Latest Platinum Supply and Demand Data and Forecast

News

|

Posted 03/12/2024

|

2681

The latest platinum supply and demand data reveals a revised 2024 deficit, steady demand projections, and a first forecast for 2025, with supply challenges expected to persist for a third consecutive year.

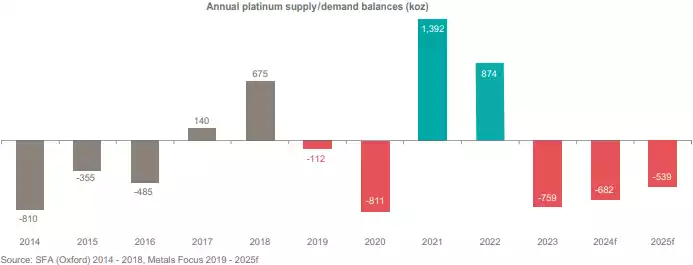

Forecasted 2024 supply deficit decreases to 682 koz, equivalent to 9% of projected annual demand

Total supply is now forecast to increase by +2% year-on-year in 2024. Total supply has been revised up mainly due to stronger than expected refined mine production in South Africa and Russia, where producers have raised full-year guidance on a release of work-in-progress inventory and swifter maintenance completion.

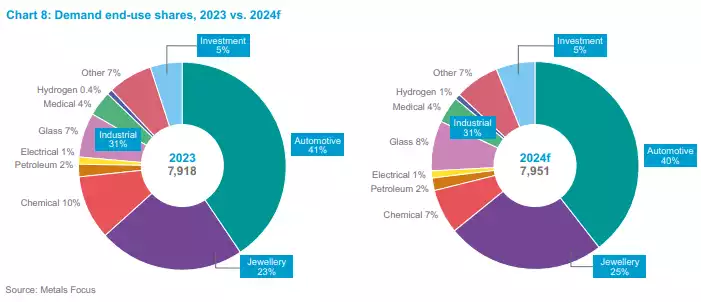

Total platinum demand of 7,951 koz in 2024 is expected to be in line with 2023. However, demand expectations were revised lower to reflect an outflow of platinum stocks held by exchanges and a downward revision to automotive production numbers in response to weaker sales as opposed to any acceleration in drivetrain electrification.

2025 expected to deliver another material market deficit

Some themes that have characterised the past two years are expected to continue into 2025, with a third straight year of deficit being forecasted. Supply is expected to remain subdued in 2025 as lower mine production offsets growth in recycling. Total platinum demand will be resilient, benefitting from the diversity of platinum’s end uses. Automotive, jewellery and investment demand are each expected to see single-digit growth in 2025, together helping to mitigate cyclical weakness in industrial platinum demand, which is dominated by the timing of glass capacity additions. Combining both weaker supply with subdued demand leads to a still substantial platinum market deficit of 539 koz in 2025, which represents 7% of demand. 2025 is forecasted to be the third consecutive year of market deficits, further depleting above-ground stocks.

The platinum investment case – subdued supply and resilient demand reiterate the risk of metal shortages

Platinum’s market trends are entrenching themselves to support a third year of consecutive deficits. Demand is proving resilient against the backdrop of global uncertainty, while platinum supply shows no sign of returning to pre-pandemic levels. The result of ongoing deficits is the rapidly depleting above-ground stocks, which are forecast to decline by 40% over the three years to 2025. The economic outlook, as it relates to the demand for platinum, has improved in recent months for two key reasons. Firstly, central banks have begun cutting interest rates and the easing monetary policy is likely to support new vehicle purchases or larger industrial investments as financing headwinds reduce. Secondly, China has announced its intentions to support its economy through stimulus. China is the world’s single largest platinum end-market, and demand could be boosted by pro-growth policies.