Macro and Global Liquidity Analysis: Gold, Silver, and Bitcoin - October 2024

News

|

Posted 01/11/2024

|

2953

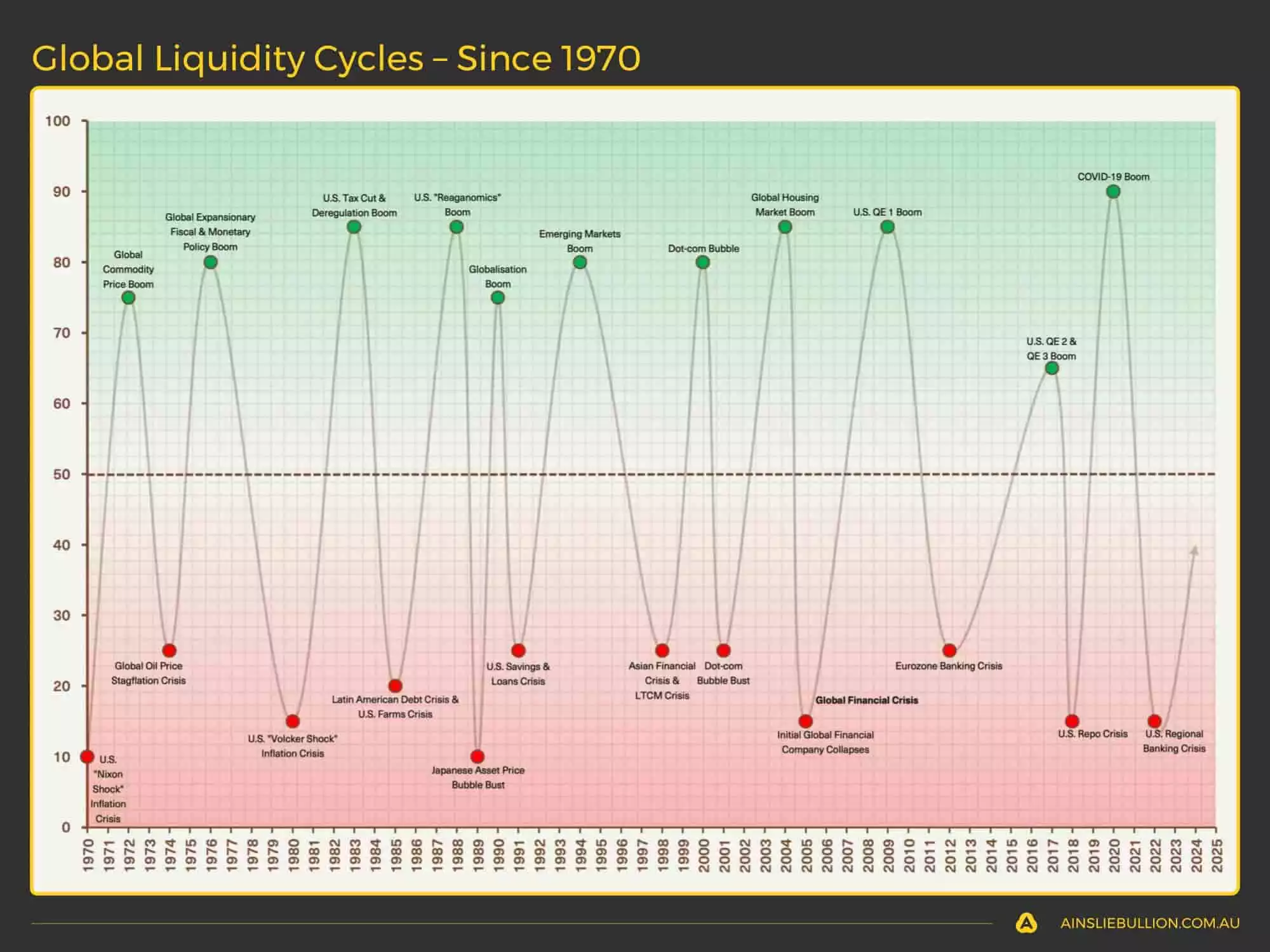

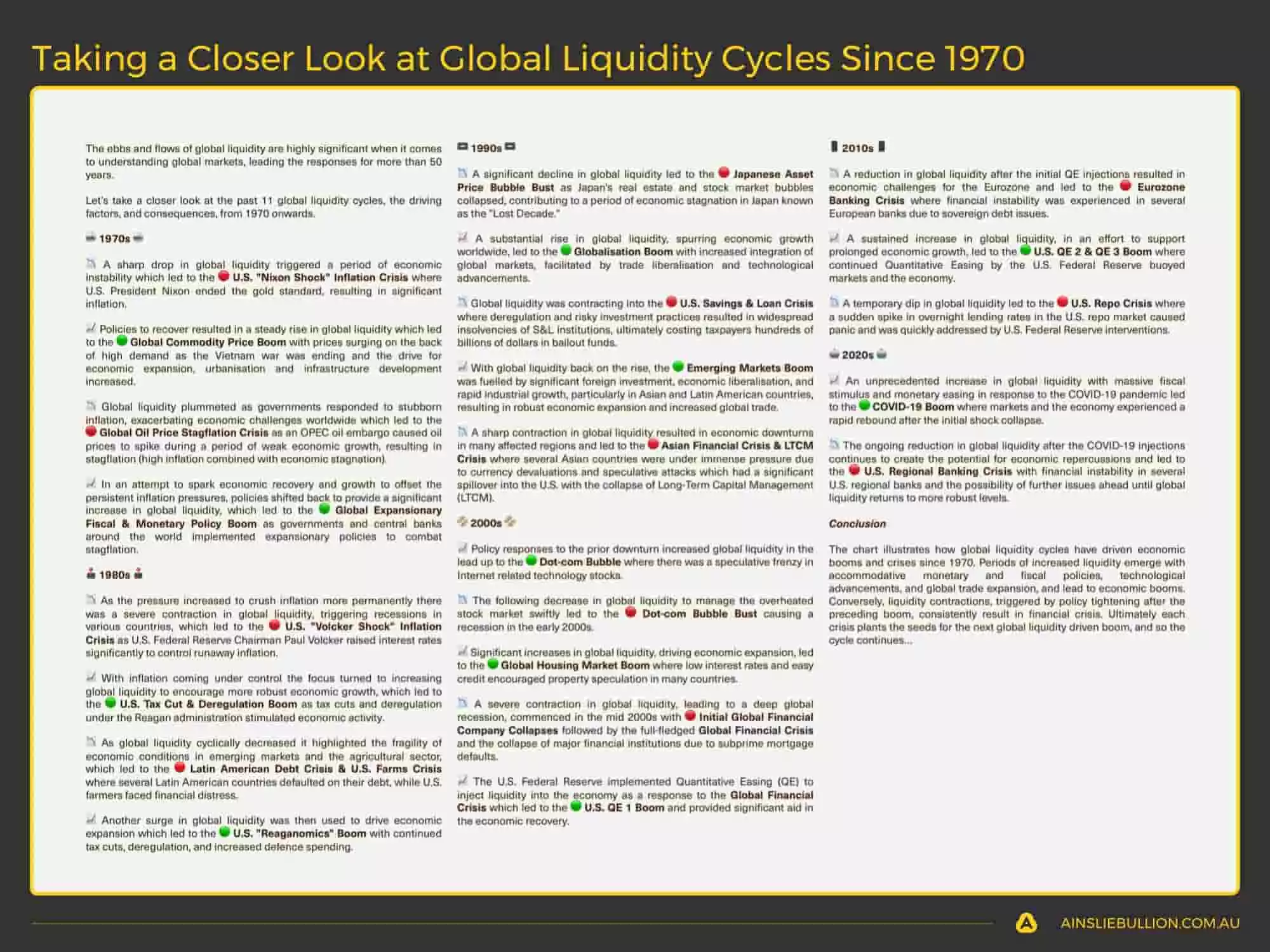

Today the Ainslie Research team brings you the latest monthly update on where we are in the Global Macro Cycle, driven by the Global Liquidity Cycle, and the implications for gold, silver, and Bitcoin. This summary highlights the key charts discussed with our expert panel on Monday. We encourage you to watch the recorded video of the presentation in full for the detailed explanations.

Where are we currently in the Global Macro Cycle?

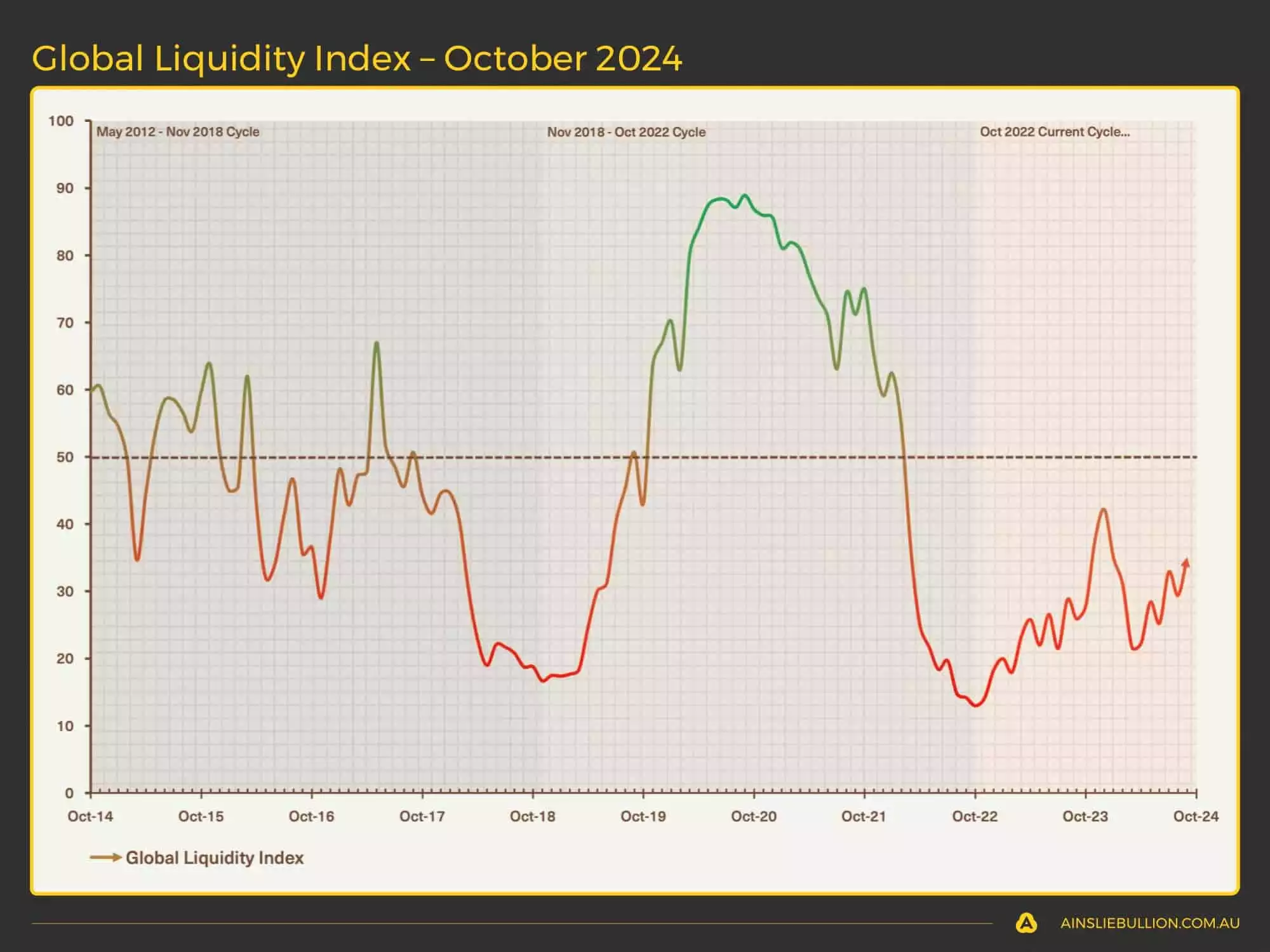

This month the anticipated higher new green dot materialised, as the mid-cycle phase continues to unfold. We are approaching the halfway line and expect some acceleration in terms of liquidity and stimulus to round out 2024 and finally break back above it.

Where are we currently in the Global Liquidity Cycle?

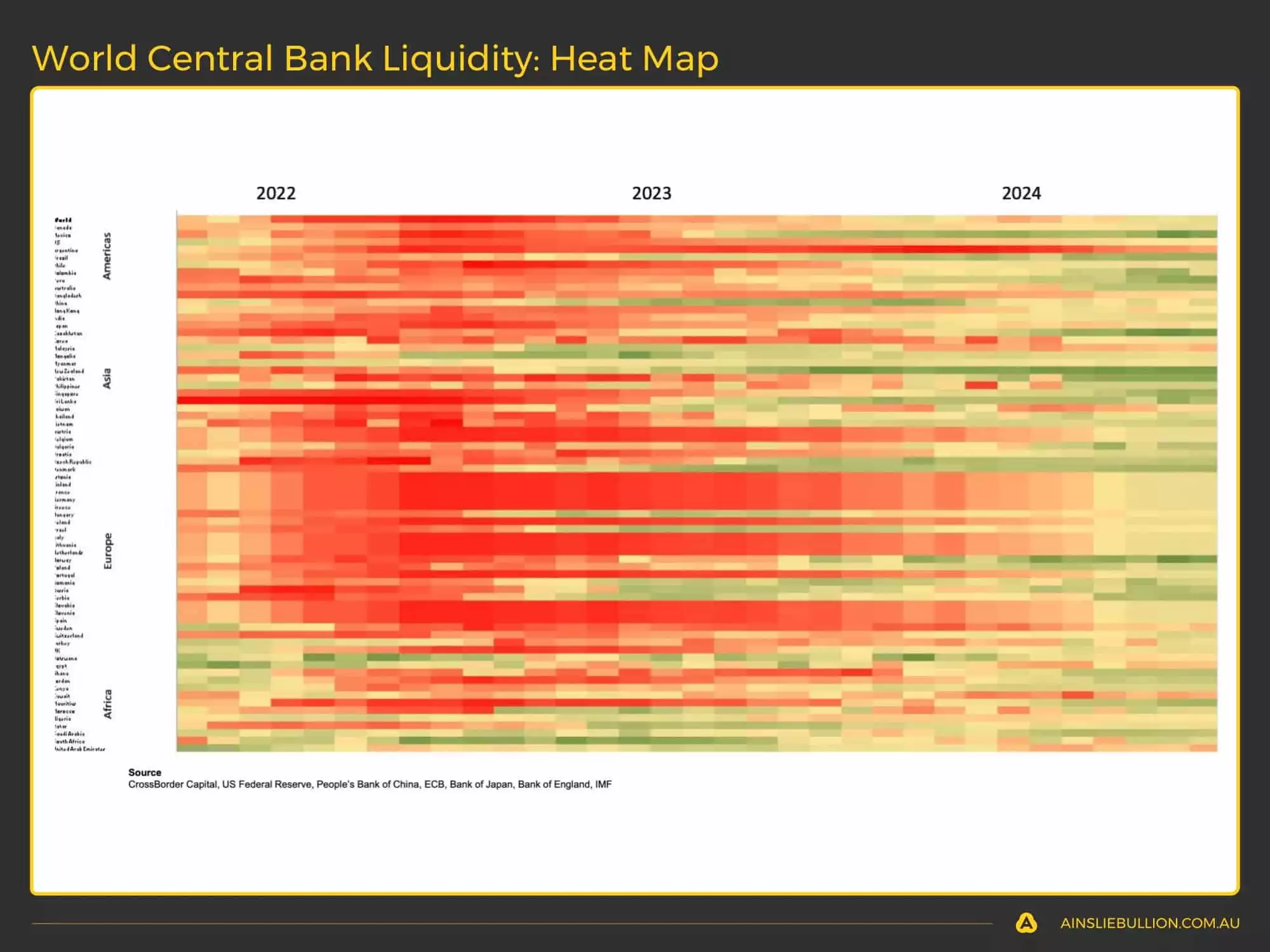

Global Liquidity leads the movement of World financial assets, so this is the indicator we look most closely at to determine where opportunities exist. It is currently showing solid signs of recovery from the cycle lows.

You can see the shift from the red patch towards improving liquidity conditions across an increasing number of global central banks with greens and lighter neutral yellows starting to dominate.

Do U.S. Growth and Inflation support where we think we are in the Global Macro Cycle?

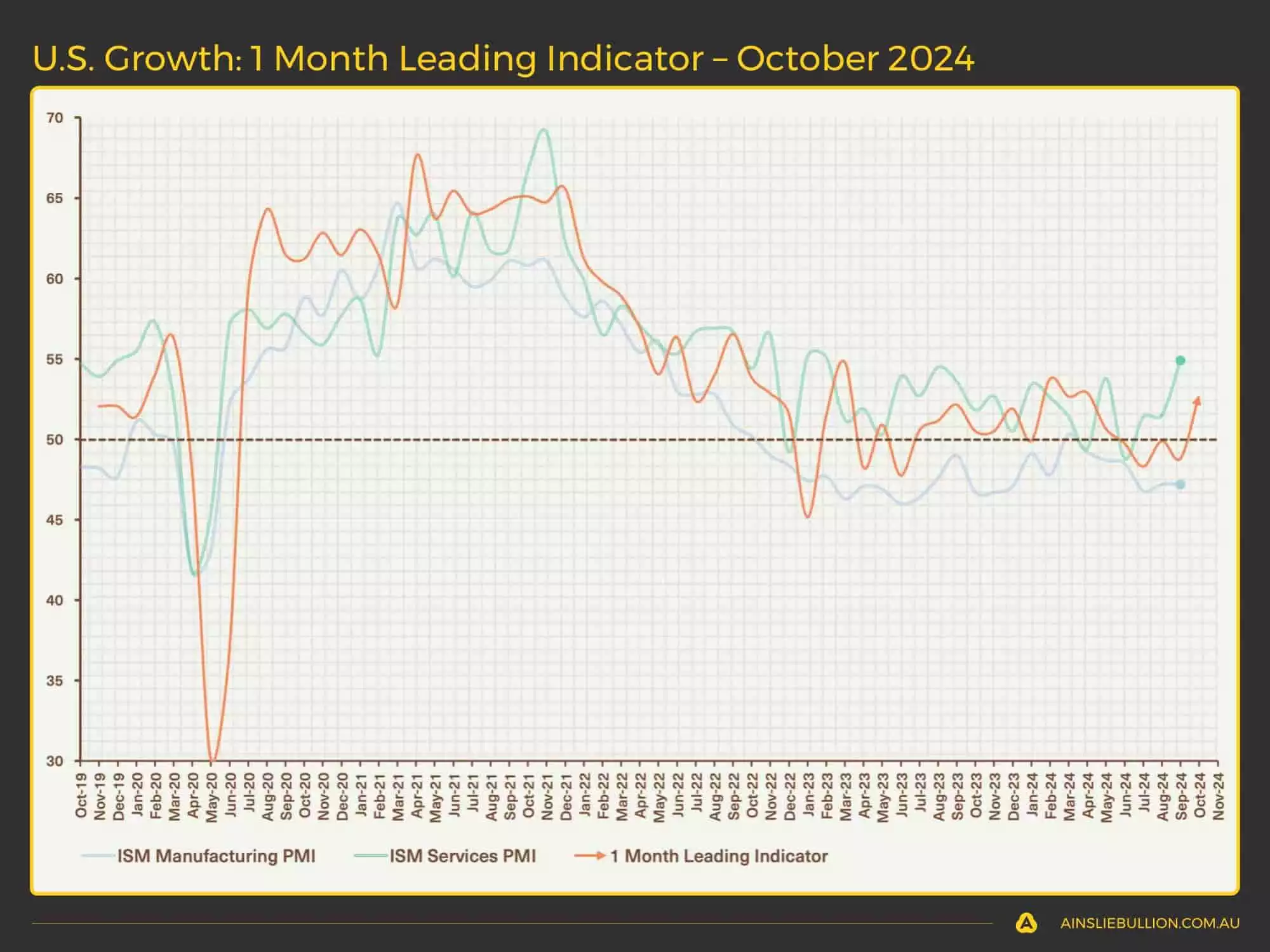

In terms of economic growth in the U.S., as evidenced by the ISM data, we continue to see mixed results between the manufacturing and services components dancing around the 50 line, but with services now taking a stronger lead…

And the forward-looking indicator over the next 3 months has returned to pointing higher on the back of strong forward orders and falling inventories.

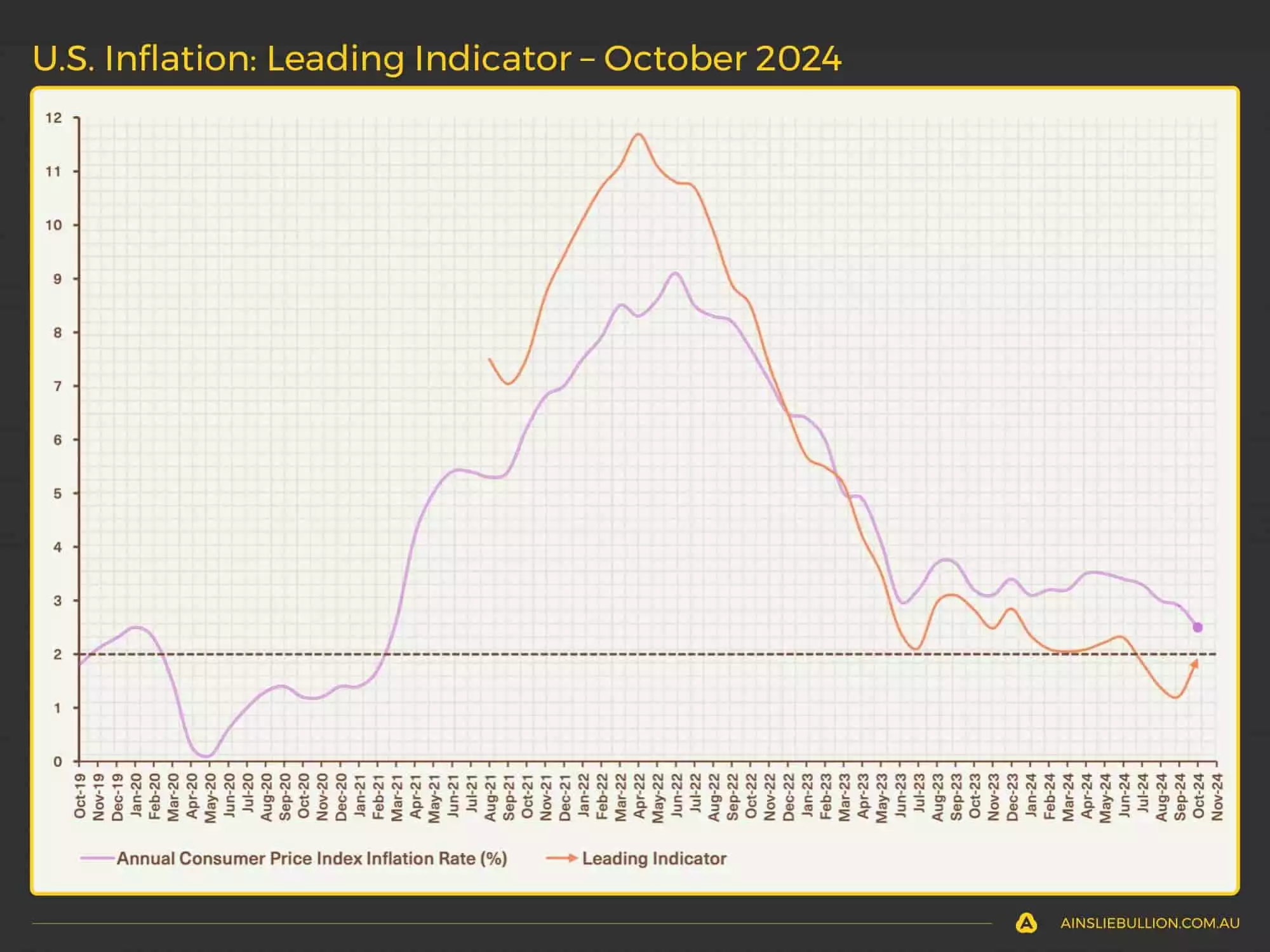

In terms of U.S. inflation, our leading indicator shows that the lagging government-reported rate continues to remain higher than the real-time data. Both lines are starting to converge upon the stated Federal Reserve target of 2%.

Does the behaviour of U.S. Government Debt, Yields and the Dollar support where we think we are in the Global Macro Cycle?

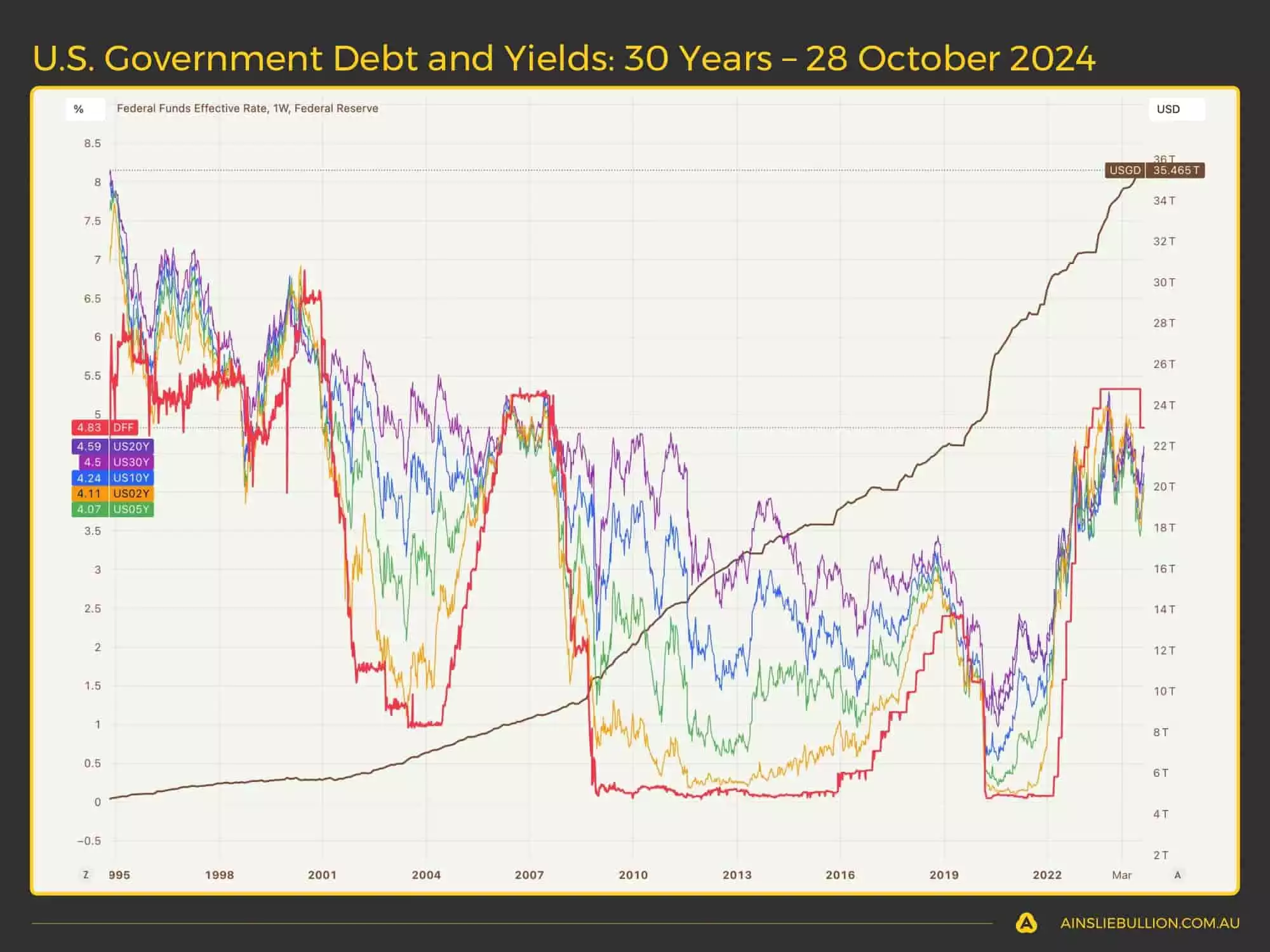

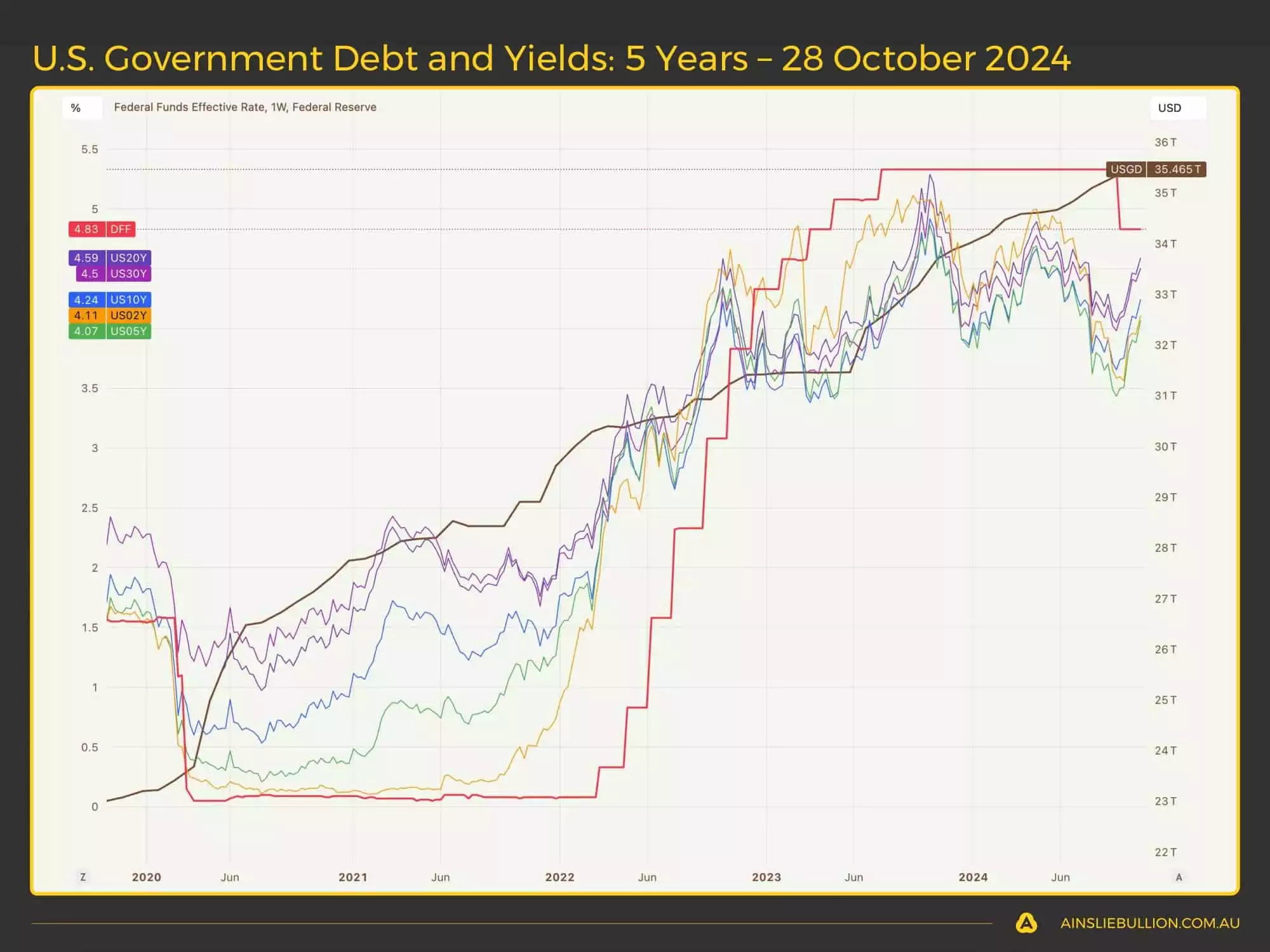

U.S. government debt continues its relentless, and increasingly exponential, march higher with no meaningful attempts to bring it under control.

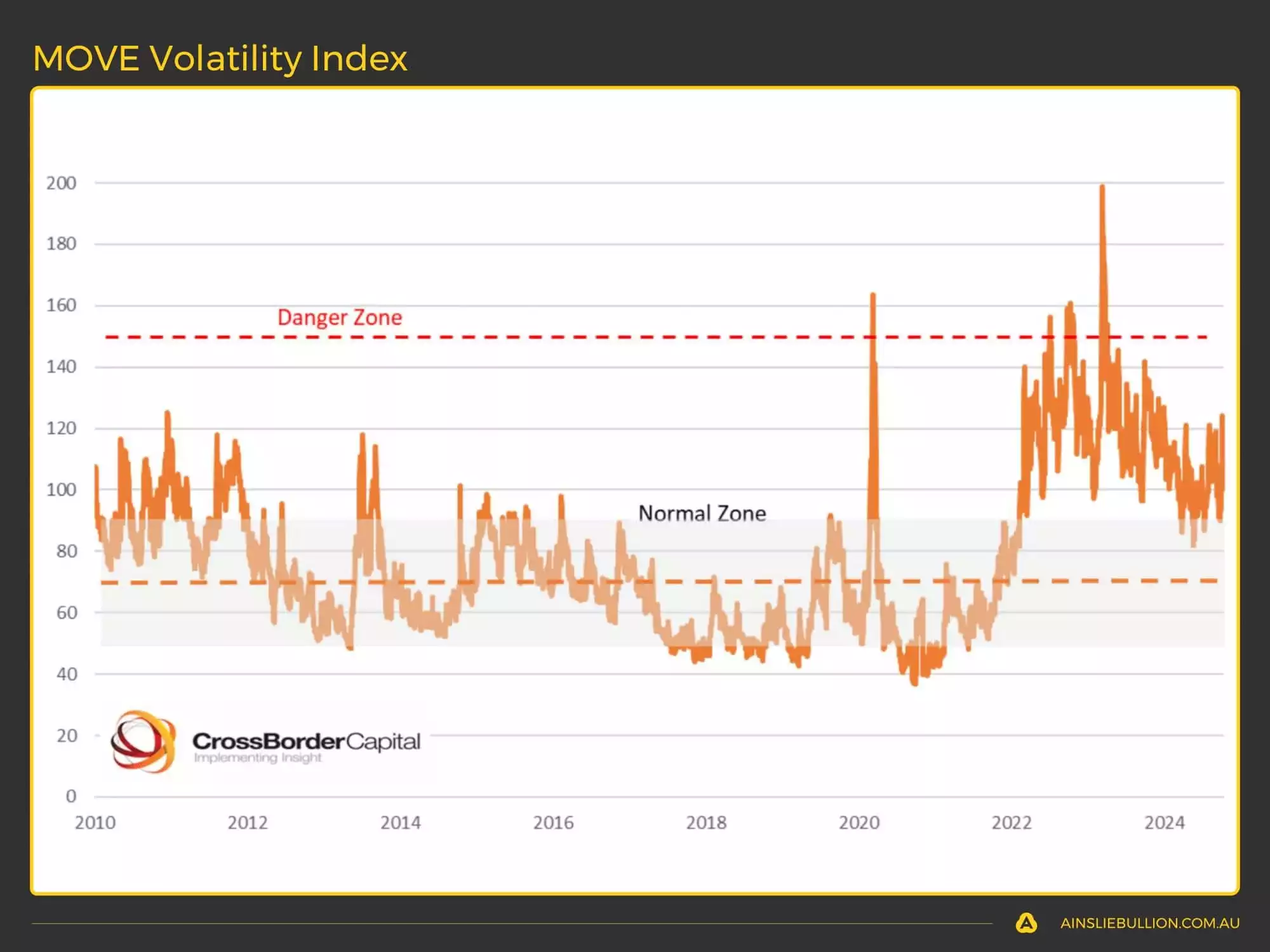

Bond yields had initially broken lower, in anticipation of a new Federal Reserve rate-cutting cycle, but now yields are starting to move higher on the back of uncertainty surrounding excess issuance ahead, which is increasing volatility in the markets generally.

The U.S. Dollar has bounced quite considerably over the past few weeks. This is inconsistent with the expectations for a falling Fed Funds Rate, but consistent with the currently rising bond yields. We continue to expect the USD to peak and roll over soon, but for now, we are watching it closely.

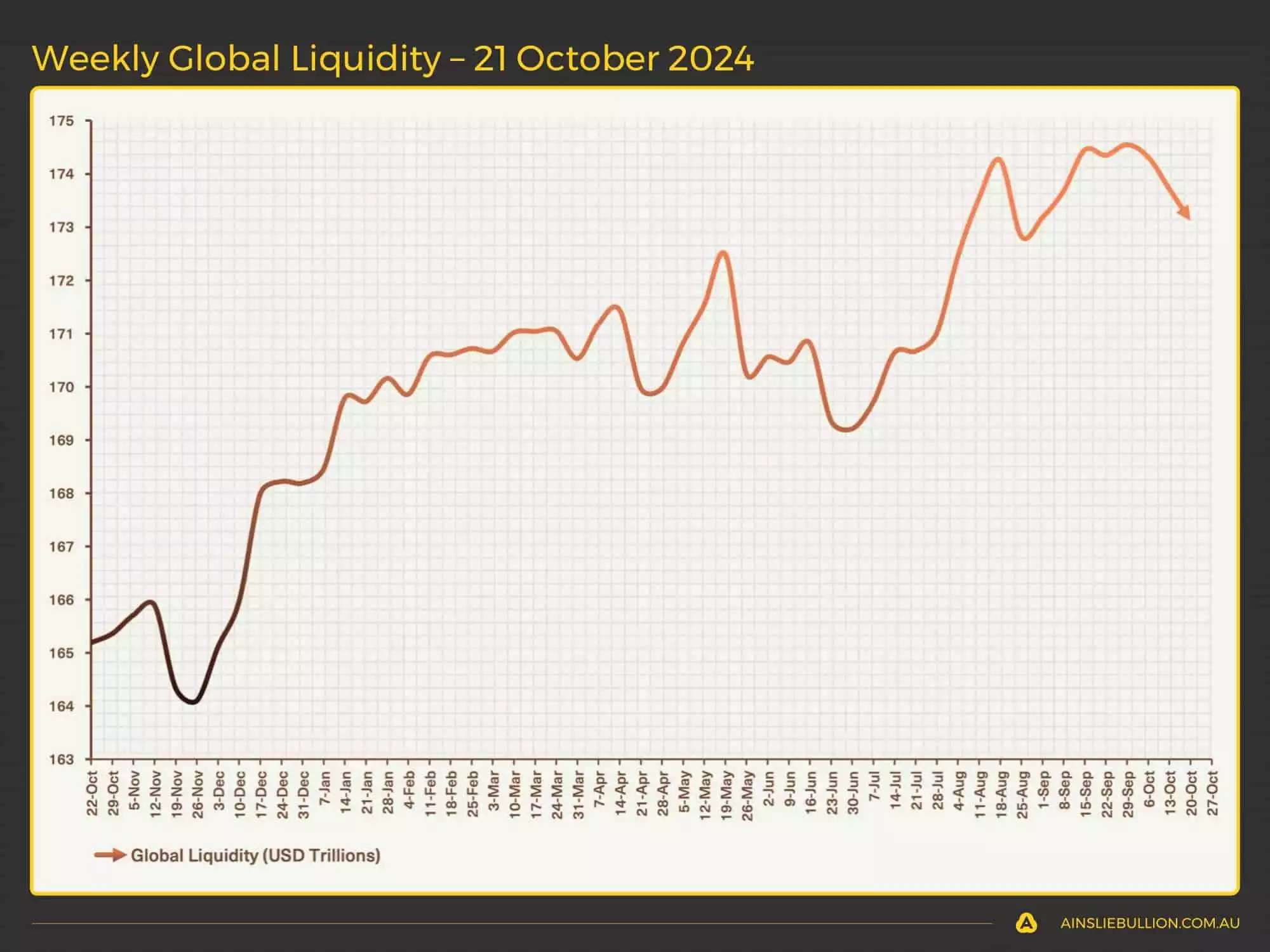

Looking more closely at Weekly Global Liquidity, does it support our expectations for the direction of the next move in the Global Liquidity Cycle?

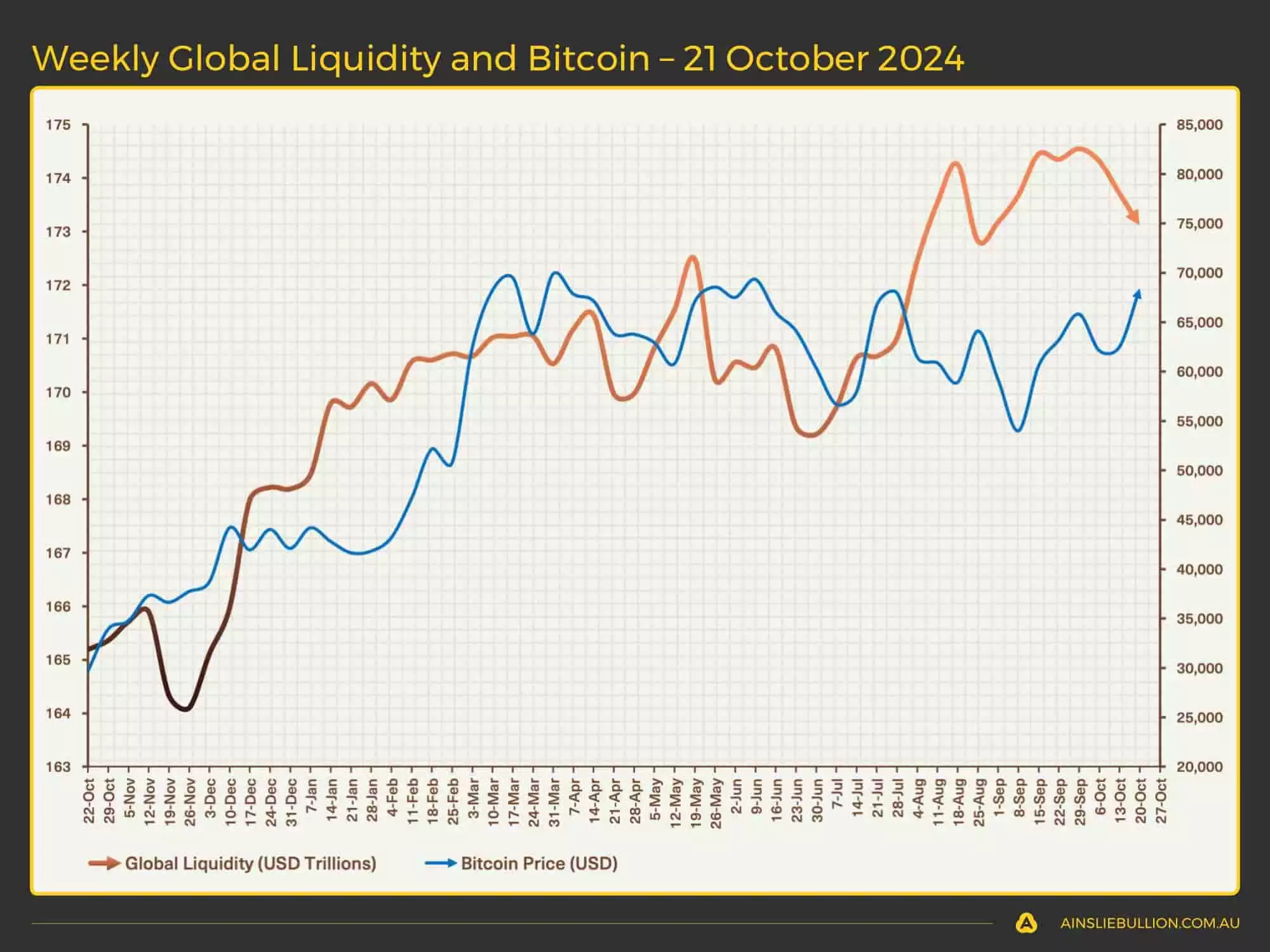

At a weekly level, Global Liquidity has been moving higher over the past few months but has stalled in recent weeks, awaiting further tailwinds to offset the most recent lacklustre support from China and the U.S. in particular.

Another significant factor holding down further Global Liquidity gains has been falling collateral values as the MOVE index hit fresh highs for the year. Rising bond volatility is damaging overall for Global Liquidity.

Macro Assets for Macro Cycles

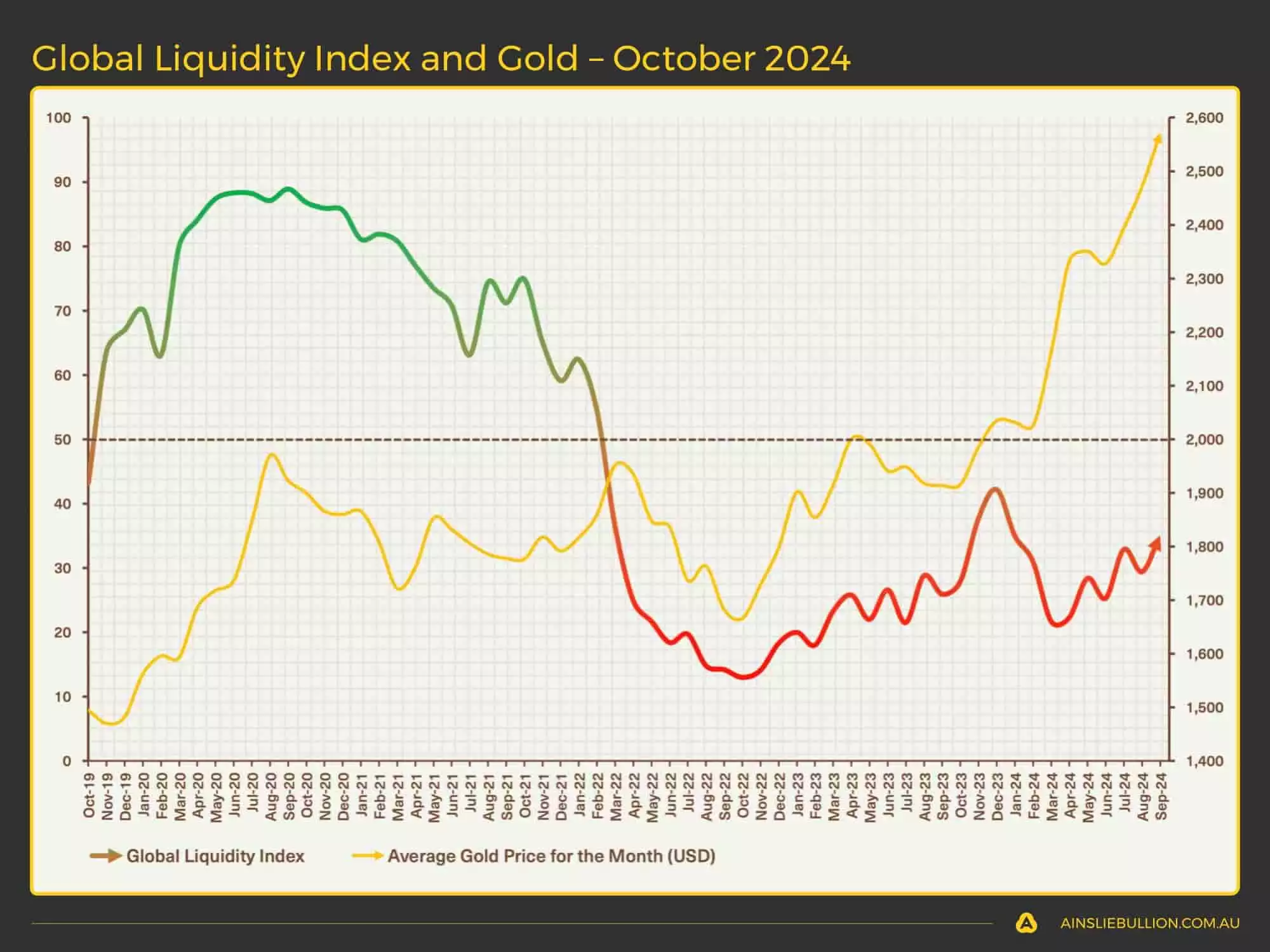

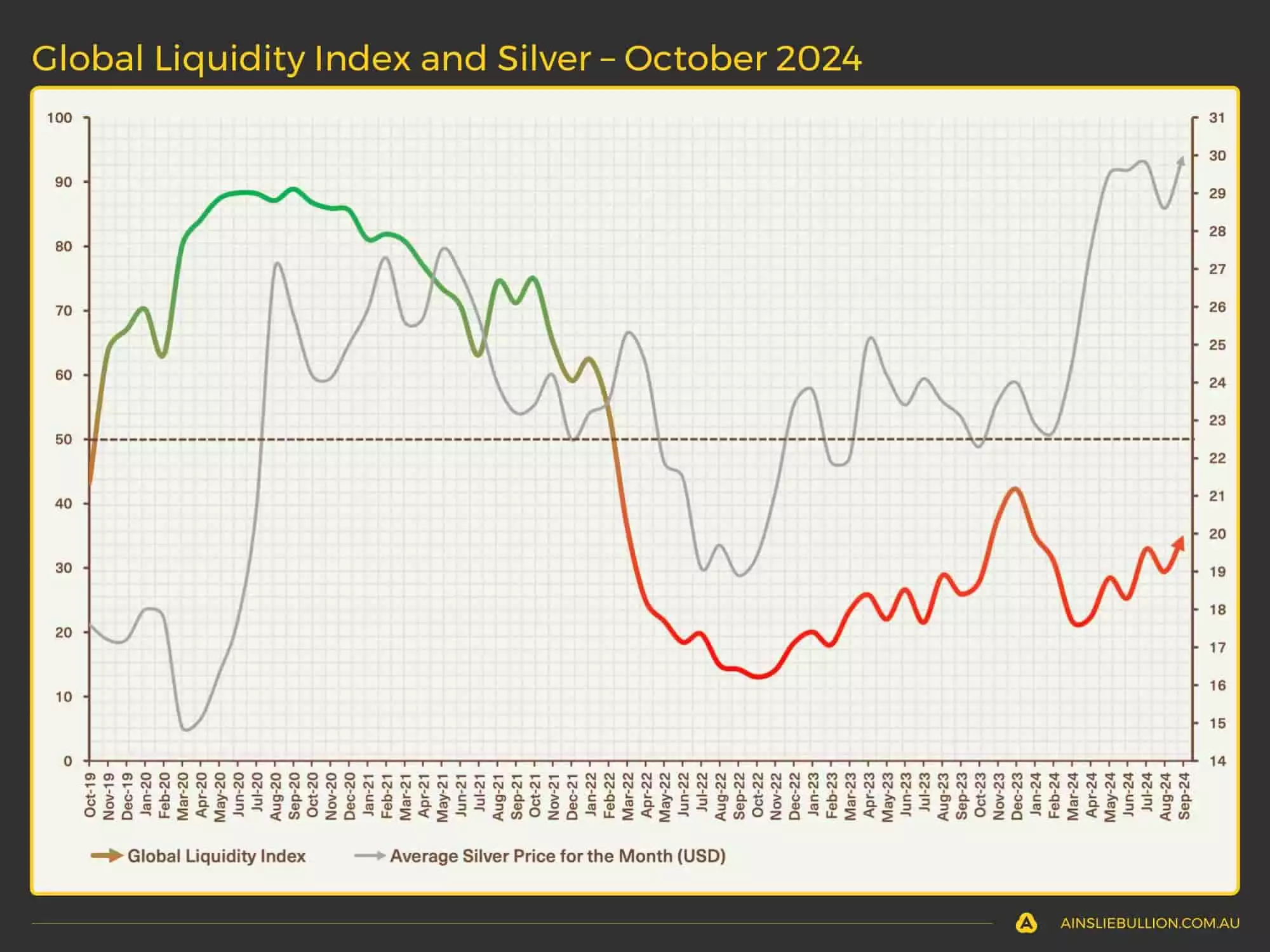

Understanding Consumer Price Inflation (CPI) is far less important than Asset Price Inflation in ensuring wealth isn’t eroded, and can actually grow, over the long term. A combination of gold, silver, and Bitcoin keeps up with the growth in Global Liquidity over time, and the corresponding debasement of fiat currencies. As such we look to trade into each at the appropriate times to take optimum advantage of the cycles. When correctly timing and structuring the rotation, it is possible to significantly outperform ongoing monetary debasement.

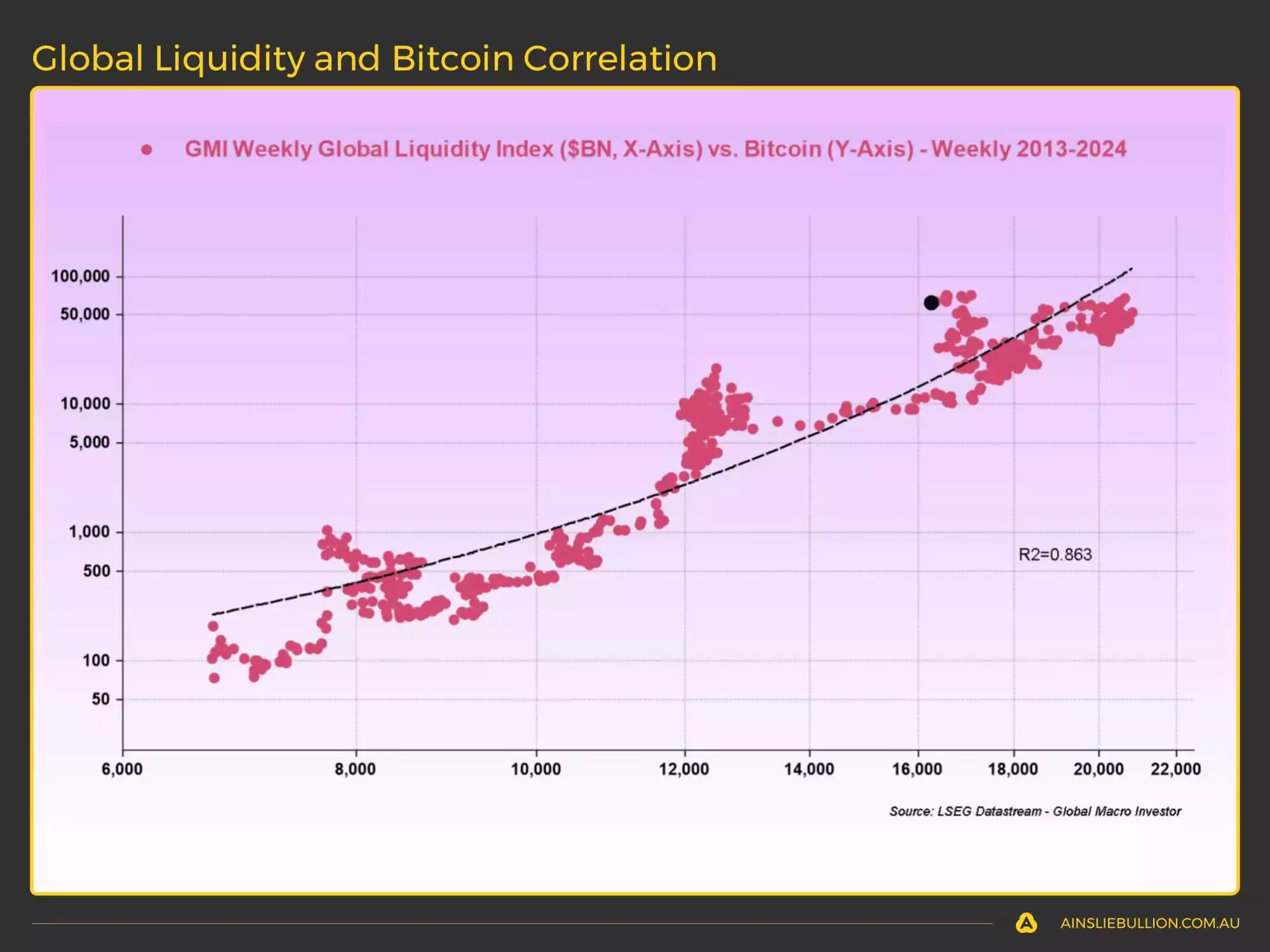

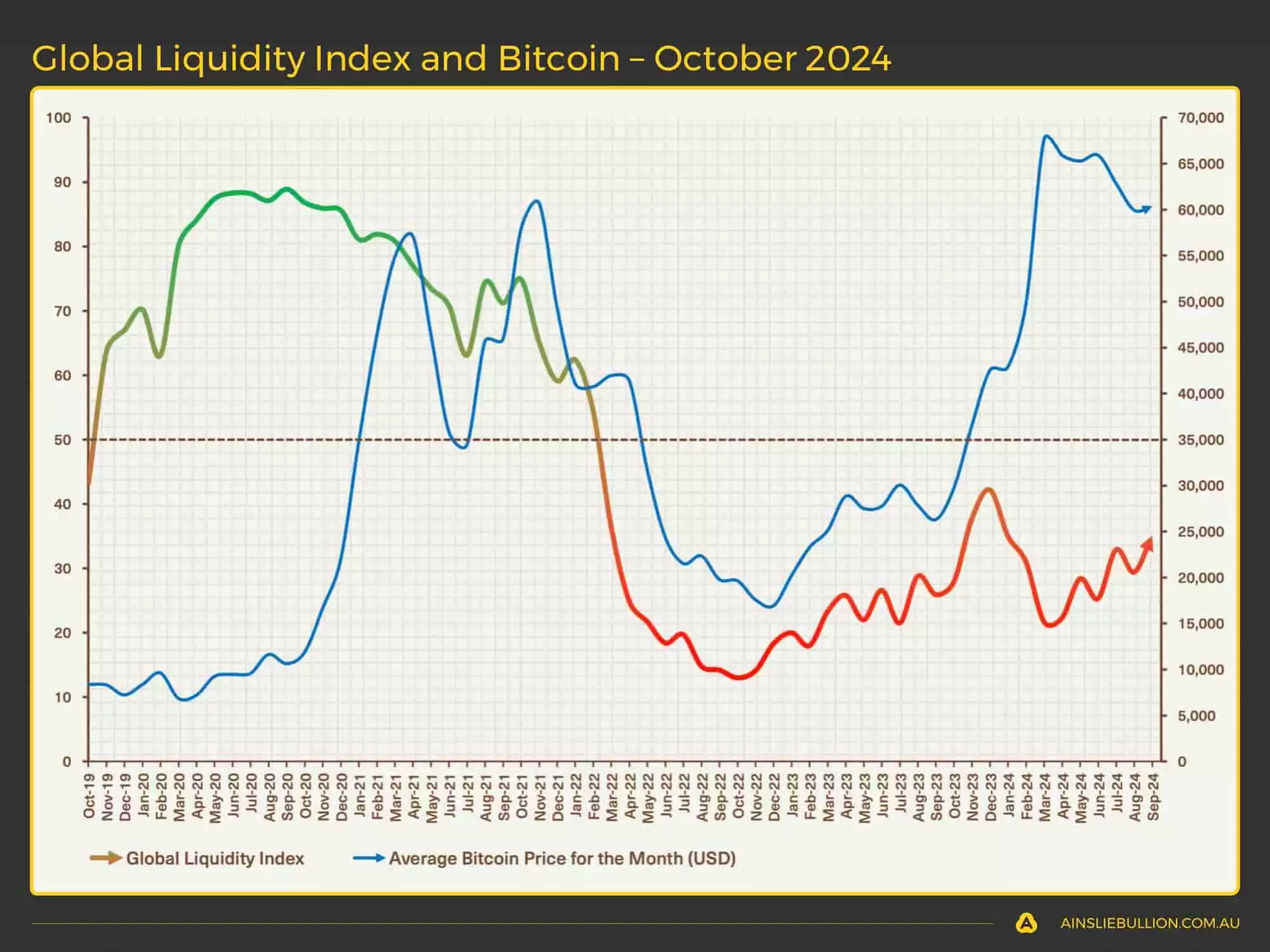

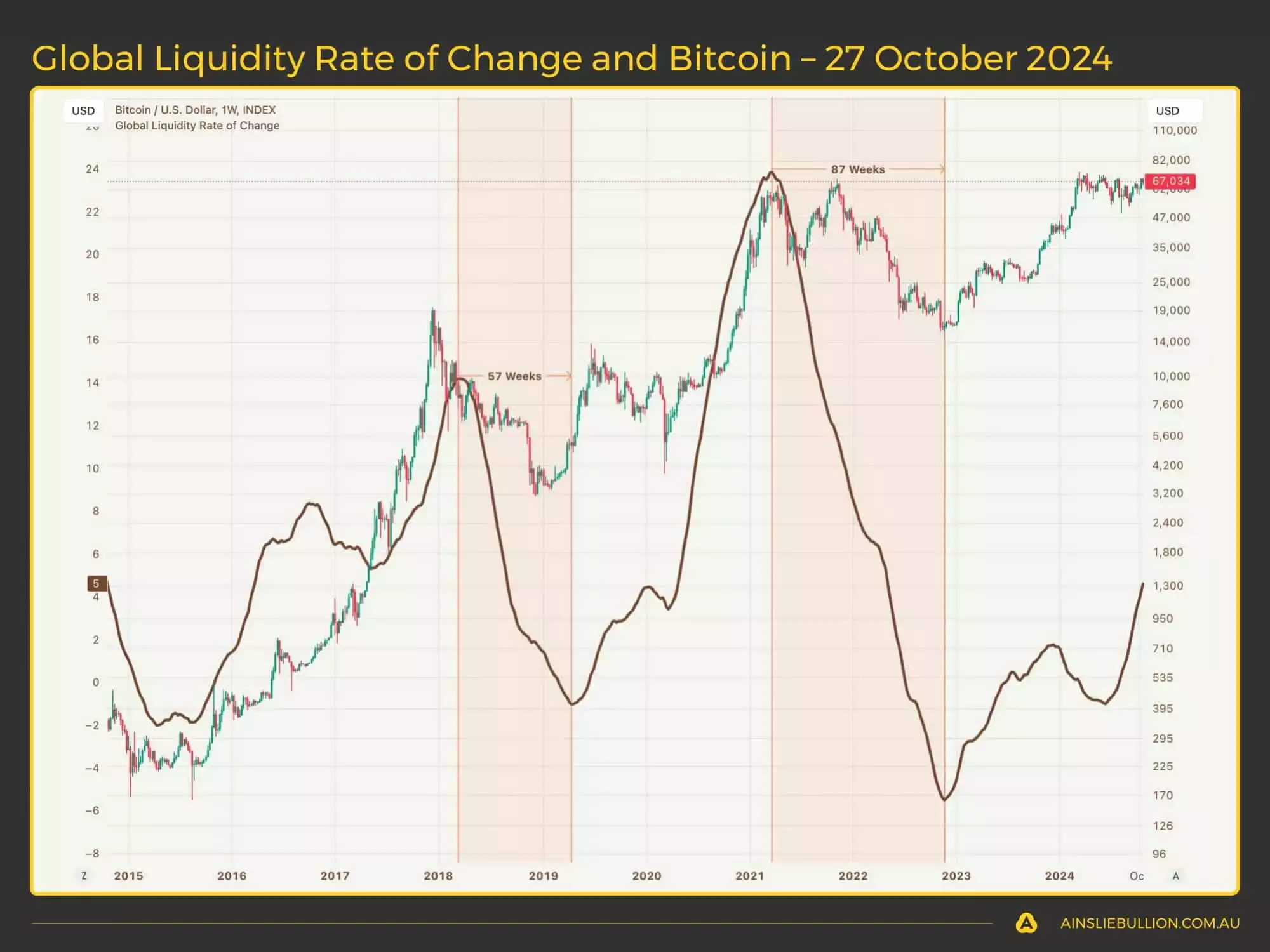

Bitcoin is the most directly correlated asset to Global Liquidity. Trading Bitcoin can be thought of as trading the Global Liquidity Cycle, but with an adoption curve that leads to significantly higher highs and lows each cycle.

The Bitcoin cycle low was in November 2022, and since then the returns have been unmatched by any other major asset. Recent short-term sideways price action is expected to resolve to the upside as Global Liquidity conditions continue to improve.

Zooming out, and looking at Bitcoin on a log scale, the picture becomes clearer that the rate of change for Global Liquidity is still increasing, which should continue to support the Bitcoin price for longer in this current cycle.

At the weekly level, Bitcoin and Global Liquidity are coming back aligned after a recent divergence.

The gold cycle low was in September 2022 and the price has been rising consistently with an improving Global Liquidity picture ever since. The recent strength has seen a run of new all-time highs which has been especially bullish.

It is a similar story with silver which also had a cycle low in September 2022 and has exploded higher with recent gains.

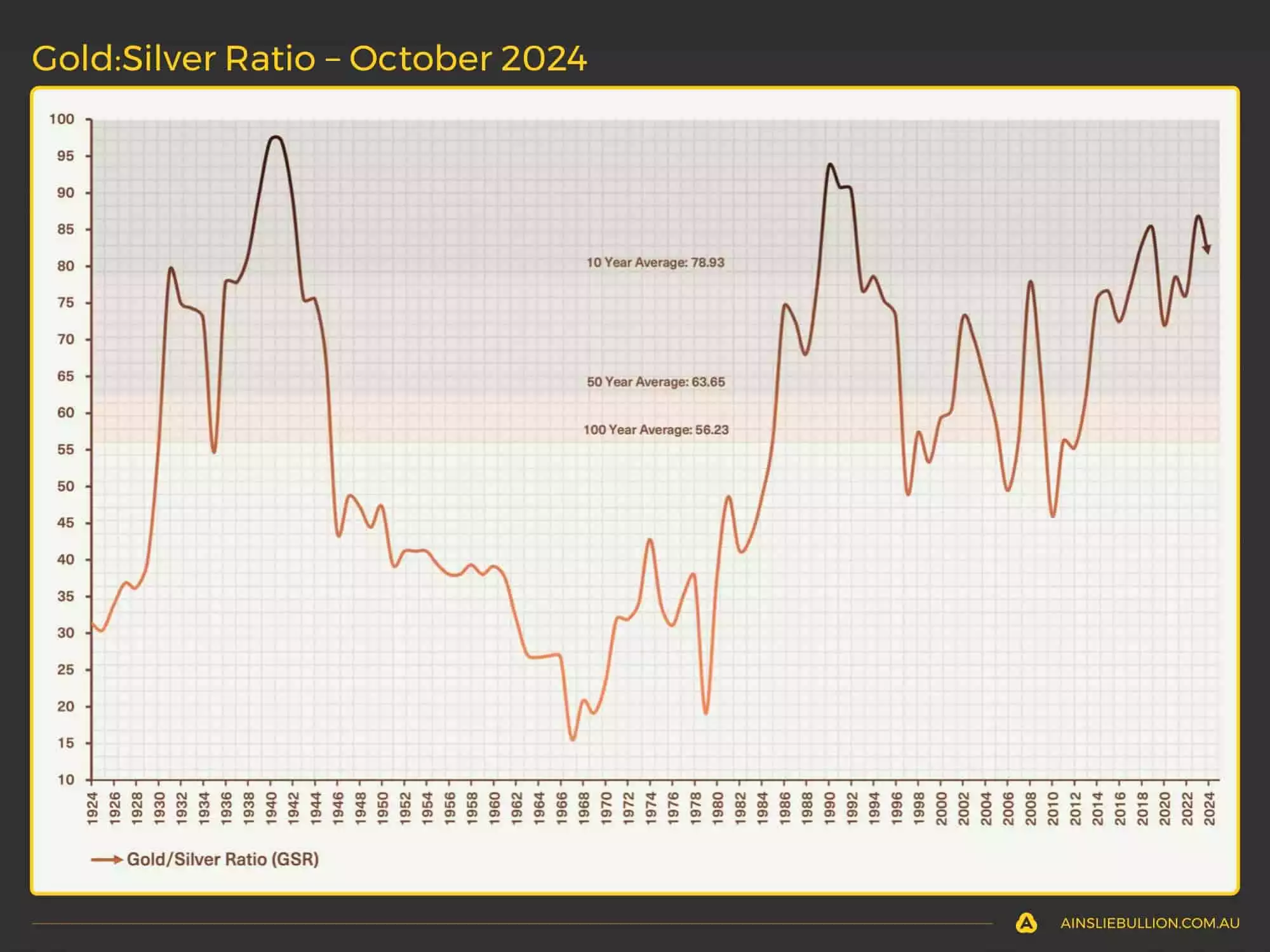

It remains prudent to keep an eye on the Gold Silver Ratio (GSR). The current GSR remains at historically high levels, which could indicate a longer-term trade opportunity to accumulate silver now, to be traded into more gold in the future.

A Simple Trading Plan to take advantage of the cycles

Watch the video presentation to see full details of the specific Trading Plan we provide, that you can follow, which has returned 164.2% p.a. as of Monday’s recording.

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here:

Until next month when we return to reassess and identify what has changed, good luck in the market!

Chris Tipper

Chief Economist and Strategist

The Ainslie Group

x.com/TipperAnalytics

Note: The monthly video presentation is recorded live with our expert panel. Our objective is to make the updates as useful and specific to what you want to understand as possible, so as always feel free to reach out with any questions or feedback that we can incorporate into next month’s video to make it something that provides you with the highest possible value for your time!