Macquaire Goes Bullish on Gold

News

|

Posted 13/09/2023

|

2858

Infamous Australian (but globally respected) investment bank Macquaire is predicting a surge in gold prices and now encouraging clients to invest in a slew of ASX listed gold miners due to central banks increasing their holdings of the precious metal to hedge against inflation risks.

On Monday gold saw a 0.2% increase, reaching $US1946 ($3023 AUD) per ounce, with Macquarie forecasting it to rise by 8% to $US2100 per ounce by the second quarter of 2024.

The bank suggests that investors consider buying shares in several ASX-listed gold mining companies, including Northern Star, Regis Resources, Genesis Minerals, and St Barbara, to potentially benefit from the anticipated rise in gold prices.

“Emerging cracks in the US labour market should widen into next year and bring back a conducive environment to financial inflows to gold.” Macquarie wrote in a recent note to clients. “We think the balance of risks is now for prices to be materially higher.”

The investment bank has revised its gold price projections, increasing them by 9% for 2024 to an average price of $US2019 per ounce, with a 5% upgrade for 2025 to an average of $US1875 per ounce.

Macquarie attributes the higher-than-expected gold prices to central banks aggressively purchasing gold throughout 2023, despite challenges posed by a strong US dollar and rising risk-free rates of return on bonds and cash.

Additionally, central banks in countries such as China, Turkey, Poland, Qatar, and Singapore have been prominent net buyers of physical gold in July. They are diversifying their reserves in anticipation of potential increases in US dollar issuance to finance constant, exorbitant, no end in sight government spending.

China, in particular, has consistently increased its gold holdings over the past nine months while reducing its US treasury holdings to a record low in June. This trend has been seen by most economists as strategic and politically motivated.

In the aggregate, Chinas bought 23 tonnes of Gold in July, totalling its net buying to 126 tonnes for the year and taking its reserves to 2136 tonnes overall, approximately 4% of the world’s reserves, according to the Gold Council.

Despite these developments, some experts, like BetaShares chief economist David Bassanese, believe that central bank buying alone may not be the primary driver of gold prices.

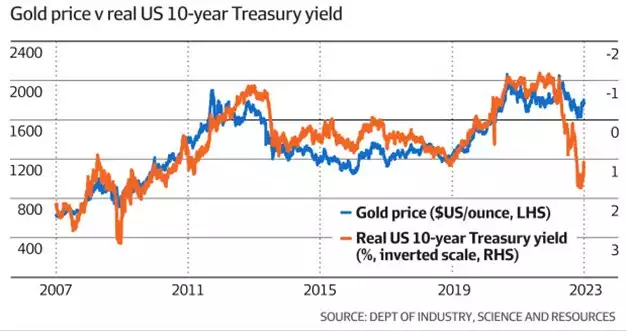

Instead, he suggests that factors like US economic growth, bond yields, and the strength of the US dollar play a significant role, as traditionally, gold prices move inversely to yields on risk-free investments since it becomes a more appealing store of value when alternative assets offer lower yields.

“I don’t think central bank buying is a major factor for now,” he said. “But gold can rally if bond yields top out and people talk about intereste rate cuts. If we get a risk on environment where the US dollar weakens that’ll boost gold.”

Even if the extremely strong central bank buying is not an immediate factor impacting gold’s price at this very moment, the longer China and other nations continue accumulating these strong reserves, the more likely a gold price rush of sorts will ensue due to this unsustainable global central bank demand/supply dynamic.