Market Signals Republican Sweep as Biden Commits to Second Debate

News

|

Posted 01/07/2024

|

1555

The market is currently signalling expectations of a Republican sweep in the upcoming elections. According to a CNBC report, President Biden has no plans to withdraw from the race and remains committed to participating in the second debate in September. This decision has been confirmed by his advisors, but keep in mind that this could change if he gets pressure from his party and those close to him. The market is interpreting these developments as paving the way for a robust Republican victory, potentially securing the House, Senate, and White House.

Previously, several scenarios suggested that former President Trump could win the presidency while the Republicans either lost the House or held it by a slim margin. Similarly, a narrow Republican majority in the Senate was also considered possible. However, a decisive Republican victory would eliminate Democratic opposition, enabling the implementation of corporate tax cuts, deficit spending, and significant regulatory changes. While this could introduce some trade uncertainties, the overall Republican agenda is viewed as pro-stock market, which investors seem to be favouring at this stage.

There were other factors at play in markets, including favourable inflation numbers in both the PCE report and the University of Michigan inflation expectations survey. The combined news has allowed the S&P 500 to reach another all-time high, reflecting market optimism under the anticipated Republican policies.

Implications of a U.S.-China Trade War on Australia

A Trump win could also heat up the U.S.-China in a trade war. As a major trading partner to both the U.S. and China, Australia finds itself in a tricky position. A further re-shuffling of global supply chains and trade flows could impact Australia's export-driven economy.

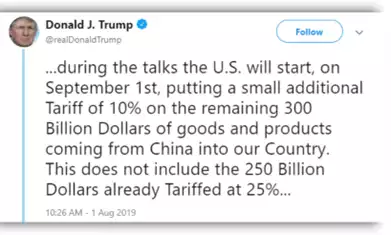

One of the first things investors could face is an initial shock drop in the Australian stock market (again). It could also be the first of several. Here is an old tweet of just one of his actions in regard to tariffs on China:

The ASX200 fell by over 5% in the days after this tweet. The major reason for this was Australia's export of iron ore, coal, and natural gas to China. A reduction in demand is a very real possibility if China is selling less products and therefore requiring less energy. There was also fear previously of China targeting Australian agriculture exports – fears which were eventually justified. Increased U.S. tariffs may not be able to put a complete stop to China's heavy reliance on Australian iron ore, but they may reignite attempts to retaliate and hurt the Australian agricultural sector again.

Australians may also have to be wary of effects on the Australian Dollar. Previous Trump actions against China that caused the Chinese Yuan to weaken have also had the same effect on the Australian Dollar. This is not only to do with the economic connections in the export markets, but also because due to forex restrictions in China the AUD is traded as a proxy for the Yuan. The RBA may be forced to hold interest rates higher than other central banks just to mitigate the currency weakness if this is the case.

Lastly, Australia may have to continue to reorganise its exports and find new avenues for profit. The U.S. and potentially other countries hunting for new supply chains in Southeast Asia, for example, may open up opportunities for Australia to diversify its customer base. This process would likely not be a smooth one though, as essentially rebuilding global supply chains will be complicated and time-consuming.