Macro and Global Liquidity Analysis: Gold, Silver, and Bitcoin – February 2025

News

|

Posted 28/02/2025

|

3104

Today the Ainslie Research team brings you the latest monthly update on where we are in the Global Macro Cycle, driven by the Global Liquidity Cycle, and the implications for Gold, Silver, and Bitcoin. This summary highlights the key charts discussed with our expert panel on Wednesday. We encourage you to watch the recorded video of the presentation in full for the detailed explanations.

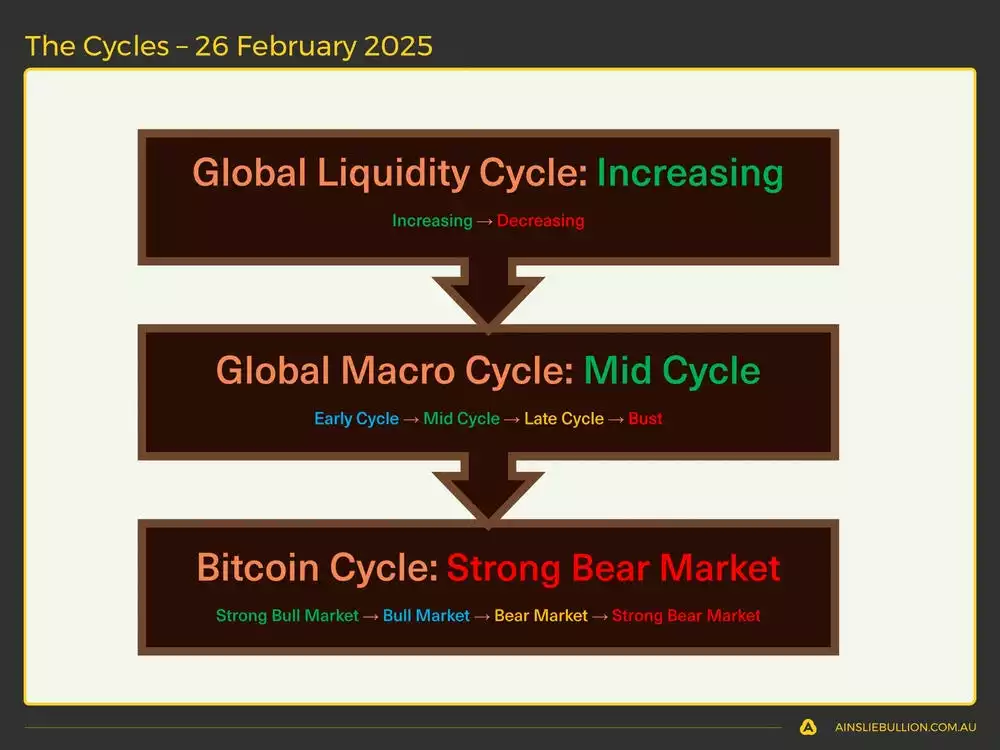

Where are we currently in the cycles?

Even though the “strong bear market” signal is currently flashing in the Bitcoin cycle, the broader context offered by the other charts—particularly the global liquidity and macro cycles—provides a valuable perspective. Relying on Bitcoin’s price action in isolation can lead to knee-jerk decisions because large price swings are common for this asset class. By overlaying a framework that considers liquidity levels (still broadly supportive) and the macro cycle (still in “mid cycle”), we can see that short-term pullbacks do not necessarily invalidate a longer-term bullish thesis. Indeed, while the recent red bars in Bitcoin have drawn attention, the same cyclical lens that flagged liquidity constraints and inflationary pressures in previous periods also suggests that liquidity must return. Consequently, episodes like these can be viewed as potential buying opportunities for those with a longer horizon—rather than signals to bail out—highlighting the importance of integrating multiple cycle indicators before making any move.

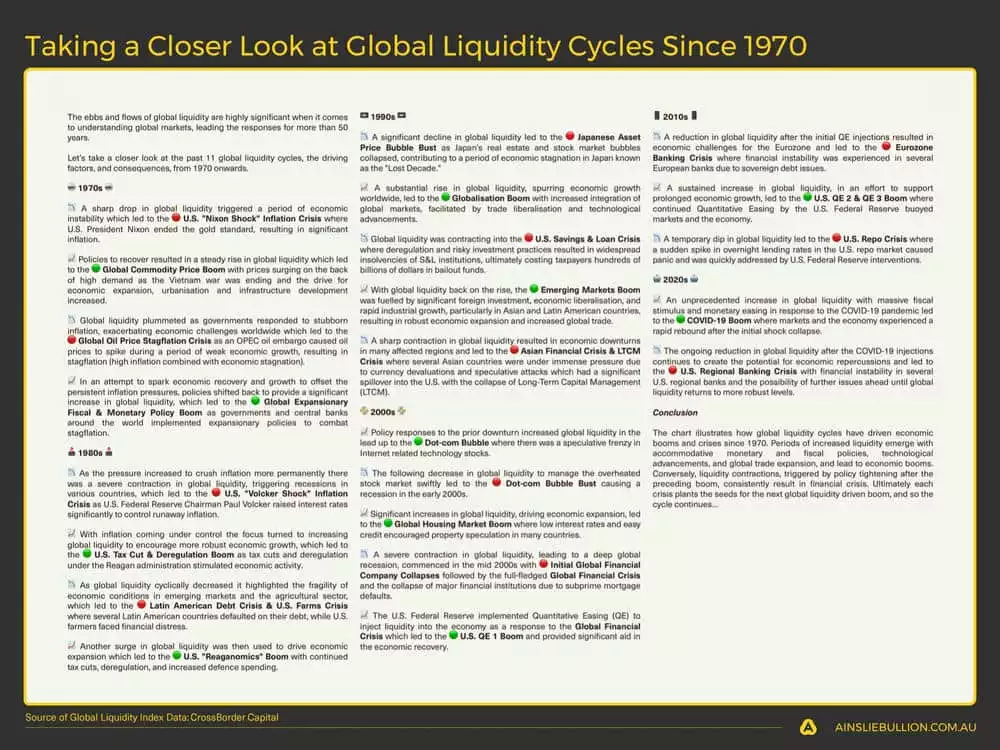

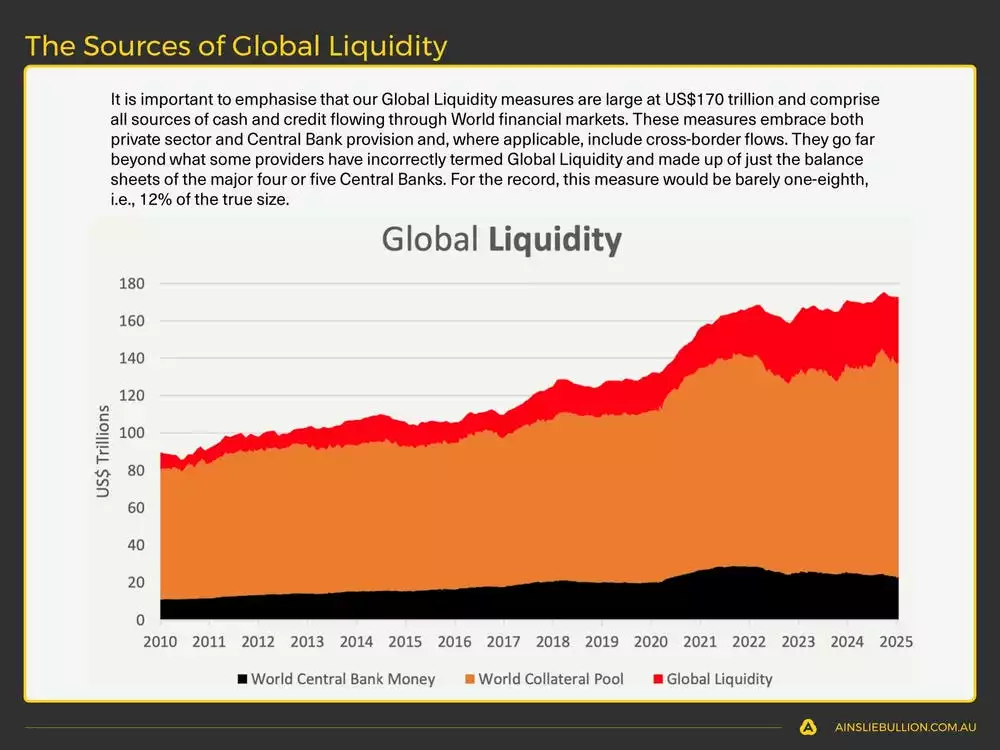

Deep dive on the Global Liquidity Cycle

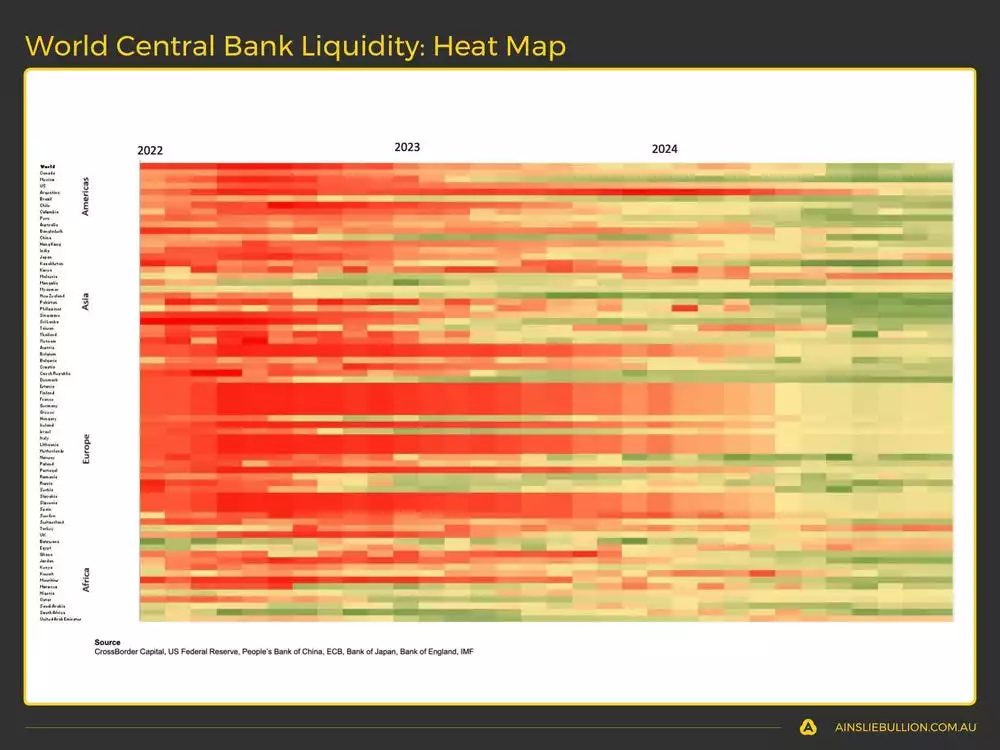

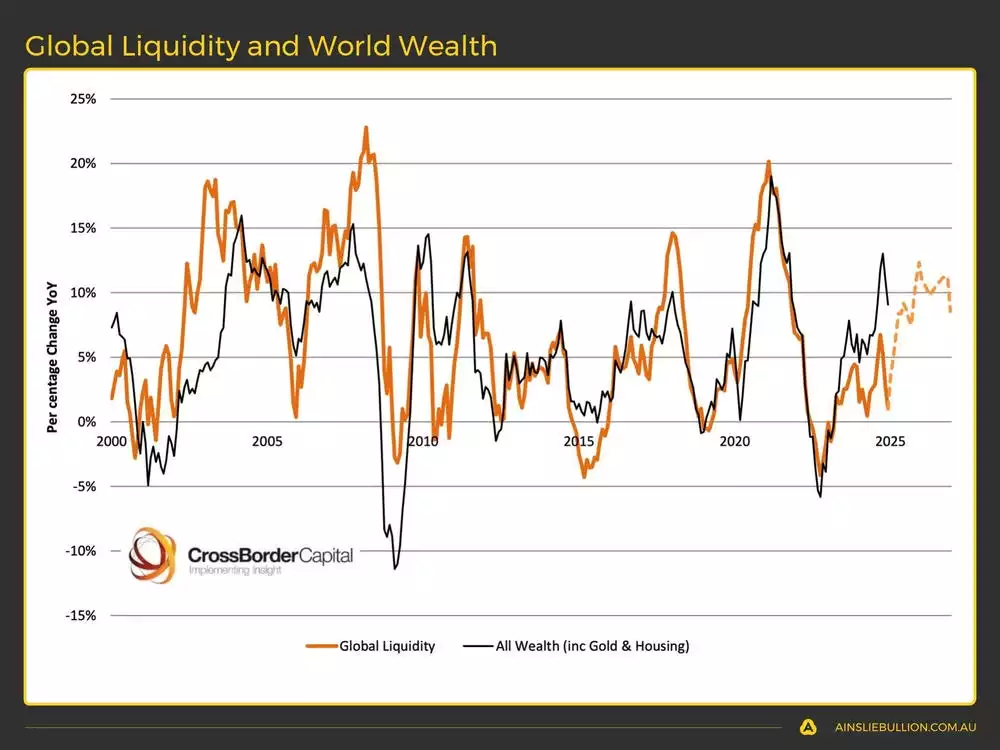

A key reason behind this continued optimism lies in the global liquidity cycle itself, which historically follows a clear ebb-and-flow pattern. We may not yet have reached the cycle’s true peak despite already hitting a relatively high-level last year. Indeed, liquidity has been grinding higher—particularly on the back of U.S. dollar weakness and improved bond-market stability—at a time when many of the major central banks remain cautious in their policy stance. Smaller or regional central banks, as well as broader credit markets, have quietly contributed to liquidity growth, showcasing that global liquidity can rise even in the absence of overt central bank easing. When zooming in on the weekly data, that upward trajectory becomes even more apparent; we’re seeing higher readings that could ultimately drive the Global Liquidity Index back above 50, reinforcing the viewpoint that this cycle still has room to run.

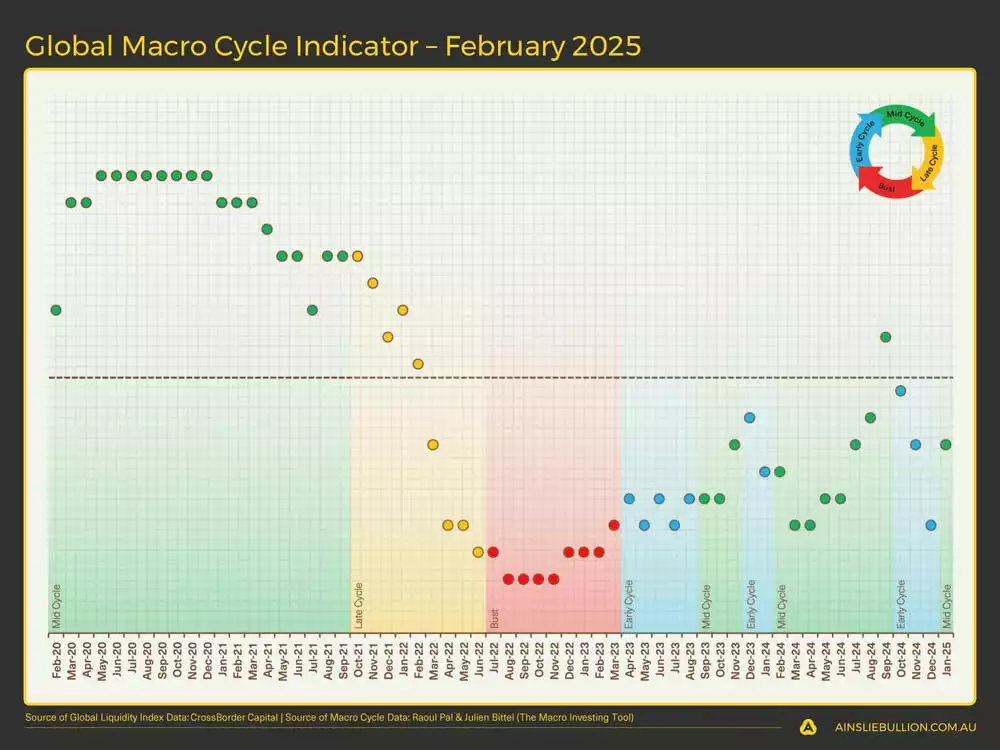

Deep dive on the Global Macro Cycle

Turning to the U.S. macro backdrop, the data shows growth indicators pushing higher, yet the market remains rattled by a huge chunk of government debt slated for refinancing this year. If that supply of Treasury issuance cannot be smoothly absorbed, yields could spike—unless the Fed steps in to suppress rates, potentially reigniting QE and pushing the dollar lower. Indeed, although technical signals hint the dollar could rally again in the short term, a weakening greenback is increasingly viewed as the “exit valve” for debt pressures, especially in an environment where inflation no longer appears to be the immediate threat. Nonetheless, policy uncertainties—ranging from job cuts in the public sector to erratic decision-making—cast a shadow over both consumer and business confidence. So while the current administration’s pro-growth stance appears to be boosting certain parts of the economy, a more “engineered” slowdown could still emerge if officials are forced to manufacture conditions for the Fed to justify rate cuts and fresh liquidity injections.

Deep dive on the Bitcoin Cycle

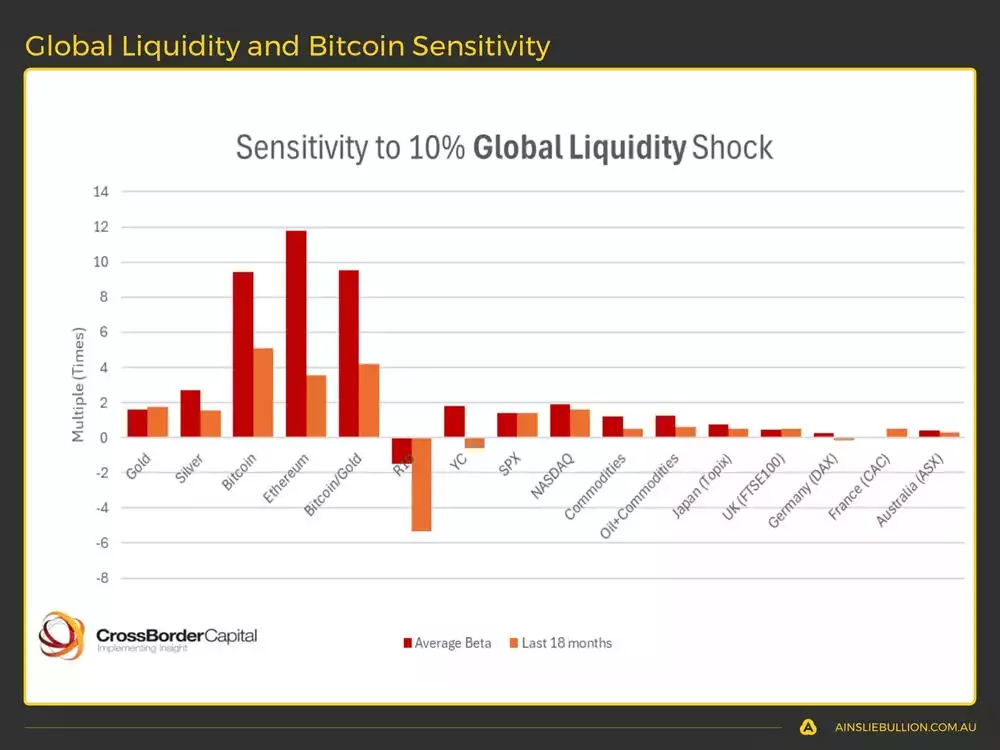

Amid this dramatic price drop in Bitcoin (the “big red candle”), Bitcoin remains our top pick in an expanding liquidity environment. Even though Ethereum’s “red bar” on the sensitivity chart is technically higher, Bitcoin is considered the purest and safest play. In essence, a 10% shift in global liquidity can translate to a 10x move in Bitcoin—an appeal that only strengthens when factoring in the broader macro-outlook. We follow the mantra of “invest in it, but watch that cycle,” especially given the necessity for central banks and governments to keep injecting liquidity. Indeed, this recent dip has so far proven to be a textbook reset of market sentiment, visible in the large number of long liquidations. Once liquidations subside and the “pain” has been inflicted, the stage is set for a strong rebound—particularly if the fundamental driver of rising global liquidity presses on through the rest of the year.

Gold and Silver

We can take advantage of the Macro Cycles by strategically allocating between the Macro Assets (Bitcoin, Gold, and Silver) during the optimal cycle stages.

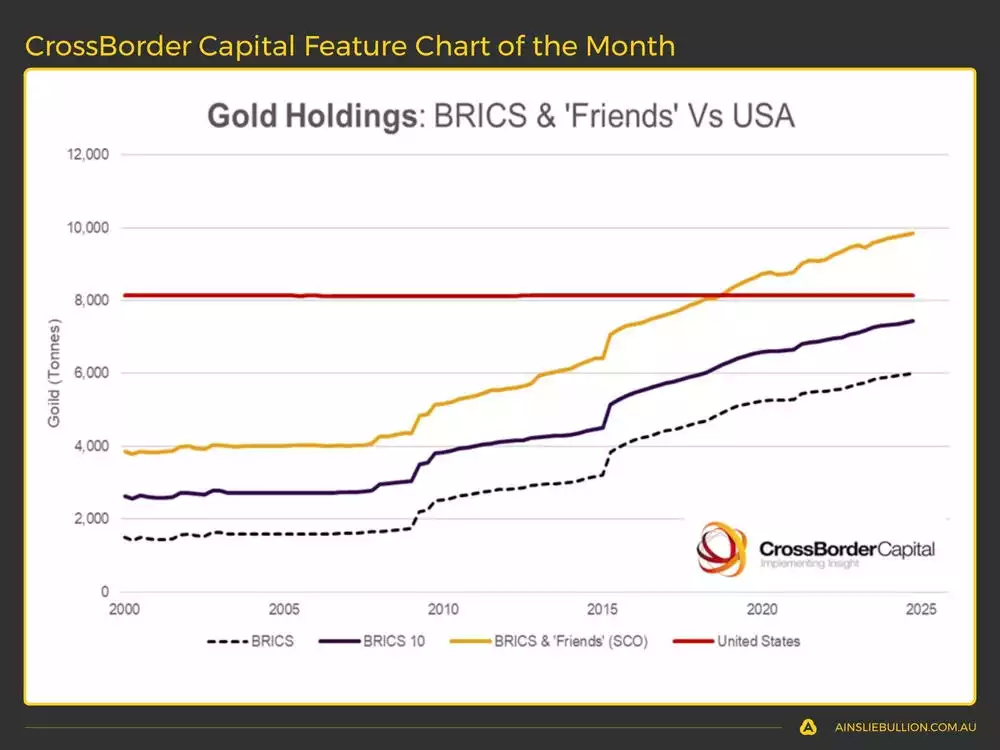

Whereas Bitcoin is our go-to asset for capturing high liquidity-driven upside, gold and silver remain critical “risk-off” hedges—particularly when macro uncertainty intensifies. Recent geopolitical developments (including warmer relations between the U.S. and key BRICS nations, widespread gold repatriation to the U.S., and Basel IV’s increased weighting for physical gold) have put gold in the headlines, pushing it closer to the psychological US$3,000 mark. At the same time, silver’s potential is quietly building it lags gold within the broader liquidity cycle, typically accelerating late in the game. With the gold–silver ratio soaring above 90, and demand for silver surging in solar panels, EVs, and electronics, many see this as a textbook setup for a possible silver “slingshot.” While retail buyers may be squeezed by inflationary pressures, institutional and high-net-worth investors appear to be stepping up their allocations—reflecting a growing recognition that the precious metals corner of the market, often overlooked until conditions become extreme, could be approaching another significant inflection point.

A Simple Trading Plan to take advantage of the cycles

Watch the video presentation to see full details of the specific Trading Plan we provide, that you can follow, which has returned 198.2% p.a. as at Wednesday’s recording.

Watch the full presentation with detailed explanations and discussion on our YouTube Channel here:

We will return in March to assess what has changed and keep you updated with everything you need to know. Until then, good luck in the markets!

Chris Tipper

Chief Economist and Strategist

The Ainslie Group

x.com/TipperAnalytics

Note: The monthly video presentation is recorded live with our expert panel. Our objective is to make the updates as useful and specific to what you want to understand as possible, so as always feel free to reach out with any questions or feedback that we can incorporate into next month’s video to make it something that provides you with the highest possible value for your time!