Lost Silver – Why that’s good!

News

|

Posted 10/09/2020

|

13090

When asked why gold and silver have intrinsic value the answer is ultimately about how rare it is and the fact that it can’t simply be expanded at whim like Fiat currency can, and currently is being expanded. As you expand the supply of a monetary asset you dilute or debase its intrinsic value. Fiat currency has none. It is a piece of plastic backed by nothing more than the promise of a government who is ‘printing’ more of it hand over fist.

New gold supply is historically consistent at around 2% or less per year. “Lost” gold is relatively insignificant as its industrial uses are nowadays comparatively minor and even then efforts are made to recover where possible due to its value. Where gold is ‘lost’ to the market is where it is bought by generational long term holders like the Chinese and to a similar extent central banks. That is why of the nearly $12 trillion value of all the gold ever mined, experts say there is really only $1.5 to maybe $2 trillion available to the investment market. Compared to over $300 trillion in financial assets that is both miniscule and tantalising from a price growth potential on the price / supply / demand equation when even a fraction of the $300 trillion takes fright and tries to get into it.

Back in June we wrote to the plummeting silver supply issue during this pandemic amid exploding demand. Silver today remains hard to get hold of and supply is slow. Whilst another shipment arrives tomorrow providing surplus stock, some Ainslie customers have been waiting 2 weeks for silver kilo bars and most other bullion dealers are stating 4-6 week waits and longer. The market is tight and freight channels to carry it in this pandemic are disrupted and expensive.

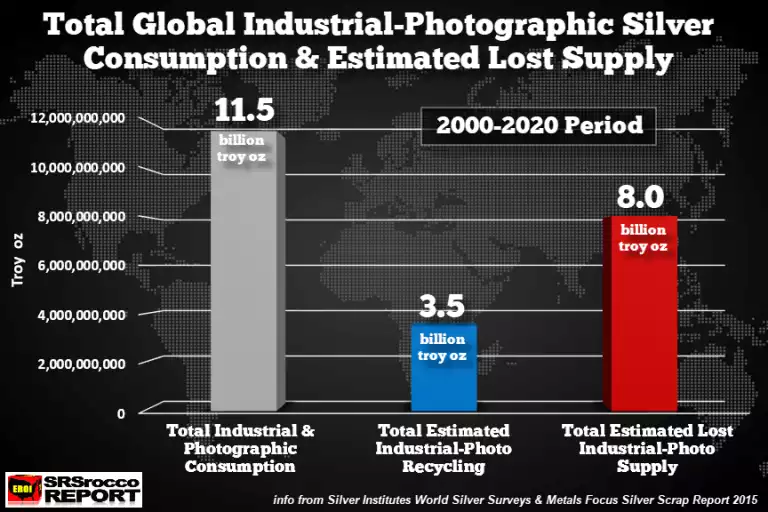

The guys at SRSrocco Report recently wrote to the amount of silver lost to industrial and photographic consumption.

“Some analysts suggest there is a great deal more silver in what they label as “Above-ground inventories” in the world but fail to mention that the majority of that amount is locked up in industrial components-equipment and landfills never to be recycled.

To provide an estimate of the lost silver supply from the industrial sector since 2000, I looked at the data from the Silver Institute’s World Silver Survey’s and the Metals Focus 2015 Silver Scrap Supply Report. This is just a basic estimate, which I will revise in more detail for SRSrocco Report Silver & Gold Members in an upcoming report.

However, since 2000, the Industrial and Photographic sectors of the silver market consumed 11.5 billion oz of silver. The estimated total recycled silver from the industrial and photographic sector was approximately 3.5 billion oz. In the last two decades, 8 billion oz of silver supply is likely lost forever.”

“Thus, 70% of total Industrial and Photography consumption over the past 20 years is no longer available to the market. I believe, gone forever… or let’s say, the overwhelming majority of that 8 billion is likely lost forever.

Now, if we add up the total silver demand from 2000 to 2020, it equals a bit more than 20 billion oz. So, with 8 billion oz of the 20 billion unavailable to the market, that equals 40% of the total market is now somewhere in SILVER HEAVEN. Compare that to only 7-8% of the gold supply lost in the industrial-technology sector over the past decade (2010-2020).”

Silver rallied strongly in July taking the gold : silver ratio from the 100’s to the low 70’s where it has paused since, taking the breath it had to take after rocketing from US$17 to US$30 in the matter of a month. However even at 70:1 that is still historically high when one looks at the circa 45:1 100 year average. Both gold and silver have played the role of monetary metal for 5000 years. Silver’s growing industrial use, particularly in disposable products like electronic devices and solar panels, makes something rare and of intrinsic value all the rarer. Remember too, over half of silver supply comes as a by-product of industrial metals such as copper, lead and zinc all of which face the headwinds of the biggest recession the world has seen in a generation.

And so, yes there are often waits for silver ordered now but that in itself should be screaming the value proposition. Ainslie only sell bullion we already own, no exceptions. We always tell you up front in the webshop if there is a wait as well. The wait is production and shipping due to rampant demand and supply constraints. It seems a wait worth waiting….