Macro and Global Liquidity Analysis: Gold, Silver, and Bitcoin – May 2025

News

|

Posted 30/05/2025

|

3133

Today the Ainslie Research team brings you the latest monthly update on where we are in the Global Macro Cycle, driven by the Global Liquidity Cycle, and the implications for Gold, Silver, and Bitcoin. This summary highlights the key charts discussed with our expert panel on Wednesday. We encourage you to watch the recorded video of the presentation in full for the detailed explanations.

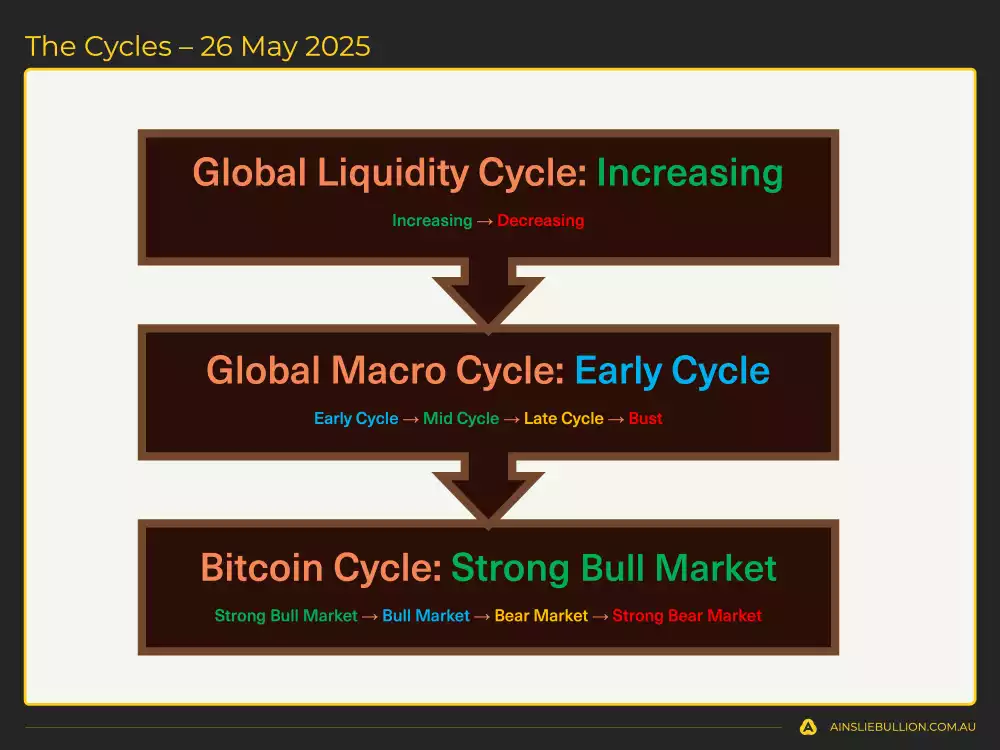

Where are we currently in the cycles?

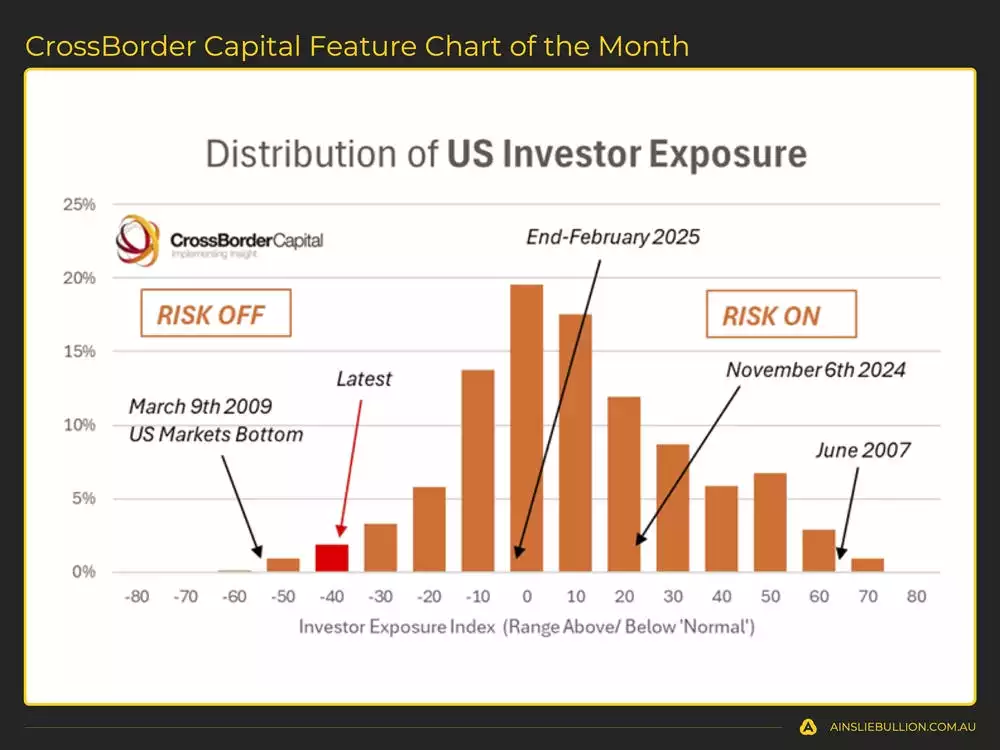

Latest data confirm the market has reset to the “early-cycle” phase after a short-lived bout of fear. Global liquidity keeps expanding, risk sentiment has swung from outright pessimism to cautious optimism, and major equity indices are again tracing higher lows. Services activity never fell into contraction, manufacturing indicators are stabilising, and Bitcoin has already reclaimed earlier losses. Volatility will resurface, yet the broader evidence suggests the new upswing still has plenty of room to run.

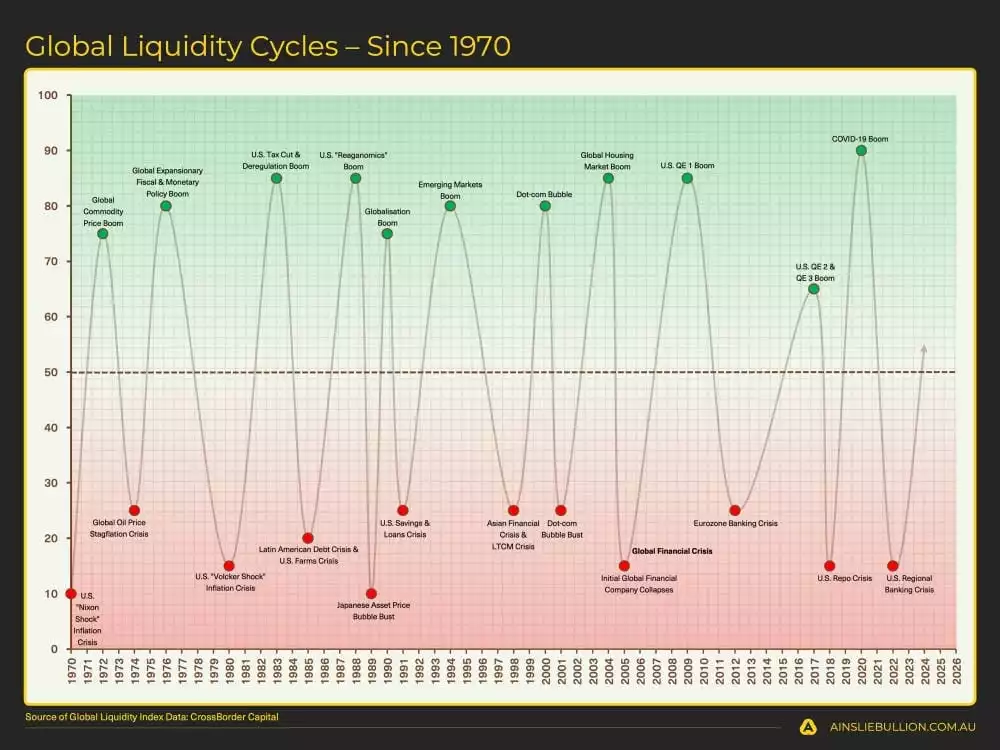

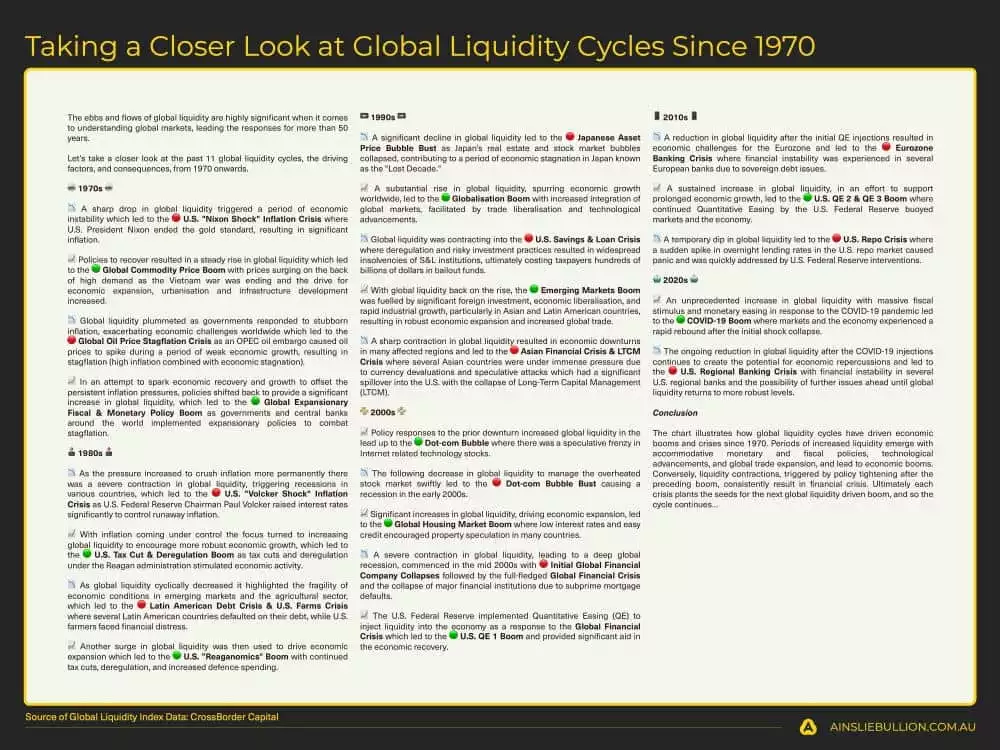

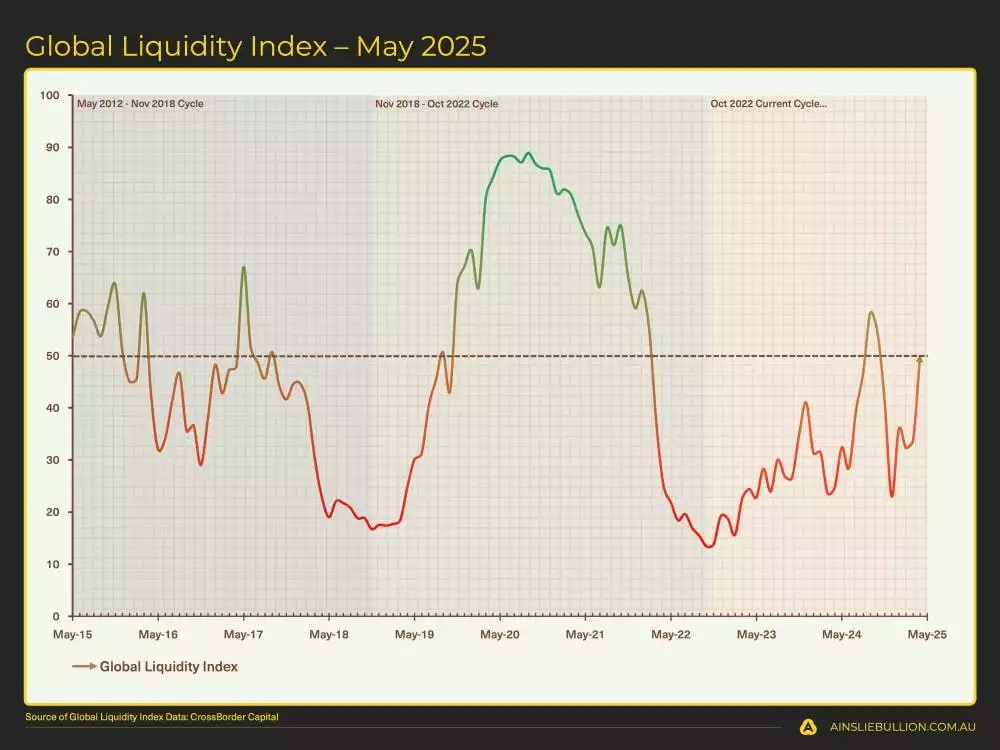

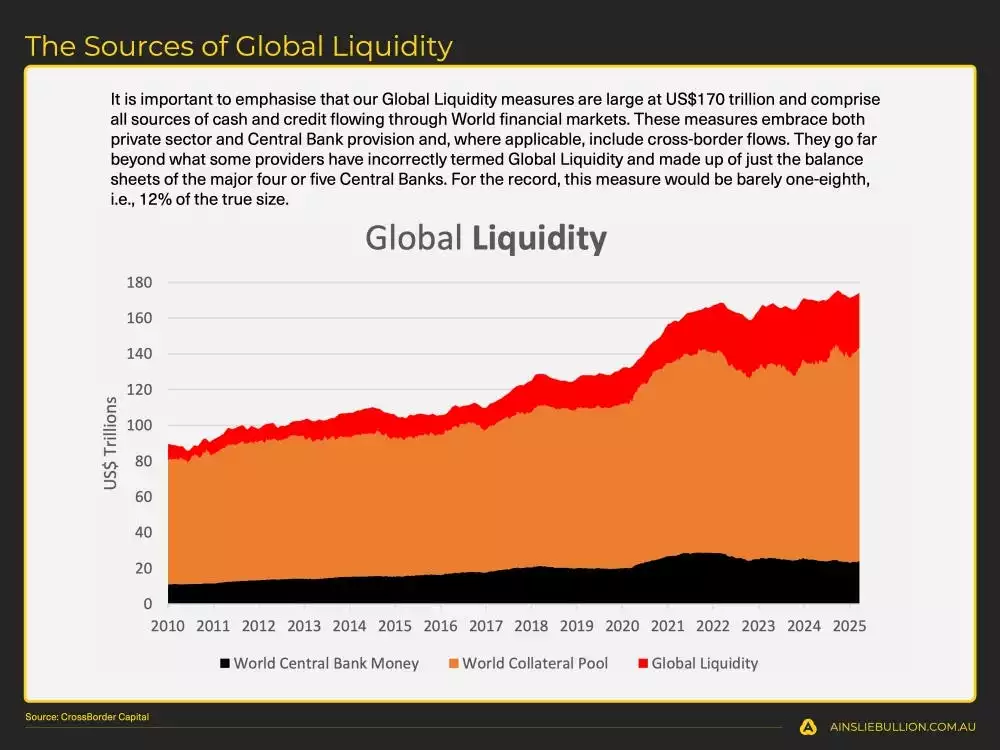

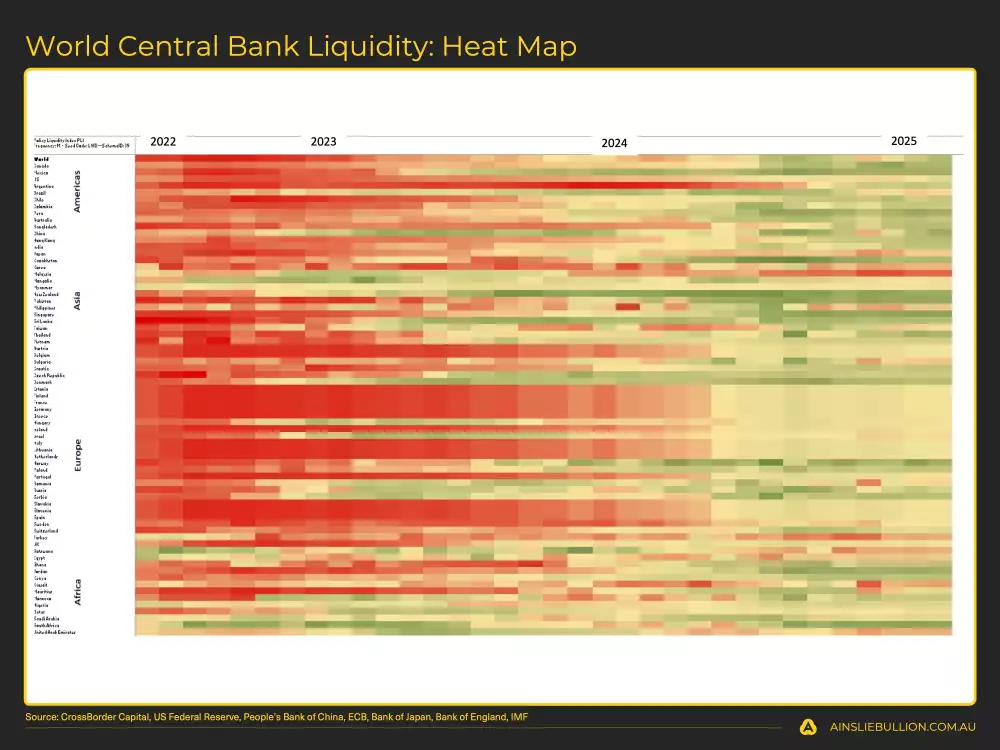

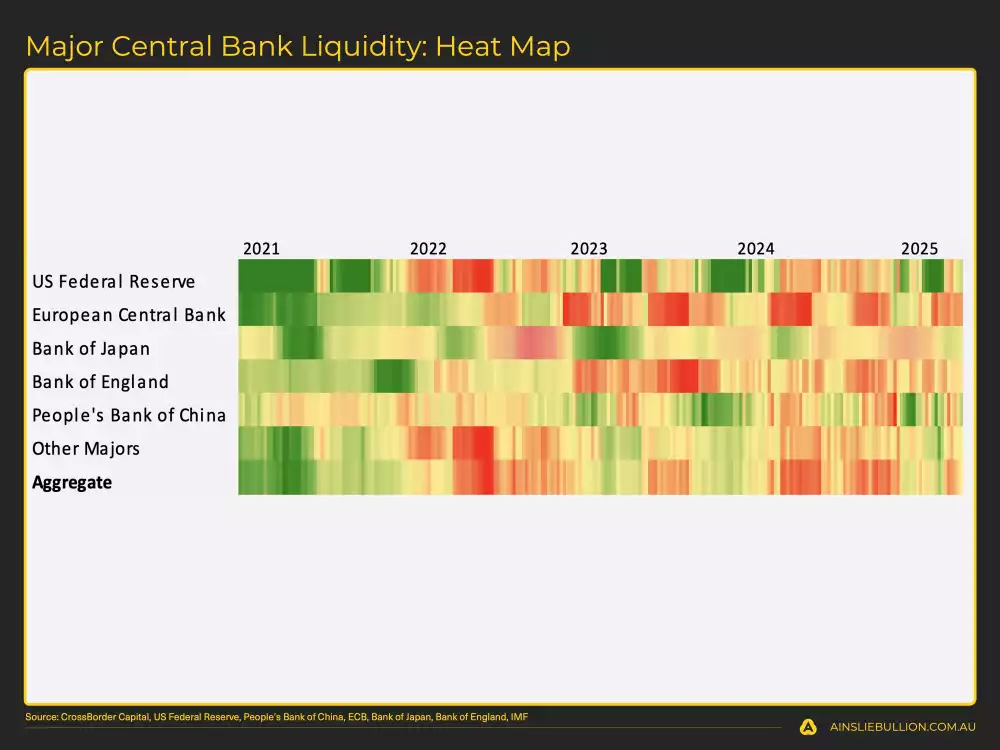

Deep dive on the Global Liquidity Cycle

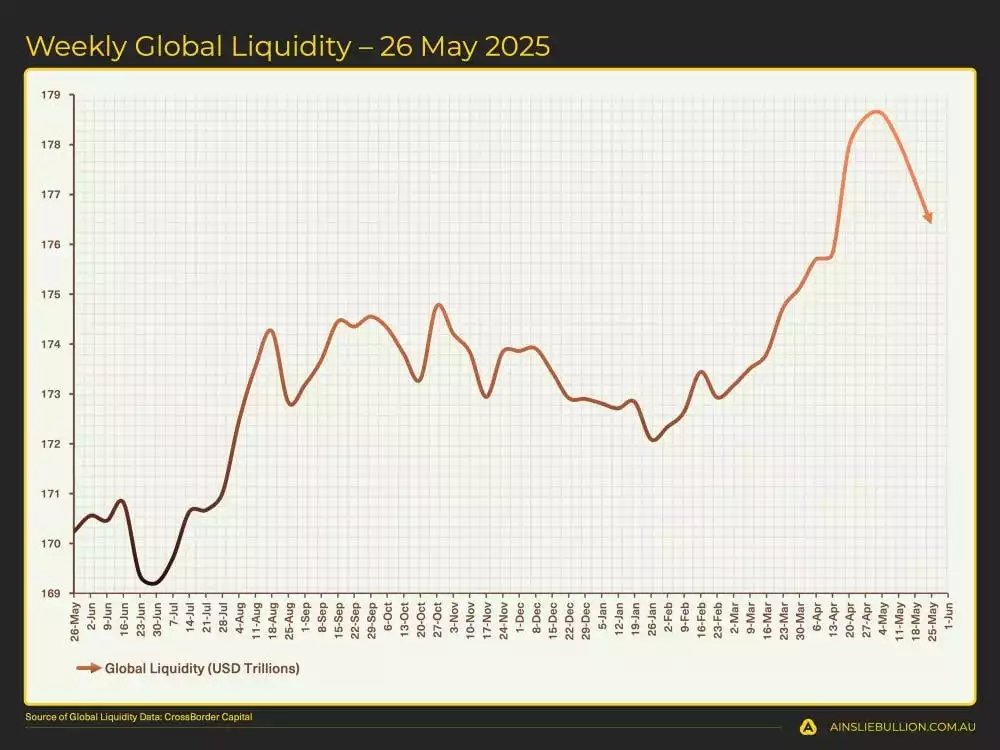

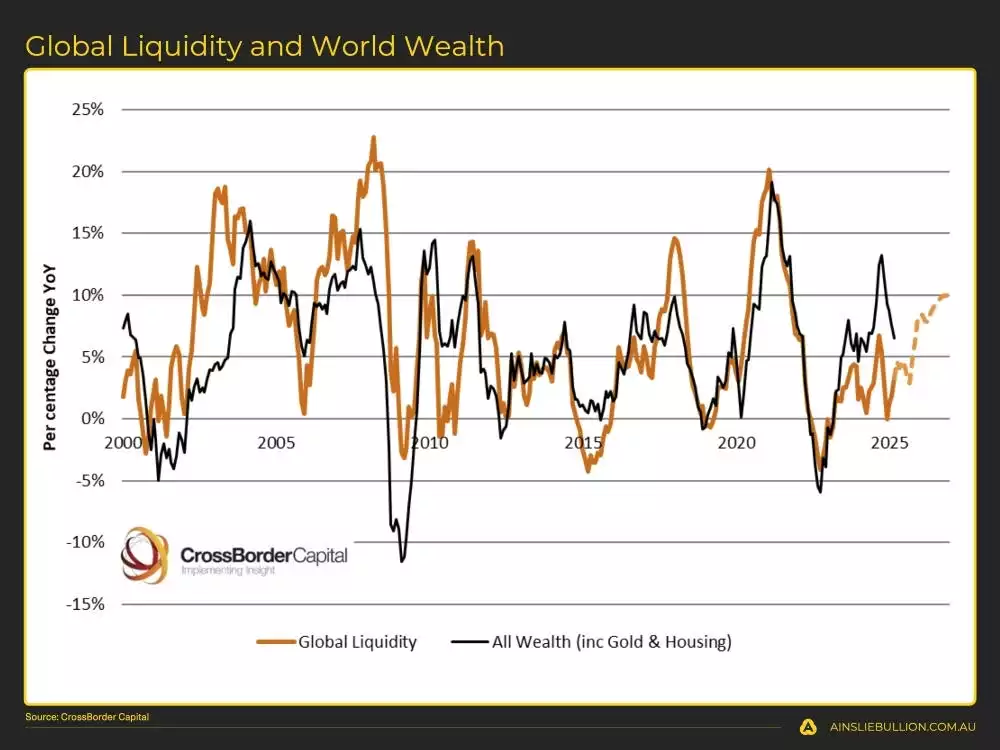

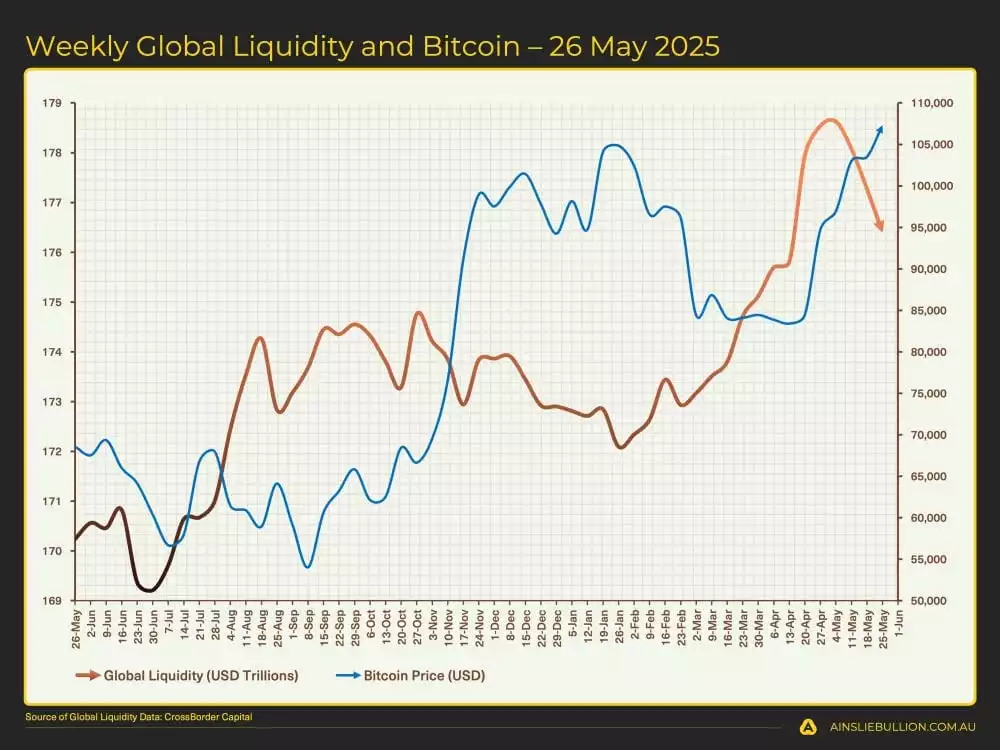

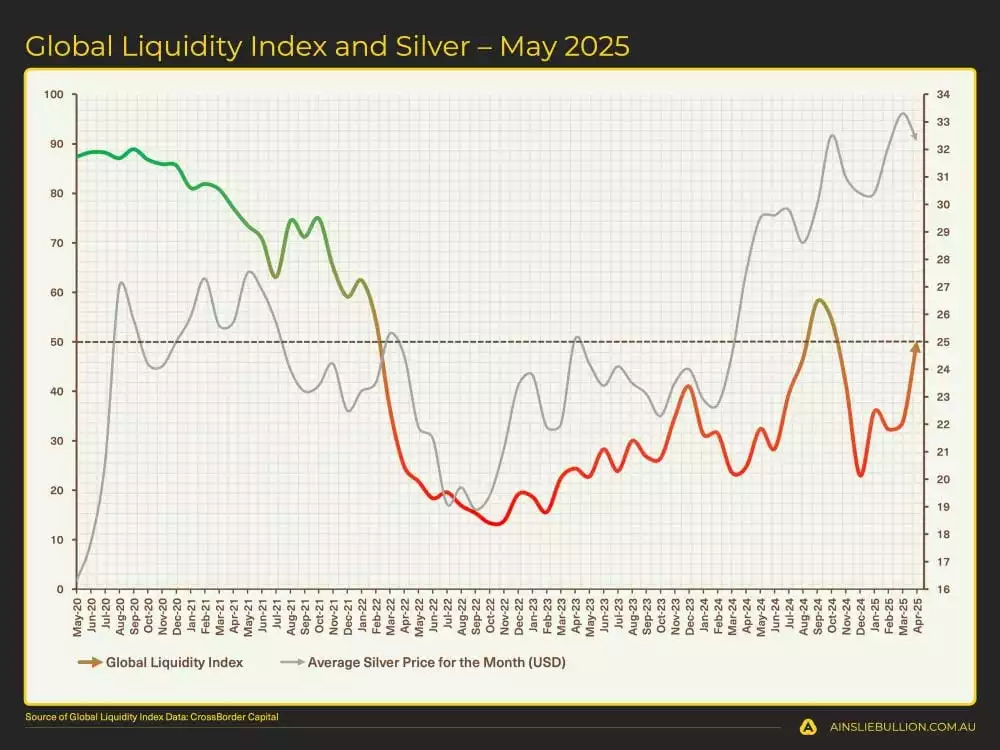

Total global liquidity now sits near US $176 trillion and remains on an upward trajectory even as headline central bank balance-sheet growth stays subdued. Much of the recent lift has come from the US Treasury’s spend-down of its General Account ahead of the debt-ceiling renegotiation and from China’s incremental easing to counter domestic deflationary pressure. While weekly flows have cooled, the index that captures the trend, rate of change, and direction remain firmly in an expansionary regime. Short-term bill issuance to fund sizeable US fiscal outlays is likely to add another burst of collateral in the September quarter, offsetting any temporary liquidity drains.

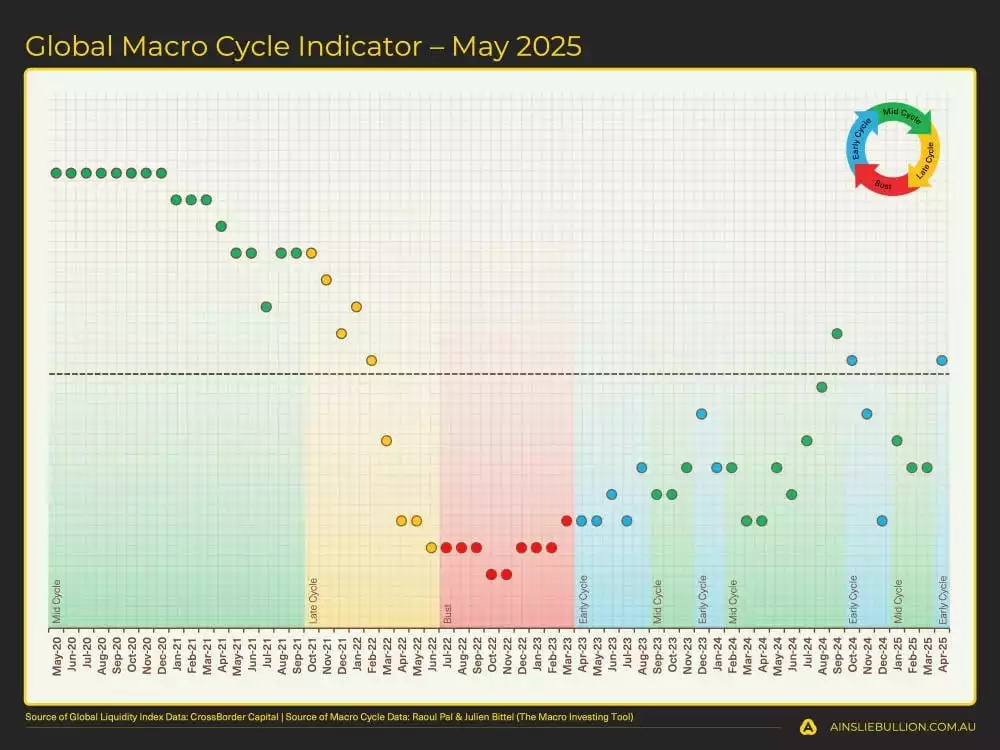

Deep dive on the Global Macro Cycle

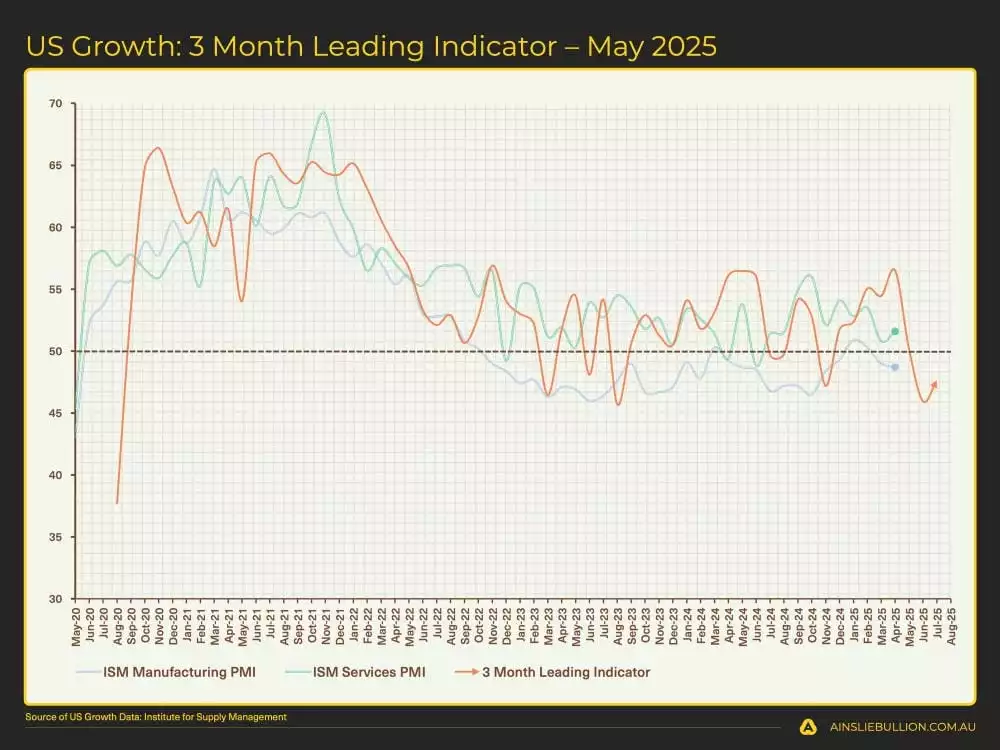

Economic conditions mirror a classic early-to-mid-cycle hand-off. US growth prospects are being underwritten by a proposed multi-trillion-dollar fiscal package that extends tax breaks and favours domestic investment. Services surveys stay comfortably above 50, manufacturing is edging higher, and unemployment has barely budged. Core inflation looks to have bottomed and could drift towards 3–4 % as fiscal stimulus lifts household cash flow, yet that level remains manageable while real growth accelerates. The main pressure point is sovereign debt: US outstanding federal debt is racing toward US $40 trillion and elevated yields are holding the bond market in a wide trading range. A sustained break lower in the US dollar—now testing the bottom of its multi-year range—would relieve global funding stress and add a fresh layer of liquidity.

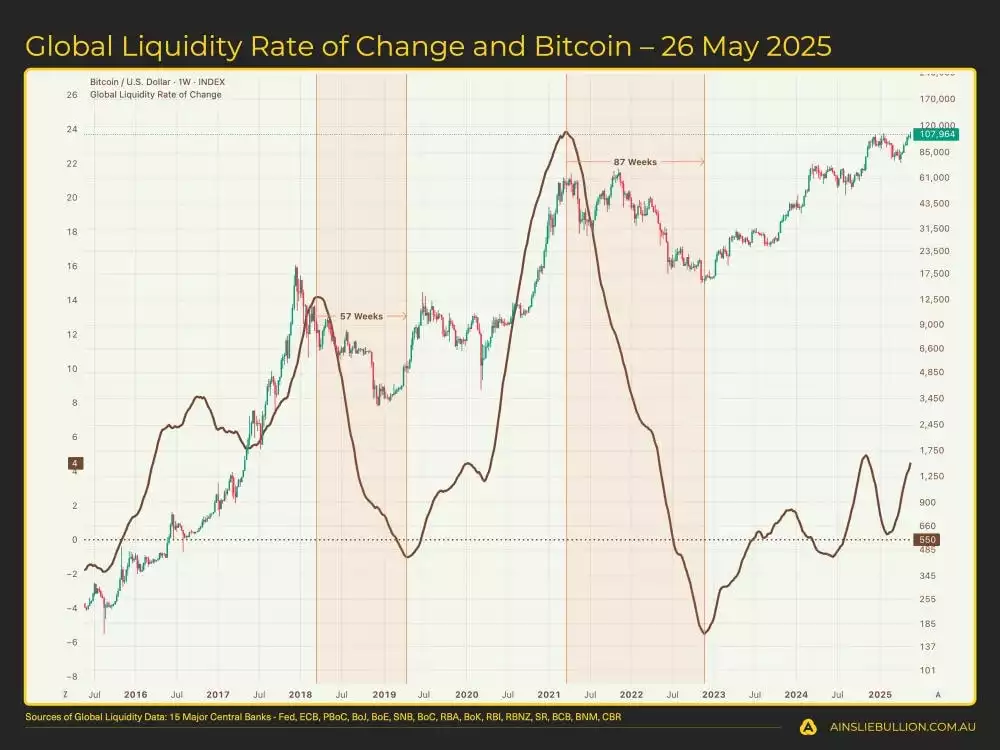

Deep dive on the Bitcoin Cycle

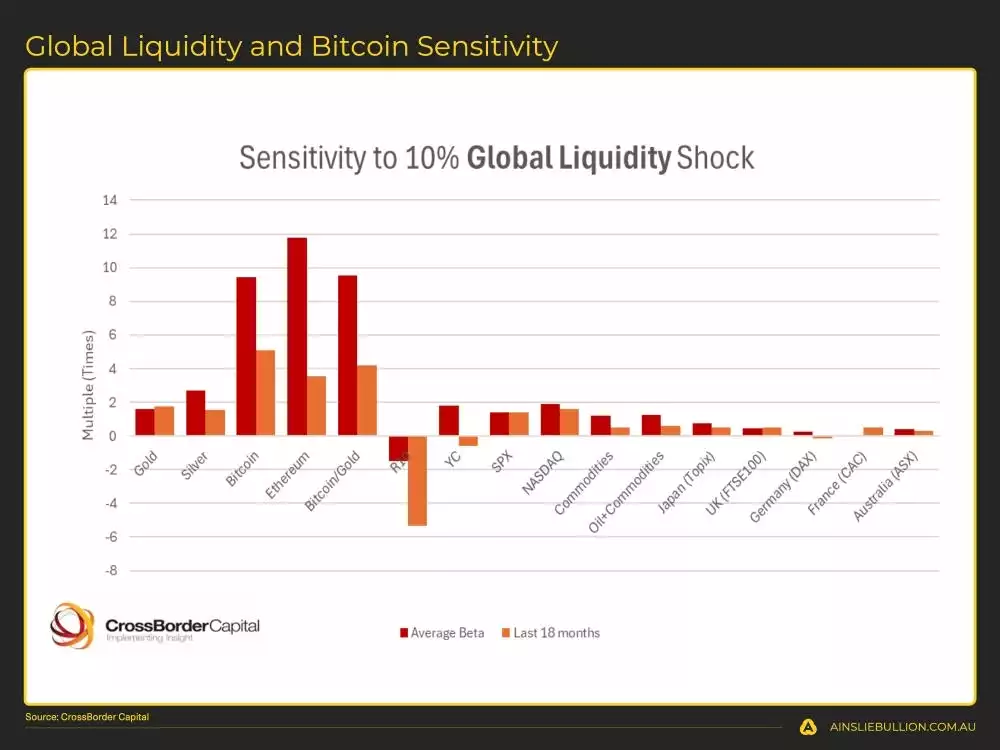

Bitcoin continues to demonstrate the highest beta to liquidity pulses, historically responding by roughly nine times any percentage change in the global pool. After a rapid rebound above the psychological US$100,000-mark, positioning has become crowded, so interim pull-backs of 10–15 % remain probable. However, projected liquidity growth through the second half of the year, coupled with improving macro conditions, points to higher highs later in the cycle. For long-term holders the risk-reward profile is still skewed to the upside; short-term weakness is best viewed as an opportunity to add rather than a reason to exit.

Gold and Silver

We can take advantage of the Macro Cycles by strategically allocating between the Macro Assets (Bitcoin, Gold, and Silver) during the optimal cycle stages.

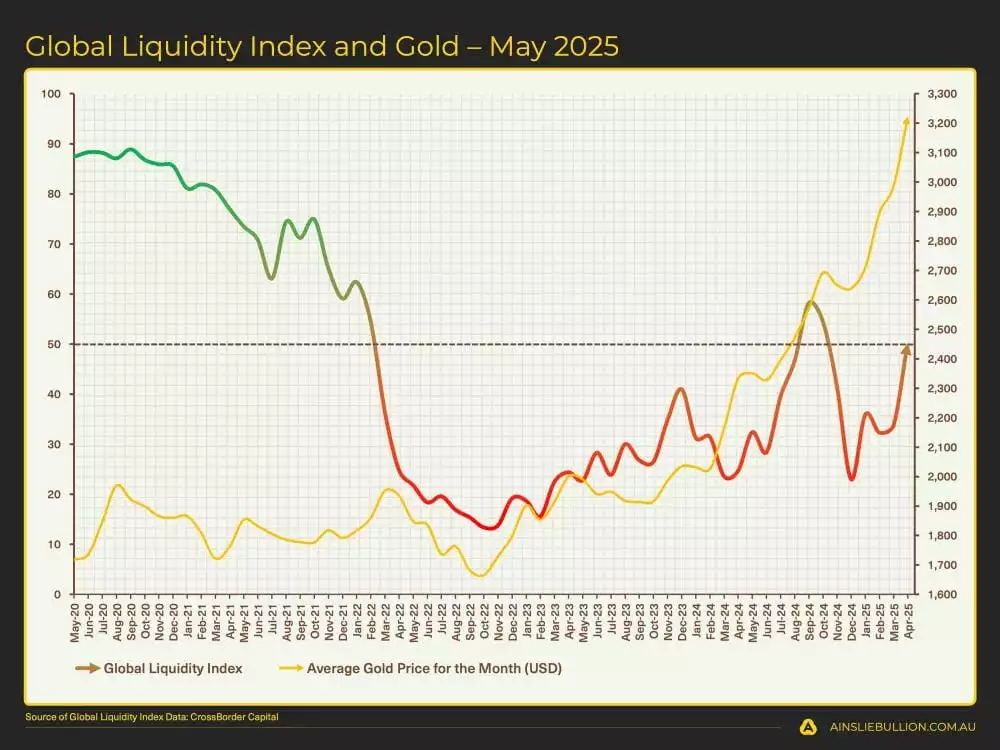

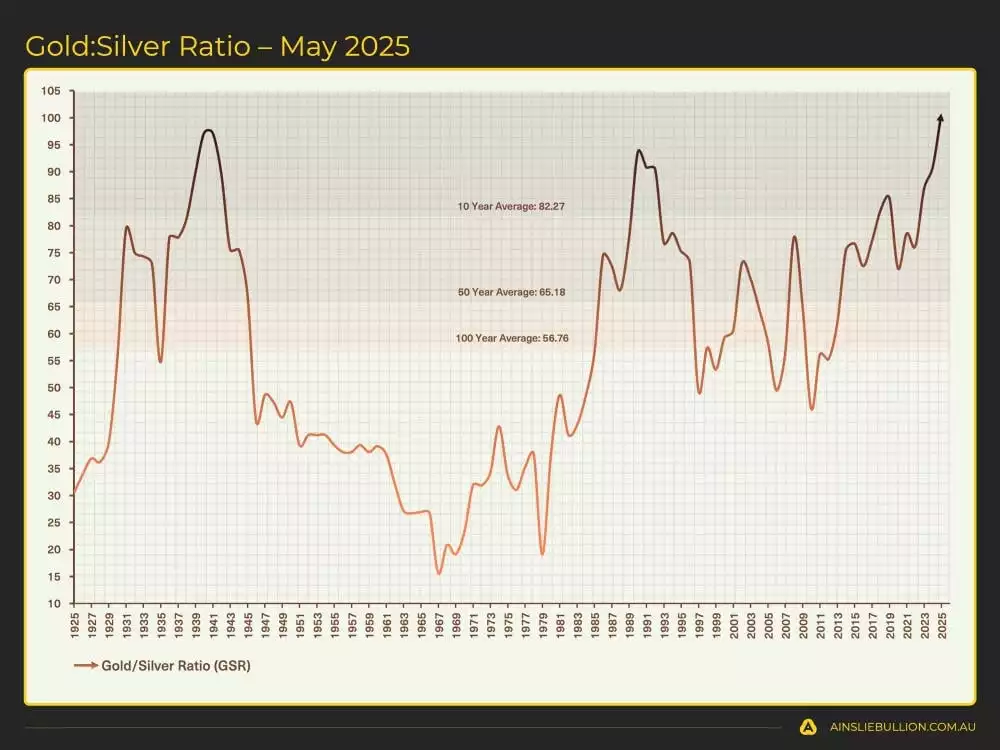

Gold’s resilience is striking, prices sit only fractionally below record peaks despite real yields still positive. Demand is broad-based—central banks are absorbing close to 1,000 tonnes a year, ETF inflows have returned to pandemic-era strength, and futures traders are increasingly demanding physical delivery. That steady bid limits the downside even if prices consolidate after an extended run. Silver remains the late-cycle play. The gold-to-silver ratio hovers near 100:1, a level rarely sustained once liquidity accelerates. Historically, a ratio compression back towards the low-80s or high-70s accompanies a powerful catch-up rally in silver. Investors seeking to rotate gold gains into higher-octane exposure are likely to find silver increasingly attractive as the cycle matures.

A Simple Trading Plan to take advantage of the cycles

Watch the video presentation to see full details of the specific Trading Plan we provide, that you can follow, which has returned 224.8% p.a. as at Tuesday’s recording.

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here:

We will return in June to assess what has changed and keep you updated with everything you need to know. Until then, good luck in the markets!

Chris Tipper

Chief Economist and Strategist

The Ainslie Group

x.com/TipperAnalytics

Note: The monthly video presentation is recorded live with our expert panel. Our objective is to make the updates as useful and specific to what you want to understand as possible, so as always feel free to reach out with any questions or feedback that we can incorporate into next month’s video to make it something that provides you with the highest possible value for your time!