Mystery Gold Buyer Confirmed

News

|

Posted 09/12/2022

|

17985

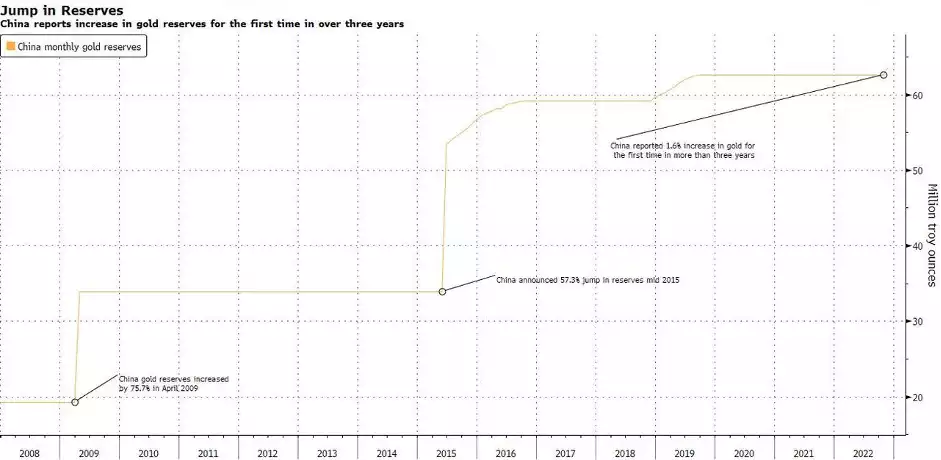

The People’s Bank of China (PBOC) reported their first official increase in its gold reserves for the first time in over three years, confirming the rumours that it was the “Mystery Buyer” behind the Central Bank gold craze we saw last quarter.

Perhaps unsurprisingly, yesterday it was announced that the Chinese Central Bank increased its gold holdings by 32 tons in November.

While the lack of clear reporting and transparency in the above graph is laughable (as there has not been an update since September 2019), the trend is clear. China is buying gold at an extraordinary rate.

China is not alone. In fact, newly released data by the World Gold Council showed that Central Banks globally added an additional 31 tons of gold to their official Reserves last month, with the Central Bank of UAE being the largest buyer, purchasing a total of 9 tons of gold in October.

This continues the key theme throughout the year of global central banks buying at record rates, with nearly 400 tons of gold being purchased in the July-September quarter alone, quadrupling the amount of gold bought during this same quarter last year.

To place these historic numbers in further context, the year-to-date total for 2022 is the largest amount of central bank gold purchases on record since 1967.

This recent excerpt from Bloomberg News discussing the characteristics of bullion, best describes the recent surge in gold demand.

“Bullion does have one crucial advantage: unlike bonds, it doesn’t bind you into a relationship with an unreliable counterparty…In a world where you can trust no one, it makes sense to bulletproof yourself with metal.”

The distinct lack of counterparty risk that exists with gold makes it significantly more attractive as a store of value than the US dollar, particularly for countries that have turbulent relationships with the West, namely China and Russia.

As we’ve seen with Russia this year, the consequences of geopolitical tensions with Western nations only worsens the greater the reliance on the US dollar, i.e the overseas assets of many Russian oligarch’s were frozen after the Ukraine invasion.

As commonly reported, Russia attempted to lessen the blow of potential Western sanctions by aggressively stockpiling gold for the past 15 years up until 2020.

China appears to be following a similar playbook. In fact, rumours are circulating that they have been buying gold from Russia throughout the past 2 years, which in part would explain the distinct lack of growth we’ve seen in Russia’s International Gold Reserves since 2020.

Like Russia, UBS analyst Giovanni Staunovo claims the ‘dedollarization’ thesis is possibly part of a longer-term plan for China too.

“Gold holdings in China as part of the total reserves are still very low, so there is probably room for further purchases down the road.”

Anticipate seeing further revelations over the coming weeks/months pertaining to China’s rapidly increasing gold reserves. And furthermore, the key reason why these nations are stockpiling hefty reserves is becoming clearer by the day. It is the same reason why we as individuals often buy gold, sovereignty.