Largest Silver Supply Deficit in 20 years in 2021

News

|

Posted 22/04/2022

|

15481

The Silver Institute’s 2022 World Silver Survey has just been released and reveals a huge year for silver in 2021 on many levels. We present the key takeaways:

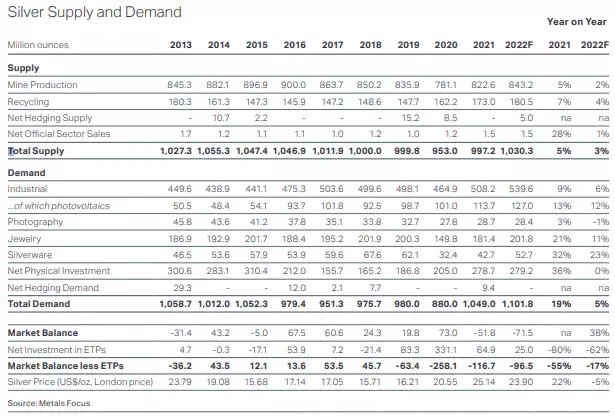

– Support from healthy physical investment and a high starting point saw the average silver price rise 22% y/y in 2021, at $25.14.

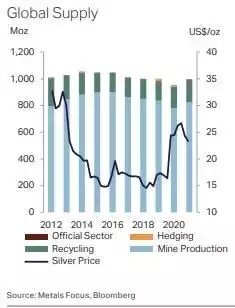

– As mine production recovered from a COVID-disrupted 2020 and industrial recycling was also higher, global supply rose by 5% y/y.

– All areas of silver demand strengthened, boosted by a post-pandemic recovery in activity, secular factors driving industrial offtake and a surge in retail investor appetite for the metal.

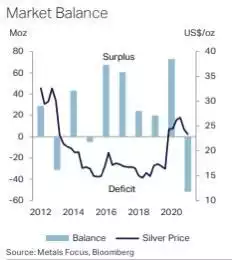

Contrasting forces dominated the silver market in 2021. On the one hand, the metal’s fundamentals were in robust health; 2021 saw silver’s first deficit since 2015 and its largest deficit by some margin since at least 2010 (when Metals Focus’ estimates begin) and very possibly in over 20 years (looking at GFMS data prior to 2010). On the other hand, professional investors’ appetite for futures and OTC positions in silver were limited and in fact the community were net sellers for much of the year. This limited the silver price’s upside in the first half of the year and put it under pressure in the second.

The strength of silver’s fundamentals was fuelled by strong gains across all demand components. In turn, these were partly related to the post-pandemic recovery and partly secular factors, such as the proliferation of green technologies. Last year’s deficit, meanwhile, came in spite of mine production recovering to levels not far off 2019, as COVID disruptions dissipated and recycling rose to an eight-year high.

Investment Silver Summary

Among silver’s physical demand segments, special mention is due to physical investment, which rose by 36% in weight terms and even more so in value terms. While the social media fueled silver squeeze in the early part of the year no doubt contributed to these gains, it was by no means the only factor. Indeed, silver bar and coin demand proved robust even after that rush had dissipated, underpinned by retail investors’ concerns towards political and geopolitical developments, negative real interest rates, global market risks and the looming specter of inflation. This created tight conditions for silver investment products, which remain in place.

Professional investors, in contrast, were less keen on silver for most of the year. This attitude was not unique to silver - appetite for gold was similarly lukewarm. We believe that this was due to unfavorable expectations for key macroeconomic drivers, interest rates and yields in particular. As these were already extremely low, investors struggled to see them falling further. Crucially, from mid-year onwards, growing concerns about inflation and signals from the US Fed of a change in attitude fueled expectations of policy tightening, which further damaged appetite for precious metals. The effect of silver’s earlier success also did not help institutional investor appetite - silver’s price had after all staged a strong rally in 2020 and the boost from its “green credentials” started to appear a little overdone.

All this saw silver move from trading within a US$24-28 range for most of the first half of last year to fluctuating within a US$22-26 band during the second half. Still, the full-year 2021 average managed to achieve a 22% y/y increase to a nine-year high of US$25.14.

Broader Silver Demand Summary

After a slump in 2020, global silver demand rose by a healthy 19% last year to 1.05Boz (32,627t), surpassing pre-pandemic volumes and achieving its highest level since 2015. All categories of demand saw gains, with the largest in volume terms being coin and bar purchases, followed by industrial demand.

Industrial - Despite logistical challenges, industrial fabrication rose by 9.3% to 508.2Moz (15,807t) in 2021, a record for our series back to 2010.

Jewellery - Silver jewellery fabrication rebounded by a notable 21% in 2021 to 181.4Moz (5,641t) as economies re-opened and consumer sentiment began to improve. On top of surging consumption, fabricators also benefited from the rebuilding of stocks that had fallen notably during 2020

Silverware - Outperforming the growth in jewellery, silverware fabrication rose by a robust 32% y/y in 2021, but output remained a third below 2019 levels. Much of the growth last year was driven by India (+40% y/y) thanks to economic recovery, pent-up wedding/festive demand and the ongoing gains for sterling silver. Excluding India, the rise in global fabrication was still a noteworthy 15%.