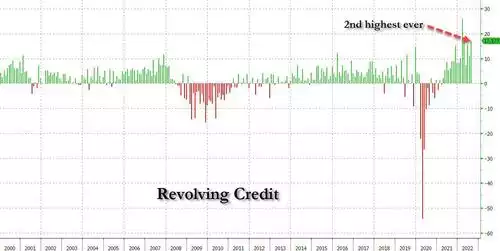

Whilst a ‘strong’ jobs market is read as economic strength the reality behind the headline is anything but with there still being a large cohort ‘working part-time for economic reasons’ and many of those with multiple jobs just to keep up with the very cost of living the Fed is determined to stamp out. If you want one good metric to illustrate the pressure on average Americans to survive (for now) then look no further than credit card debt which just hit its 2nd highest level ever…

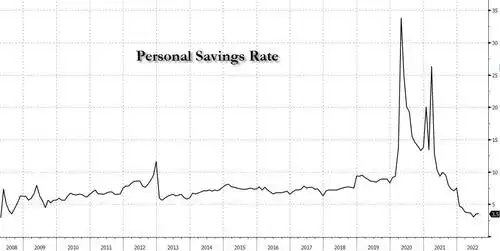

…whilst savings are at their lowest on record..

And so, yet again we see the Fed’s (and every western central bank) dilemma. Keep hiking and bring on the recession that will see a sharp reversal of the strong jobs markets and this broadly financialized economy as shares tank. Pivot, lowering rates and ending QT, and the shares soar initially on the free money game being back, but inflation kills an already near dead main street, consumption dies and with it earnings and GDP. Any scenario sees economic turmoil and a very strong reason to be in gold as protection.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************