“Mr Too Late” - Is Trump Correct in Calling Out the US Fed Chair?

News

|

Posted 07/05/2025

|

1542

The US Federal Reserve has a reputation of being notoriously late to enact policy changes with them being “data dependent”, and the data they depend on lagging by months behind real changes in the economy.

While some will disagree with this sentiment, US President Donald Trump isn’t one of them, having recently been very vocal about his disapproval of US Fed chair Jerome Powell’s decisions around holding interest rates steady, calling him “Mr Too Late, a major loser”.

While the US Fed must maintain an image of independence from the president to sustain market confidence in central bank intervention, is Trump's assessment of the US Fed being too late, correct?

US Truflation At 1.45%

While it is no secret that CPI data is both lagging and manipulated – data sets like Truflation can provide investors with more up-to-date, unbiased readings of inflation rates. With the current reading at an anaemic 1.45% - it appears for now - that the US Fed has been sufficiently restrictive with monetary policy to help calm the runaway inflation caused by their extravagant 2020 stimulus printing.

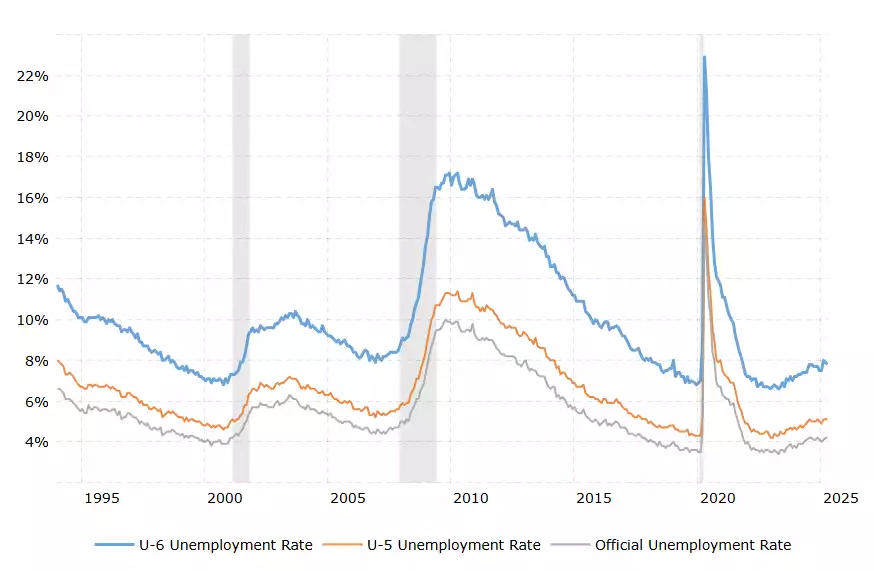

Unemployment Steadily Increasing

The unemployment rate has been steadily increasing, in what may well be a lead-in phase to the sudden acceleration. While this could certainly roll over - and chop around sideways - the current uptrend is (worryingly) yet to show signs of slowing.

With the US Fed’s official mandate being to manage inflation and unemployment - and with inflation cooling, and unemployment ticking up - one is forced to ponder. What is the US Fed waiting to see before decisively cutting interest rates?

Trump vs Powell

With Trump putting pressure on Jerome Powell to cut rates and Powell standing strong - many are questioning who finally calls the shots. To answer this, we look towards the market that both the US president and Fed chair must inevitably bend the knee to - the US Bond markets.

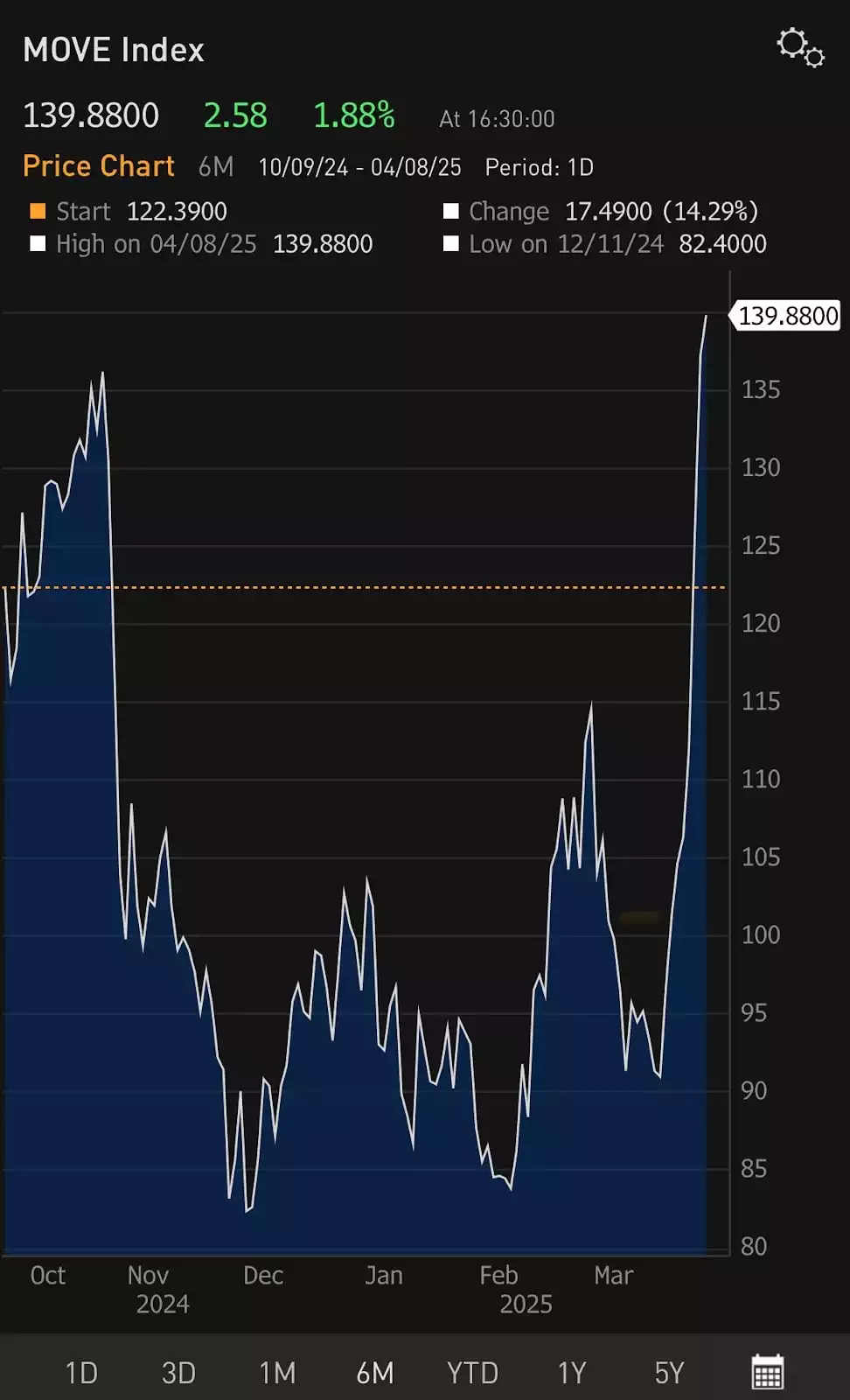

Bond Market Volatility

The MOVE index tracks volatility in the bond markets. Recently Trump's tariff policies resulted in massive sell offs in stocks and widespread critique from rival politicians - however he remained steadfast in his goals and methods - unflinching in the face of short-term pain for long term gain.

However, as nation states began retaliating, we found major volatility in the US bond markets -with the US10Y yield spiking and bond values plummeting. While we found that Trump would not relent for the sake of stock market, politicians, or voter sentiment - once the US 10Y yield spiked - he immediately began cooling off on his stance.

This action in the US bond market caused a spike in the MOVE index to 139.88. It is noteworthy that historically, a MOVE at 140 has resulted in US Fed intervention to stabilise the bond market with monetary easing, which is what Trump wanted all along.

So, while Trump and Powell argued in the backseat, the US Bond markets threatened to “turn this car around”, resulting in US Fed likely easing in line with Trump's views, and Trump cooling off on tariffs, putting a likely end to their disagreement.

However, one can’t help but wonder - was this reaction from the bond market in the front seat, part of Trump's plan all along to get Jerome Powell to bend the knee?

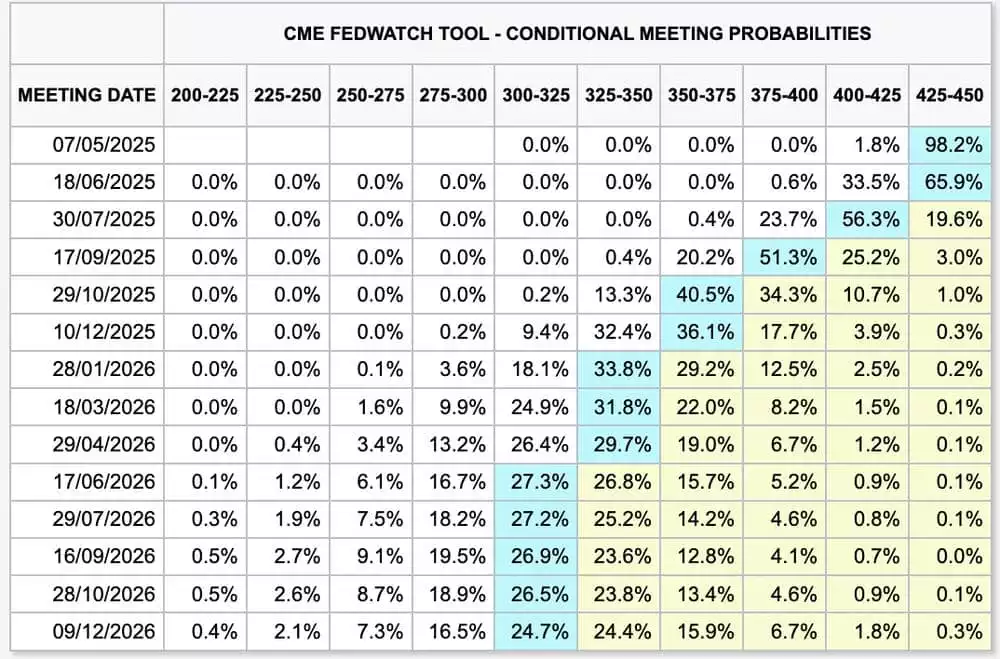

While the market is predicting no rate cuts at tomorrow’s Fed meeting - looking forward it seems likely that a genuine rate cutting cycle will likely commence by next month - however, all eyes are on the US10Y to validate this expectation. A drop in US bond yields will all but confirm this rate cutting cycle.

While we could always see a surprise rate cut at tomorrow’s meeting – it seems most likely that rates will be held still. What is arguably more relevant however, is the rhetoric around monetary easing during the press conference which follows, the forward guidance that will greatly influence stock and bond markets alike.

So, the question remains, will the US Fed act in time and engineer a soft landing after all? Or will they be characteristically late to act once again, playing catch up down the track with emergency style easing instead?

While this is yet to be seen, one thing is for sure, the uncertainty in financial markets and global politics is far from over. In fact, if macro cycles are any indication, we haven’t seen anything yet!

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=i1chbSx-kgg