More Sharemarket Crash Warning Signs

News

|

Posted 01/02/2017

|

7075

So now for something completely different… some more evidence of what looks to be a very overly exuberant US sharemarket, this time courtesy of some excellent graphs from the Lamensdorf Market Timing Report who have just issued a recommendation to go to their maximum short position of 50%...

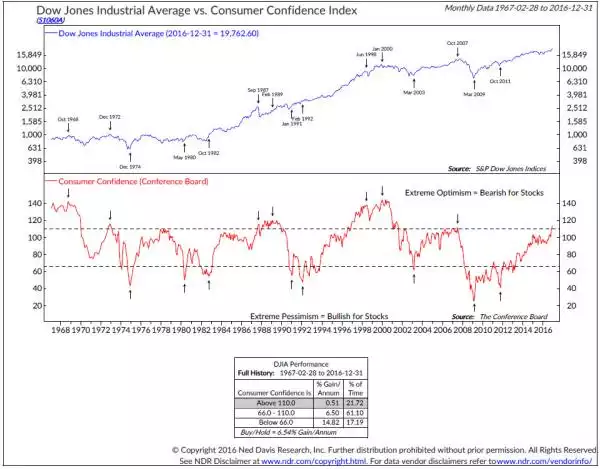

Firstly, listeners to the Weekly Wrap will know how consumer confidence has rebounded strongly on Trump-phoria. The chart below shows the unhappy relationship between euphoric confidence and the Dow Jones immediately after each peak.. At 113 it is now at its highest in over 15 years.

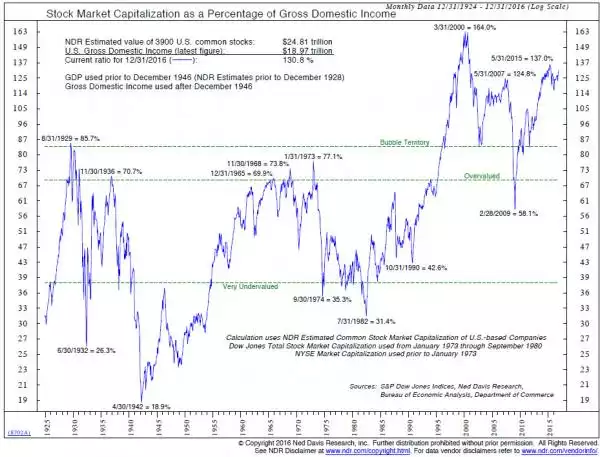

Second… Sharemarket capitalisation as a percentage of gross domestic income is currently at its second highest level in 90 years at 131%!

Third… For some the purest or least subject to manipulation figure is the price to sales ratio (as opposed to the traditional ‘earnings’ which can be enhanced through accounting tricks). On the S&P500 it is also at its second highest level in history with, yet again, the extraordinary dot.com bubble the only one higher (and it lost 80% in its crash)…

But it’s probably different this time yeah?....