Latest Deutsche Bank Research

News

|

Posted 16/02/2015

|

8706

Summary

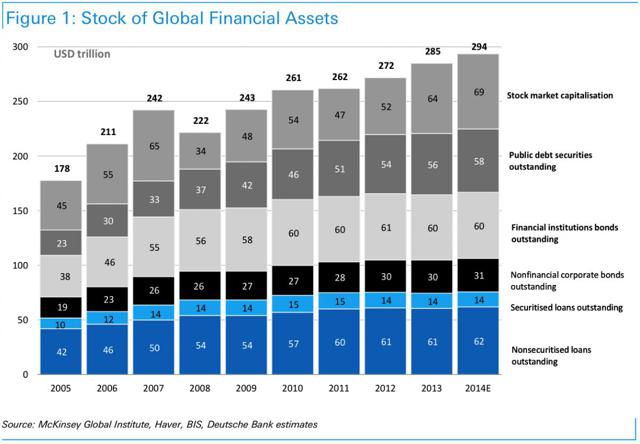

- Recent research by Deutsche Bank shows global financial assets grew to an all-time high of $294 trillion.

- Since 2007 most of this growth has come from government debt markets which have almost doubled over the past 7 years.

- We may not be seeing inflation in consumer goods but we are seeing it in financial markets.

- This growth is not sustainable and anything that spooks debt investors may cause a mass exodus in financial assets.

- A small shift of global assets due to a market panic would cause a big increase in the gold price and an even bigger one for gold miners.

Last week we discussed the increasing global growth in debt and how unsustainable it is, and how one solution for investors is investing in some (or in our belief a lot) gold. This week we're going to take a look at a table showing the world's estimated financial assets by Deutsche Bank's Sanjeev Sanyal, and we think that supports last week's thesis that gold stands to benefit from a global financial debt crisis.

Source: Deutsche Bank

As investors can see, according to Deutsche Bank (NYSE:DB), global financial assets hit another record high in 2014 of approximately $294 trillion worth of total assets. Year-over-year growth was around $9 trillion, with the majority of that growth in stock market capitalization ($5 trillion) and public debt ($2 trillion).

Of course, when anyone is estimating total global assets in the hundreds of trillions, no estimate is going to accurate, but the general trends and size we think can be relatively accurately estimated. Also, investors should remember that we're talking financial assets here, so it doesn't necessarily include things like real estate, farmland, and physical gold that are not backed by a financial equivalent (e.g. an ETF), though if any of those things are purchased with debt then it would be indirectly counted as a consequence of the debt created.

There are a couple of things that we think that investors should take away from this table.

Inflation is Not Dead

For all this talk about the death of inflation, we are seeing total growth in financial assets and it has been pretty consistent.

As investors can see the growth hasn't been extraordinary but other than 2011, it has ranged between 3% and 9%, and over the last few years it has been around 3%.

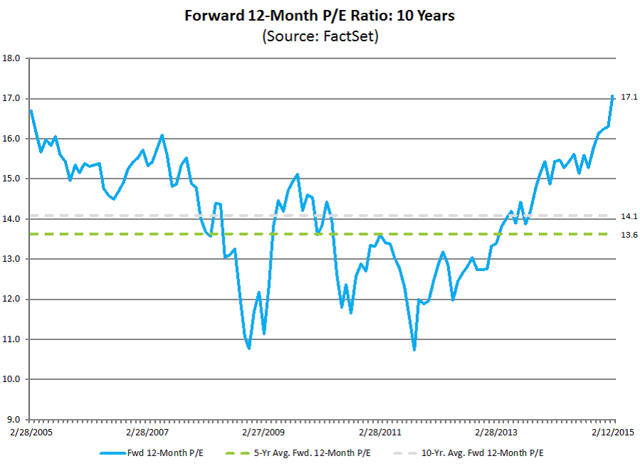

Is this inflationary or not? Well it depends on your definition of inflation, and whether or not this growth is due to efficiencies in production or are investors paying more for the same thing. While there is no certainty in this debate, we think that it is the latter and one sign of that is that forward earnings on the S&P 500 has been increasing pretty consistently as investors can see below.

In a nutshell, that means that investors are actually paying more for less earnings - not any different from the standard historical inflation experience where the price of the same egg or loaf of bread is now much higher. In this case we are talking financial assets instead of consumer goods, but it is the same thing.

This all makes a lot of sense as a result of global central bank quantitative easing that has pumped trillions of dollars into the global economy. Instead of being spread out evenly amongst people, it has primarily gone to the banks and the wealthy first, and in turn, they have used that money to purchase financial assets and thus the growth in financial assets. We are certainly seeing inflation - you just have to look in the right places.

Debt Growth Far Outpaces Market Growth

The second take away from the table on the growth in financial assets is that it is much skewed on the debt side. Since 2007, global market capitalization has only grown by around $4 trillion, but government debt growth has been a stunning $25 trillion - almost doubling in the span of 7 years.

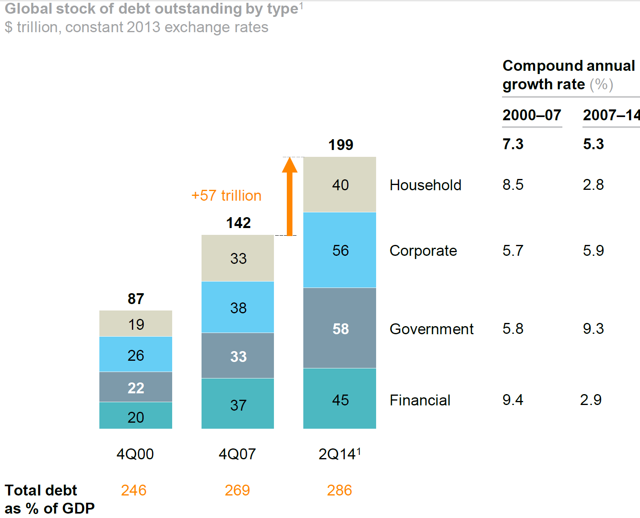

If we refer back to last week's McKinsey chart on the growing ratio of global debt-to-GDP, this table pretty much confirms McKinsey's conclusions on the massive amount of debt growth since the crisis.

Source: McKinsey Global Institute

In fact, if we compare global debt stock outstanding to global financial assets in Q4FY07 ($142 to $242 trillion or 59% debt-to-assets) versus 2014 ($199 to $294 trillion or 68% debt-to-assets), we can clearly see that the debt ratio is rising. We caveat this with the fact that we're comparing two different research reports so the exact numbers may be a bit off, but the important thing here is not the specifics (we're talking trillions after all) but the general trend, which we think clearly indicates debt is growing as a percentage of financial assets.

Back To Our Gold Thesis

There are many more things to take away, but we want to get to our discussion on gold as it is the best way we think investors can protect themselves from the debt crisis we think is brewing.

As we said last week, with debt growing as a percentage of outstanding financial assets eventually the money won't be there to service the debt load and that means problems - including default. We are not going to go into this discussion in-depth (you can read our previous article if you want details), but the result is that one default can cause a crisis of confidence and the mass exodus of investors from debt securities. That is further exacerbated by the fact that interest rates are at historical lows, which means that there is really very little gain against the possibility of default and the total loss of principal.

The exodus from debt securities should be relatively obvious by now, but stocks can also see mass selling if there are problems in the debt markets. First, risk in any markets will lower the attractiveness of equities as they are usually the first to suffer in bouts of panic. Secondly, a debt exodus will mean rising interest rates as the incentives of investment will need to go up to entice investors to buy bonds - that means higher costs of capital for companies and lower profit margins, which is obviously not good for share prices.

Finally, in a debt crisis interest rates won't only rise but debt will also be harder to come by and obviously will not be able to grow at the same rate - in fact it will probably fall. That means that economic growth that was the result of increasing leverage will no longer occur, and will hit companies hard regardless of their own debt levels.

The Primary Way This Benefits Gold

The most important way that we think this will benefit gold and gold investors is that it will be a safe-haven source for money fleeing financial and debt assets. Historically gold has been a great source of stability during times of panic, and we don't see any reason why that will change now. In fact, we think gold's desirability will only be amplified by a debt crisis as it has no counter-parties (you don't have to worry about being paid back) and it cannot be inflated away by a desperate government looking to pay off unsustainable debts or issue currency to pay off the debts of failing "too big to fail" institutions.

Ultimately money should flow right into gold as investors and asset managers seek sound investments, which gets us to possibly the most attractive part of the gold argument - its scarcity. According to the World Gold Council, as of the end of 2013 there were approximately 177,200 tonnes of above-ground gold in existence, and we can probably assume that it is around 180,000 tonnes at the end of 2014 due to the addition of newly mined gold. That equates to around 5.79 billion troy ounces of total gold, or at today's price ($1230 per troy ounce), a total stock of around of around $7.1 trillion.

That's a minute 2.5% of total financial assets. Put another way, if we see a debt crisis and only a tiny 1% of total financial assets ($2.9 trillion) shifts to gold then that would mean a 40% increase in the gold price, or say "hello" to $1700 gold! This is also assuming that all of that $7.1 trillion of above-ground stocks of gold is available to be bought - in reality only a small percentage of that is available for investors (i.e. try buying one ounce of the 8,000 tonnes held by the US government). So we would expect a much higher price of gold if any of those assets shift into gold.

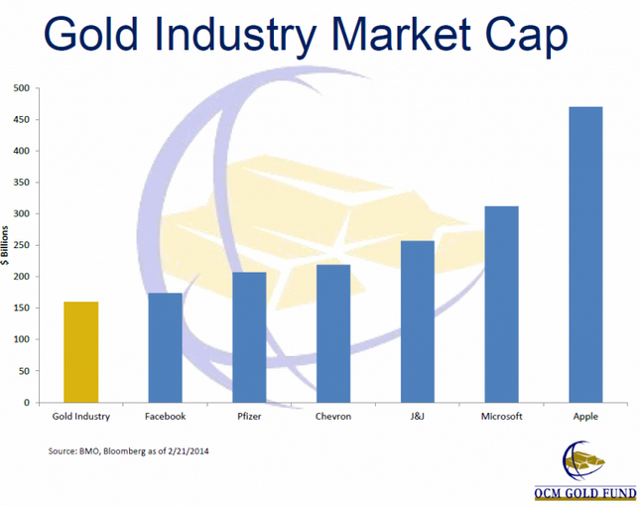

Finally, if we take a look at the global capitalization of gold miners we find them to be an even scarcer resource.

Source: International Business Times

At a miniscule $150 billion, the gold industry market capitalization would soar with any significant shift in global assets.

Conclusion for Gold Investors

Inflation is alive and well in financial assets and the size of the year-over-year growth ($9 trillion from 2013 to 2014) is eye-popping. Additionally, according to Deutsche Bank, much of this growth since the financial crisis has been in global government debt as the ratio of "debt to financial assets" has grown faster than total financial assets. This mirrors the findings of the McKinsey Global Institute that shows that GDP has been growing slower than debt. This is simply unsustainable and we think any problems in the debt market will cause a mass exodus of investors into safe-haven assets - with gold being a significant beneficiary.

#ref SeekingAlpha.com