Milei The Trump of Argentina

News

|

Posted 21/11/2023

|

2247

Argentina has a new right wing pro liberal president Milei. His intentions have been very clear - dollarisation of the Argentinian economy (adopting the USD), the shutting down of the Argentinian Central Bank and the possible adoption, like El Salvador of Bitcoin. Milei won by a landslide with 56% of the vote, with Messa conceding defeat yesterday. Milei’s rise is no surprise with the socialist government having led Argentina to another economic crisis, with inflation at 142% (not a typo) in 2023, and a disillusioned generation living among the ruins of skyscrapers and bourgeoise mansions from an era of economic prosperity, where Argentina was amongst the richest of developed nations up until around 1950. So what went wrong in Argentina and is dollarisation the solution or the same mistake?

Who Is Milei?

Javier Gerardo Milei is an economist and author, gaining notoriety as a supporter of the Austrian School of Economics, criticizing the fiscal policies of the government which has led to hyperinflation in Argentina. He is a professor in economics and has taught both in Argentina and abroad.

When you think Milei – think about the theatrics of Trump with the dishevelled hair of Boris Johnson. He is the Libertarian answer to a generation of despair. His theatrics include wielding chainsaws, superhero costumers and smashing of a Pinata representing the Central Bank and his quotes are even more poignant;

On Politicians

‘For me the state is an enemy, as are the politicians that live off it’

‘Mickey Mouse is the aspiration of every Argentine politician because he is a disgusting rodent whom everybody loves’

On The Central Bank

‘Last year the Central Bank robbed six points of gross domestic product via its inflation tax and this year it will rob six more points. So its fraud and that happens because inflation is not a tax approved by Congress’

‘If printing money would end poverty, printing diplomas would end stupidity’

On Government Spending

‘Redistributing of wealth is a violent act’

On China

‘doesn’t cut deals with Communists’

The Economics of Argentina

The state of the Argentina Economy has led to a generation of Economists in Argentina, with Argentina producing the most economists in the world. Not only are there huge amounts of economic degrees studied and handed out, the Argentinian economy is one of the most studied economies in the world, with the ‘Argentine paradox’; How a country has achieved such enormous financial advancements in the 19th Century only to lead to complete economic destruction, defaulting 9 times on its debt, and with inflation at times reaching 5000%. So how did this happen?

Before 1930

At the turn of the Century Argentina was as wealthy as the US, with skyscrapers rivalling New York. GDP growing 6% year on year in the 43 years before 1914. Its exports in 1914 amounted to 4% of global trade. A 2018 study of Argentina between 1880-1920 describes the country as a ‘super exporter’ crediting the boom to low trade costs and liberalization.

From 1914 1975

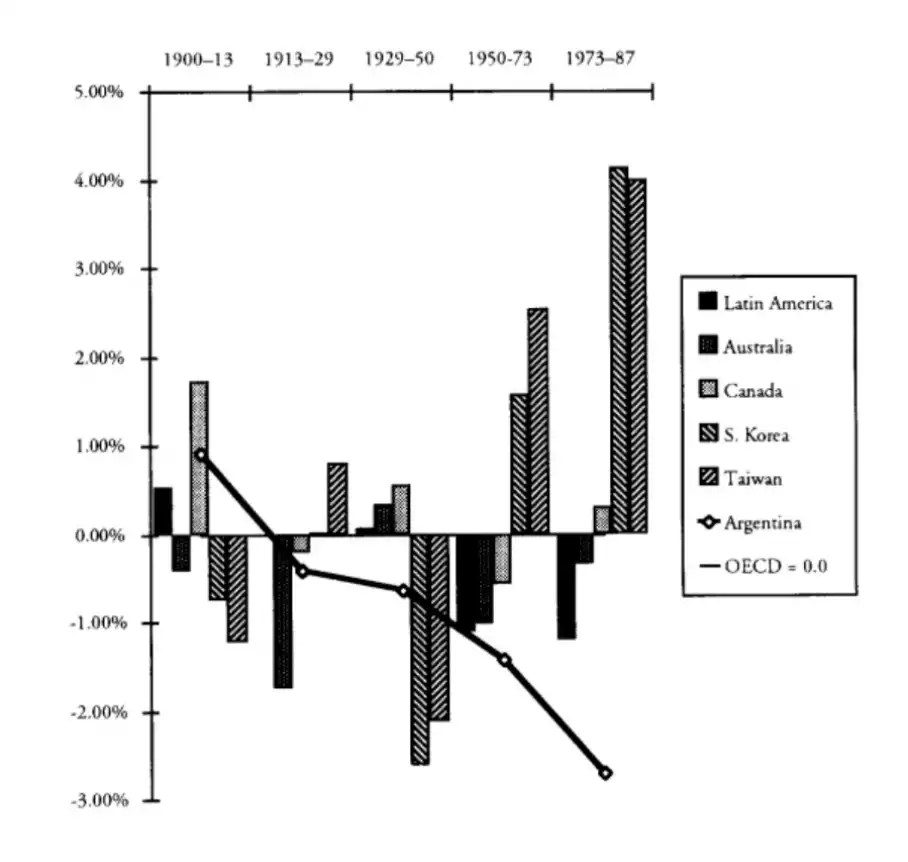

From 1914, after strong GDP growth Argentina began to see its GDP growth not keep up with developed nations. This led to significant instability with a military junta taking place in 1930 ending seven decades of a constitutional government. Up until 1930, Argentina was one of the most stable conservative countries, turning into one of the most unstable following the Great Depression. Up until 1962 the GDP per capita was higher than Japan, Austria and Spain, falling less than 1% per year up until then 1950, with an accelerated decline fallowing this period.

*Argentina comparative economic growth

Successive governments from the 1930s to the 1970s pursued a strategy of import substitution, ie the blocking of importing of manufactured goods. This policy means allocation of resources away from your competitively advantaged goods, in Argentina’s case, its farming, which pre 1914 modernisation was a key reason for the high GDP growth, to uncompetitive markets that due to government intervention have no need to innovate to stay competitive. Import substitution can achieve industrial self-sufficiency but at the cost of inflation as internally produced goods become protected and not competitively innovated.

1976 -1990 End of substitution, beginning of socialism and stagnation

In 1976, the governments pursuit of substitution ended, with the economy in ruins and a class of government protected industrialists showing huge inequality within the economy. A socialist style of government was adopted with ever growing government spending which led to chronic inflation. During this period real per capita income fell by more than 20% with protected industrialised industries declining back to the level of the 1940s. Growing government spending, large wage rises and an inefficient economy created from the substitution era, all led to inflation of 1000% in the 1980s

The US Today and Milei adoption of dollarisation - is this a mistake?

Do the mistakes of the Argentinian economy sound similar to those being made in the US but in a more rapid timeline? Substitution (Trump), Socialism (Biden) – what comes next…. Chronic inflation? By trying to stabilise the Argentinian economy by adopting the USD late in the chronic inflation cycle, could Milei be repeating the mistakes made by previous Argentinian governments?

The Argentine Paradox is real, and what is interesting is a swing in government policy, agenda and economic theorising leads to an overcorrection and exacerbation of economic uncertainty and destruction. As the world once again has socialist governments, like in the 1970s spending their way to fairness, the stagflation of the 1980s seems like the inevitable outcome for the next period of world history and how long do we need to wait for a new golden era?

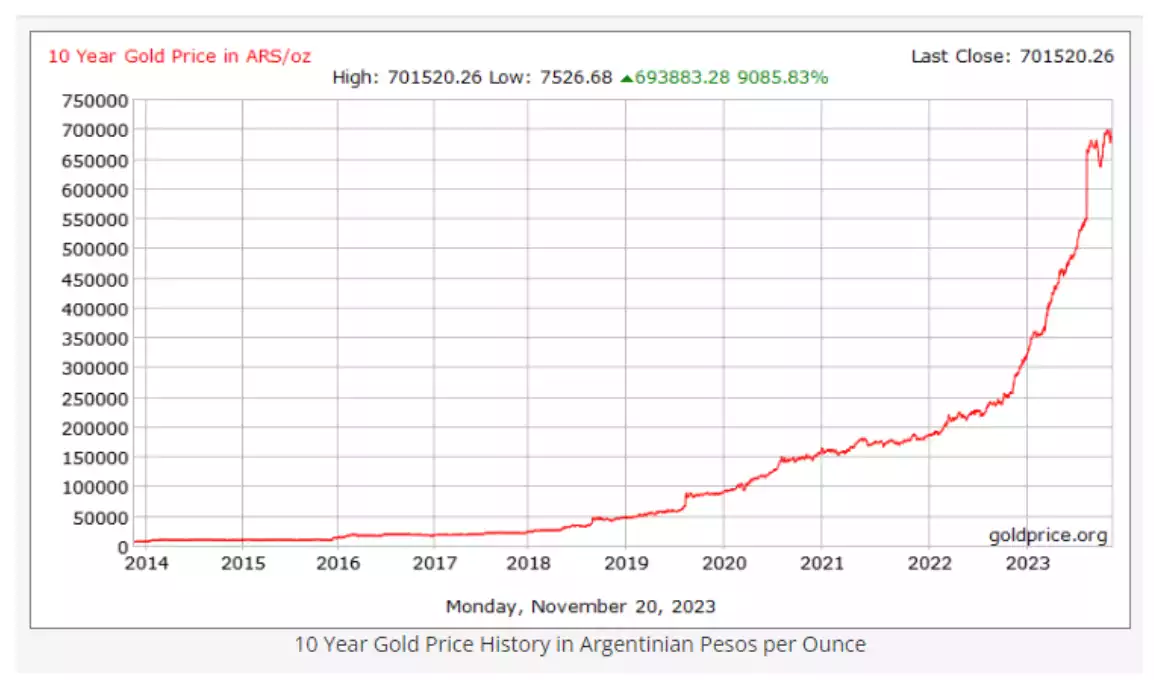

On an ‘unrelated note’… here is how those who held gold in Argentina faired over the last decade….

Source: Goldprice.org