Market Shocked by Much Higher Than Expected Inflation Numbers

News

|

Posted 11/04/2024

|

1660

U.S. stocks experienced a sharp decline on Wednesday, as Wall Street was stunned by a surprisingly high inflation report, leading to a reassessment of their expectations for Federal Reserve rate cuts for the remainder of the year. The Dow Jones Industrial Average alone plummeted by over 1 percent early in the day.

Bond yields also surged, with the 10-year Treasury yield climbing by 10 basis points to 4.474% after an appalling bond auction.

In March, inflation continued its acceleration, with consumer prices unexpectedly rising 0.4% for the month and 3.5% year-over-year. Core inflation, excluding volatile food and energy prices, also spiked to 3.8% year-over-year, surpassing economists' 3.7% projection.

The persistent inflationary trend has fuelled concerns that the Federal Reserve might keep interest rates higher for an extended period. Initially, investors had anticipated significant rate cuts at the beginning of the year, but they are now only pricing in a 6% chance that the Fed might implement rate cuts of 100 points or more this year, down from the 61% chance predicted a month earlier according to the CME FedWatch tool.

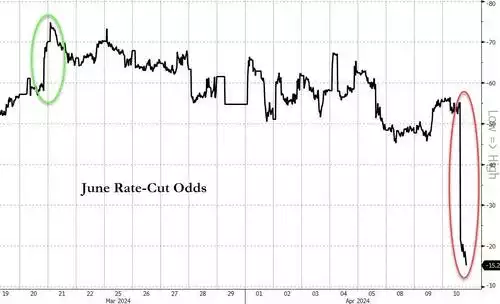

Additionally, the probability of a rate cut by the Fed in June has been completely ruled out, with investors now estimating a 0% chance compared to the 57% chance projected a month ago.

The latest CPI report may have even dashed the odds of a July Fed rate cut off the table, according to Seema Shah, the chief global strategist at Principal Asset Management.

"This marks the third consecutive strong reading and means that the stalled disinflationary narrative can no longer be called a blip. In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch," Shah said in a note.

The moment the Consumer Price Index (CPI) data was released, there was a notable shift in market sentiment, with expectations for rate cuts being drastically revised downward. Now, less than 2 rate cuts are being priced in for the year, with roughly a 50% chance of the first cut occurring in July or earlier, leaving a 50% chance for September.

This revised outlook has implications beyond the financial markets. Politicians, particularly those currently in power (Biden administration), are closely monitoring these developments as they navigate public sentiment regarding inflation. High inflation has historically been detrimental to the approval ratings of elected officials, especially in an election year. The Federal Reserve, while apparently apolitical, faces pressure to manage inflation effectively, especially as geopolitical risks persist.

Moreover, recent discussions among Fed officials have hinted at the possibility of a higher neutral rate than we would have previously anticipated. This raises questions about the trajectory of future rate cuts and the ultimate terminal rate.

While the prospect of no rate cuts is not the base case scenario, it is gaining consideration as inflation shows no signs of abating. If the Fed proceeds with rate cuts and inflation continues to rise, it will undoubtedly continue to face scrutiny and questions about its decision-making process.

Before it now, the Fed have the dilemma of reigning in inflation for political support and its own mandate, but those same politicians likely opening the fiscal spending spigots in the lead up to the election to win votes AND the interest payments, already a staggering $1.1 trillion annually, rising on more debt and persistently high rates and lacklustre economic conditions. No wonder gold is going so strongly. This simply can’t end well.