More Cracks for USD Hegemony

News

|

Posted 23/01/2019

|

7675

The farce that is the US government shutdown, constant witch hunt over the Trump Russian election collusion, unilateral sanctions, trade wars and of course the not so small issue of $22 trillion in official debt and around $200 trillion in committed unfunded liabilities not even on the books does little to instil confidence in the mighty US dollar.

The cracks in this hegemony are starting to become very visible in meaningful ways.

Russia is probably the most prominent and President Vladimir Putin recently warned the US is "making a colossal strategic mistake" by "undermining confidence in the dollar."

Well he is taking clear action. Russia was once a top 10 holder of US treasuries. It has slashed those holdings and used the funds to acquire gold and other foreign currencies such as the Yuan, Euro and Yen.

In their latest update on the makeup of their foreign reserves to June last year (just issued with a 6 month lag) their holdings of US Treasuries dropped from 43.7% to just 21.9% and plenty of anecdotal evidence to suggest it has dropped markedly again since then. The transfer of around $100b in that sell off to other currencies saw the Euro at 32%, the Yuan at 14.7% and another 14.7% to other currencies (mainly the Pound and Yen). Their total foreign reserves increased by $40b over that year to $458b.

Their latest update gives some insight since June and gold was the big mover. Last year gold holdings increased by over $10b, a 13% increase and taking gold’s share of reserves to 18.5%. Just last week Russia overtook China to become the 5th largest gold holder in the world after adding 8.8m oz over January to November last year taking their total holdings to 68m oz or 2.125 tonne. (No one believes China is disclosing their total holdings though. They are likely the largest holder in the world now)

But it’s not just Russia. China, whilst still the largest holder of US Treasuries in the world, have been reducing their share of US Treasuries as trade tensions and sanctions have tested their patience. In tandem they have been making substantial moves to internationalise their Yuan including boosting gold reserves, starting yuan priced oil futures, and expanding trade with Yuan now and with massive expansion plans with the Belt and Road Initiative.

India, the 6th largest economy in simple terms and 3rd largest on a PPP (purchasing power parity) basis has defied the US by buying weapons off Russia in rubles and oil of Iran in rupee, and in December finalised a currency swap arrangement (bypassing the USD) with the UAE.

Turkey’s president very recently announced plans to end the US dollar hegemony through non USD trade with China, Russia and Ukraine and possibly soon Iran.

Needless to say a diminishing USD would be great news for gold. It is no coincidence then that each of the countries discussed above have a strong affinity with the yellow metal.

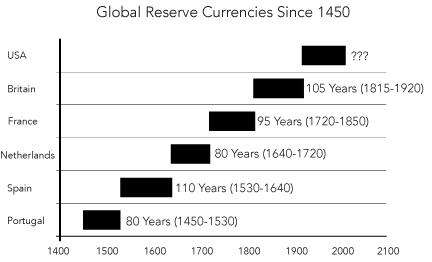

And as a reminder, history would indicate it’s time is nearly up…