Markets Anticipating The Merge

News

|

Posted 06/09/2022

|

10274

Amidst a persistent contraction in global liquidity, Bitcoin Short-Term Holders find themselves under immense pressure, with Bitcoin markets struggling to hold the psychological $20k support level. However, with Ethereum’s Merge coming up, is demand returning?

Liquidity across all asset markets continues to fade this week, as persistent dollar strength pushes the DXY Index to a new 20-year high of 110.27. The Eurozone finds itself under increasing stress, with the balance of trade in deficit, concerns over energy shortages, and the Euro falling deeper below USD parity.

With weakness in almost all other currency pairs, the pressure remains on equities, bonds and crypto markets alike. For Bitcoin specifically, the underlying market very much resembles the macro scene, with a volatile and uncertain short-term, whilst the longer-term outlook is more consistent and characterised by well-developed trends.

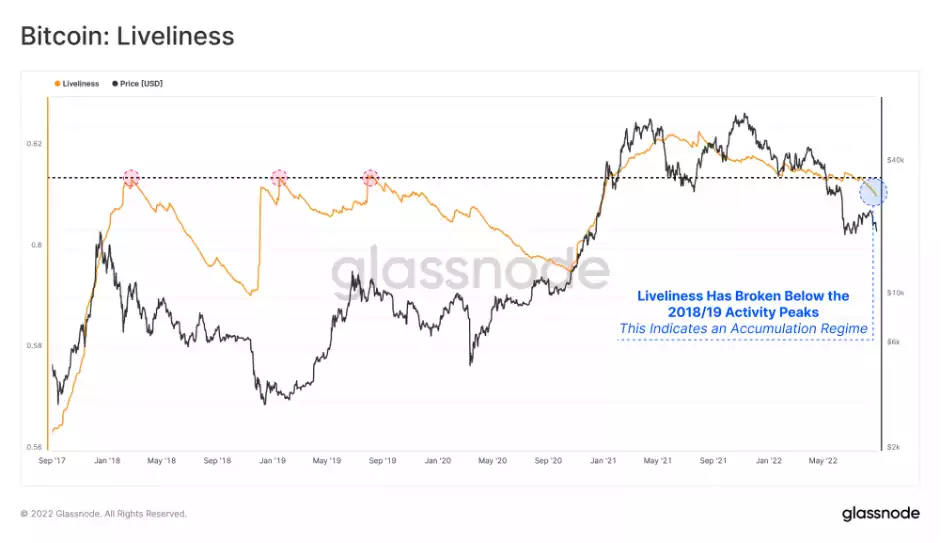

To assess the macro state of Bitcoin's long-term behaviour, we initially can turn to the Liveliness metric. Liveliness measures aggregate network activity by balancing the all-time aggregate Coin Day Destruction against all-time Coin Day Creation. The trend and gradient of it then provide information on wider market preferences for HODLing (downtrends) or spending (uptrends).

Liveliness is currently in a strong downtrend and has convincingly broken below the triple peaks of the post-2018 bear market. This event suggests that Coin Days are being accumulated by the supply much faster than they are being destroyed, and is coincident with a HODLing dominant regime.

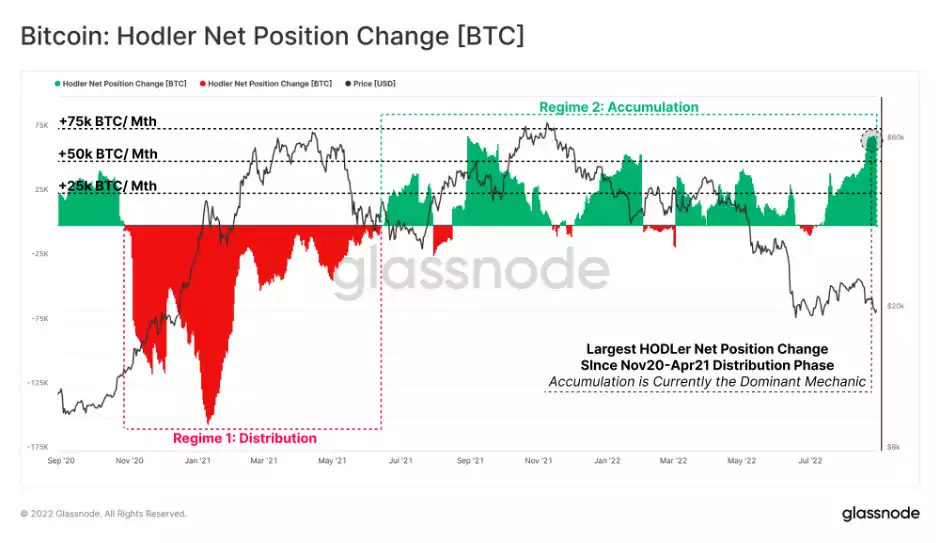

We can also inspect a derivative of Liveliness that brings it into the supply domain; the HODLer Net Position Change. This metric can be used to assess an implied monthly change to HODLed supply, with two notable phase shifts during this market cycle:

Price appreciation from Nov 2020 to Apr 2021 triggered a large-scale HODLer distribution event, with long-term investors distributing at a peak rate of -150k BTC per month.

This period of distribution has been currently balanced by HODLer accumulation from the second half of 2021 to the present. Currently, we are seeing a position change of +70k BTC per month, the largest monthly HODLer position change since March 2020.

Assessing the period from Nov 2020 to the present day, we can observe that macro HODLing behaviour is at a multi-year high, reaching 70k BTC/month, and aligning with a longer-term conviction (even whilst price action remains dire).

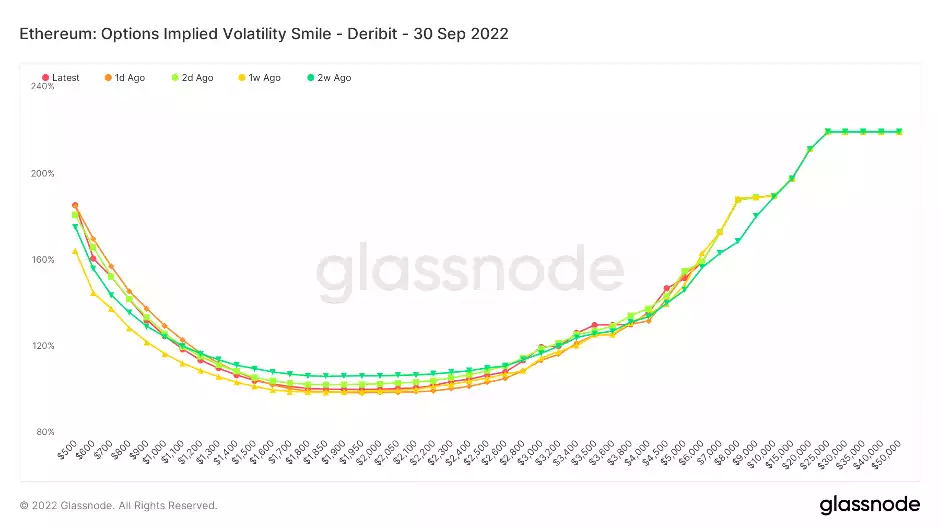

Looking towards Ethereum, options traders anticipate Ether’s price to reach $2,200 from its current $1,540 level ahead of the Merge. There appears to be demand for downside protection among traders after the Merge, indicated by a so-called “options implied volatility smile” metric (OIVS).

OIVS illustrates the options’ implied volatilities with different strikes for the specific expiration date. So, contracts out of capital typically show higher implied volatility and vice versa. For instance, in Ether’s Sept. 30 options expiry chart below, the smile’s steepness and shape help traders assess the relative expensiveness of options and gauge what kind of tail risks the market is pricing in.

With all that said, the global bear market remains in full effect with prices continuing to linger above range lows. Periods of price elation have been met with aggressive distribution from the largest of investor classes, as the search for exit liquidity persists. However, macro accumulation over a multi-year scale remains in effect, with HODLers and Long-Term Holders seemingly unfazed by prevailing economic conditions.

**********************************************************************************

This afternoon, the Gold & Silver Standard Insights team will be breaking down the charts and providing technical analysis for the precious metals and crypto markets.

SUBSCRIBE to the YouTube Channel to be notified when the Gold Silver Standard Insights video is live.

**********************************************************************************