Low Sentiment, Unemployment Drive Gold

News

|

Posted 13/05/2024

|

2167

Recent payroll data combined with initial unemployment claims from late last week have revealed that there are cracks in the U.S. economy. This is often a sign that risk markets could be in trouble and has the potential to move the Fed's proposed rate cut to an earlier timeframe.

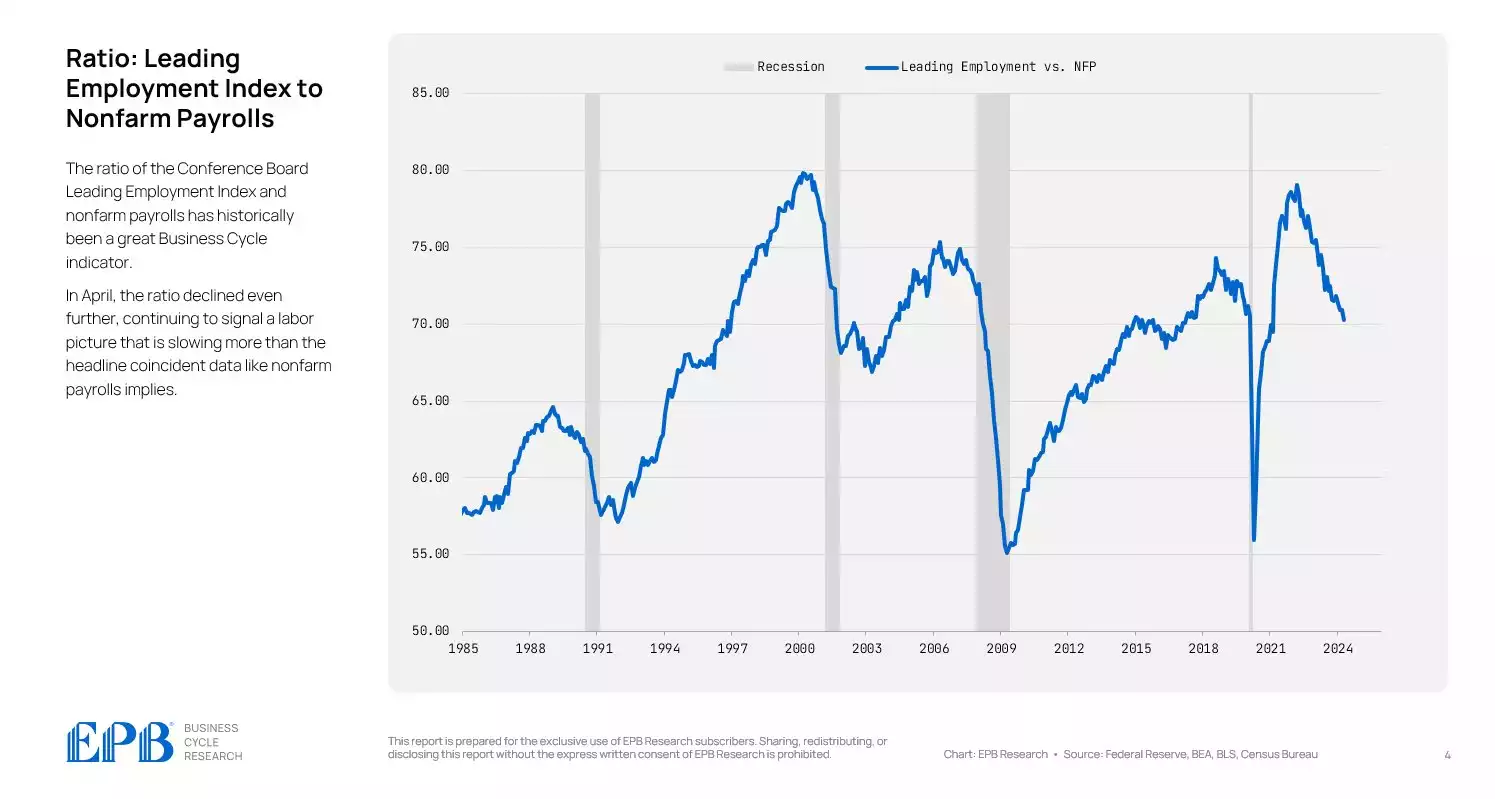

The ratio of the Conference Board Leading Employment Index and nonfarm payrolls has historically been a great Business Cycle indicator. Last month it declined further, indicating things are worse than the NFP Employment figures indicate:

Gold has reacted to this by darting upward out of its slight dip:

An arsenal of central bank speakers came out over the weekend who seemingly tried to quell the excitement.

Atlanta Fed President Raphael Bostic expressed optimism in an interview with Reuters, stating that policymakers could potentially reduce the benchmark lending rate this year. However, he emphasised uncertainty regarding the timing and extent of any policy easing.

Meanwhile, Chicago Fed President Austan Goolsbee suggested that the current monetary policy might be somewhat restrictive, as reported by Reuters. He noted a lack of evidence indicating that inflation is slowing down, particularly emphasizing that inflation remains around 3%.

Fed Governor Michelle Bowman underscored the importance of maintaining credibility in the fight against inflation. She emphasised the need for policymakers to proceed cautiously and deliberately to achieve the 2% inflation target.

Dallas Fed President Lorie Logan cautioned against premature considerations of lowering interest rates due to potential upside risks to inflation, according to another Reuters report.

To address inflation concerns, the Federal Open Market Committee (FOMC) had tightened monetary policy by 525 basis points from March 2022 through July 2023. Since then, the FOMC has maintained unchanged interest rates, with the most recent pause announced last week.

Data from the University of Michigan's Surveys of Consumers revealed a decline in the main sentiment gauge to 67.4 in May from 77.2 in the previous month. This makes it the most significant month-to-month decline since August 2021. The U.S. two-year yield rose by 6.1 basis points and the 10-year rate increased by 5.1 basis points.

Fed speakers' attempts to calm cut hopes could prove difficult as the Fed does not want to be seen as trying to cause a crash. The poor data above puts them in a difficult position in which they are expected to respond credibly. Future bad data, potentially the upcoming CPI, could further pressure them to cut earlier than expected.

Recall our analysis of the last Fed FOMC meeting last week. Whilst all eyes are on rates, they are quietly easing already on the Fiscal stimulus and monetary supply side. Gold is reading the play, not the headlines.