Lowe Goes Rogue: RBA Shocks the Market Yet Again

News

|

Posted 03/05/2023

|

8605

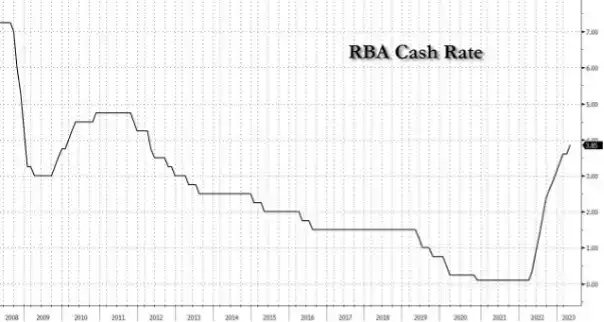

In yet another monthly interest rate surprise, yesterday the RBA announced a 0.25% rate hike, ending all the optimism that followed after last month’s brief pause.

The decision was predicted by only 9 of 30 Bloomberg analysts and had an outsized effect on both global and domestic markets, with the ASX 200 in particular finishing the day down 0.9%.

There was a strong historical precedent for the RBA to regularly hold multi month pauses, which made the decision even more staggering.

In the midst of the pubic and media backlash, Philip Lowe has held firm, justifying his decision within the current context of the Australian economy during yesterday’s meeting.

“Since [the April meeting] we have seen further evidence that the Australian labour market is still very tight, that services price inflation is proving to be uncomfortably persistent abroad, and that asset prices – including the exchange rate and housing prices – are responding to changes in the interest rate outlook.”

Lowe went on to admit that “energy price inflation is still high and will likely remain so for some time.”

Of course, some of the main drivers of inflation such as energy prices and supply constraints remain outside of the RBA’s control, begging the question as to how much these rate rises can truly impact inflation without completely destroying middle class consumption.

Philip Lowe also hinted at a continuation of these interest rate rises in the coming months.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve.”

During the last meeting, the RBA said the pause was due to wanting to gather more information about the current economic situation.

Confoundedly, by almost every metric, it appears the economy has only worsened, which makes their decision even more baffling.

For example, Australia’s economic GDP growth forecast was reduced from 1.5% to 1.25% this month, a sign, if anything, that the rate hikes have been effective.

Additionally, another major US Bank, First Republic, recently went under (which we predicted last week on insights here) and has been subsequently bought out by JP Morgan.

Even with all the economic chaos, the RBA still decided to raise rates again. Similarly, The US Federal Reserve is expected to do the same later in the week.

If there is a lesson from the shock rate hike announcement yesterday, surely it would be to not only expect the unexpected from the RBA, but most importantly, protect your portfolios against the chaos accordingly.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************