Liquidity-Fuelled Drop in Unemployment

News

|

Posted 11/09/2025

|

1485

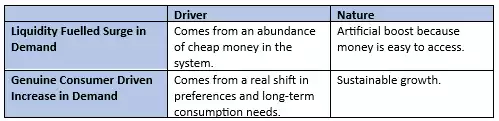

Employment growth, at face value, is universally seen as a good thing — more jobs, more money, more prosperity. However, more employment often means more money circulating in the economy, which can stimulate growth but also fuel inflation, currency debasement, and asset price bubbles. While a rise in employment driven by consumer demand is important, not all job growth is green or sustainable, particularly when it is fuelled by an expanding money supply.

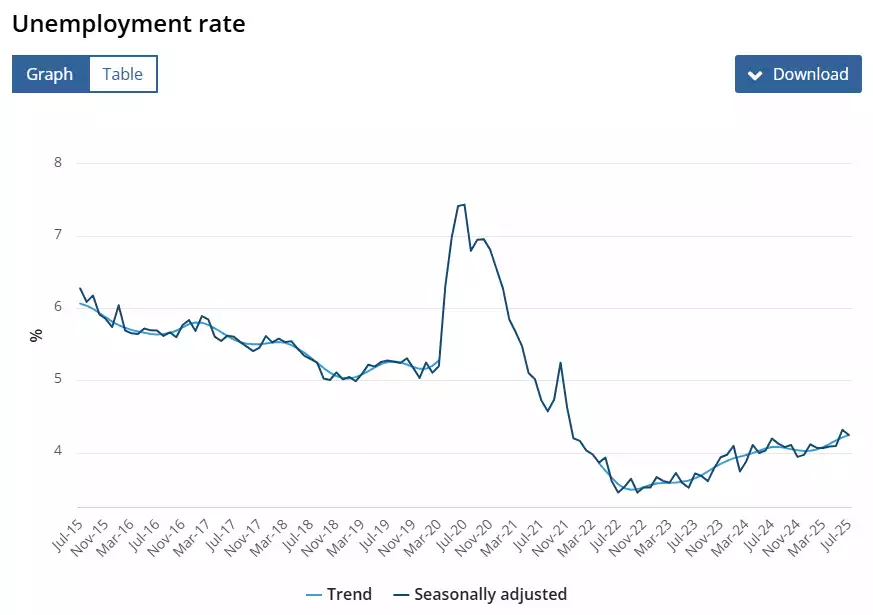

Since COVID, the rate of unemployment has fallen a staggering 3.9% going from 7.4% in November 2020 to 4.2% in July 2025. This would be a truly remarkable feat if the growth in employment was fuelled by real consumer demand and not just an increase in money supply.

Australian unemployment chart sourced from the Australian Bureau of Statistics.

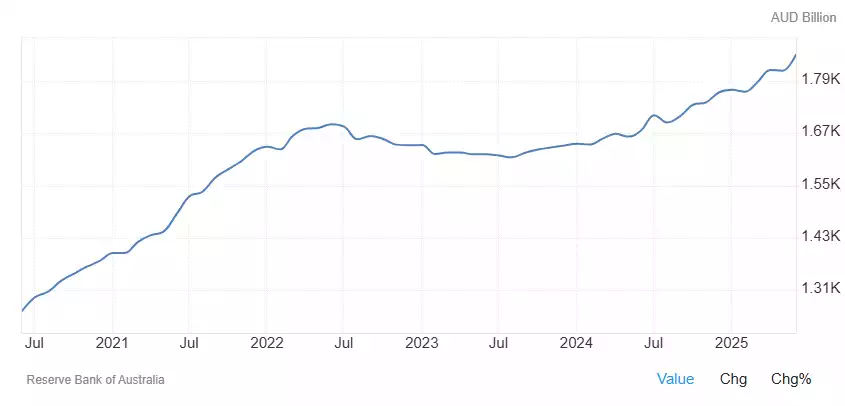

There is an inflation-fuelled increase in employment, which is unhealthy and unsustainable in Australia. Since COVID, our currency has been debased by 27.5%, closely mirroring an equivalent increase in the money supply. When there is more M1 money circulating in an economy, the purchasing power of each individual dollar goes down. If you held a $100 note in 2020, today it would only buy you the equivalent of $72.50 worth of goods, products and services. The 27.5% surge in money supply suggests today’s lower unemployment rate is the product of stimulus, not real demand. When more money is injected into the economy, consumer spending and business investment increase, which boosts demand for goods and services, in turn, creating more jobs to meet that demand. More money in the system boosts demand, and higher demand means businesses need more workers, so employment rises.

Increase in the M1 money supply sourced from the Reserve Bank of Australia.

The link between surging money supply and falling unemployment is not a coincidence; it is the undeniable consequence of monetary expansion. More money flooding the economy artificially fuels job creation, giving the illusion of prosperity. This increase in demand, being largely liquidity-fuelled is unhealthy and unsustainable, as it heightens inflationary pressures and distorts genuine market signals.

Employment is absolutely critical for livelihood; however, job creation alone, particularly when it is liquidity-fuelled, doesn’t guarantee real prosperity.