“Landing a jumbo jet on a football field”

News

|

Posted 04/12/2019

|

14583

Last night the Dow dropped 1.2% and gold jumped 1.1% and silver 1.5%. Why? That good news on the US China Trade War that saw the last rally was, surprise surprise, a little premature with it now looking like Trump might hit China with the next lot of tariffs on 15 December. We will again remind you, in case you haven’t read it, of Jim Rickards excellent and compelling thesis as to why this trade war is not ending any time soon here.

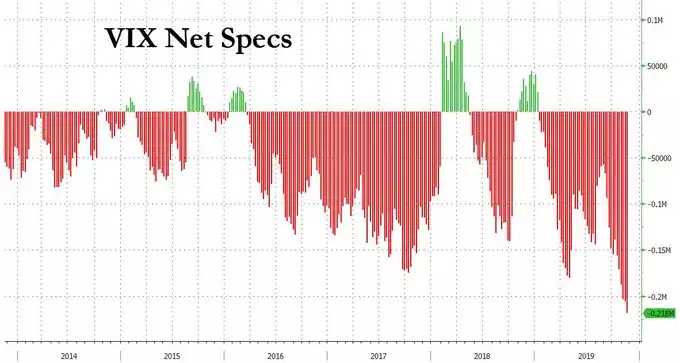

When a market gets as overvalued as the current US sharemarket remains, it is a bubble looking for a pin. The level of short bets on volatility (VIX) hasn’t been higher. We have reached ‘peak complacency’ that the Fed’s ‘got this’. That never ends well…

Joseph Carson, Former Director of Global Economic Research at Alliance Bernstein wrote recently of this disconnect between fundamentals and current prices.

“In the past 5 years, the S&P 500 stock index has risen over 50% and during that period operating profits for non-financial companies have declined over 15%, a drop that has always been associated with economic recessions.”

“The weakness in operating profits is centred in non-financial companies—with the biggest declines in the manufacturing sector. In the past year, profits for non-financial corporate businesses declined nearly 5%, bringing the cumulative 5-year fall to 15.5%--three times larger than the decline for all companies.

Profit declines of this scale, and even less, have always been associated with an economic recession. In fact, since 1975, there have been 6 recessions and of those only two--- the dot.com bust and the Great Financial Recession - recorded larger declines in operating profits than the current slump.”

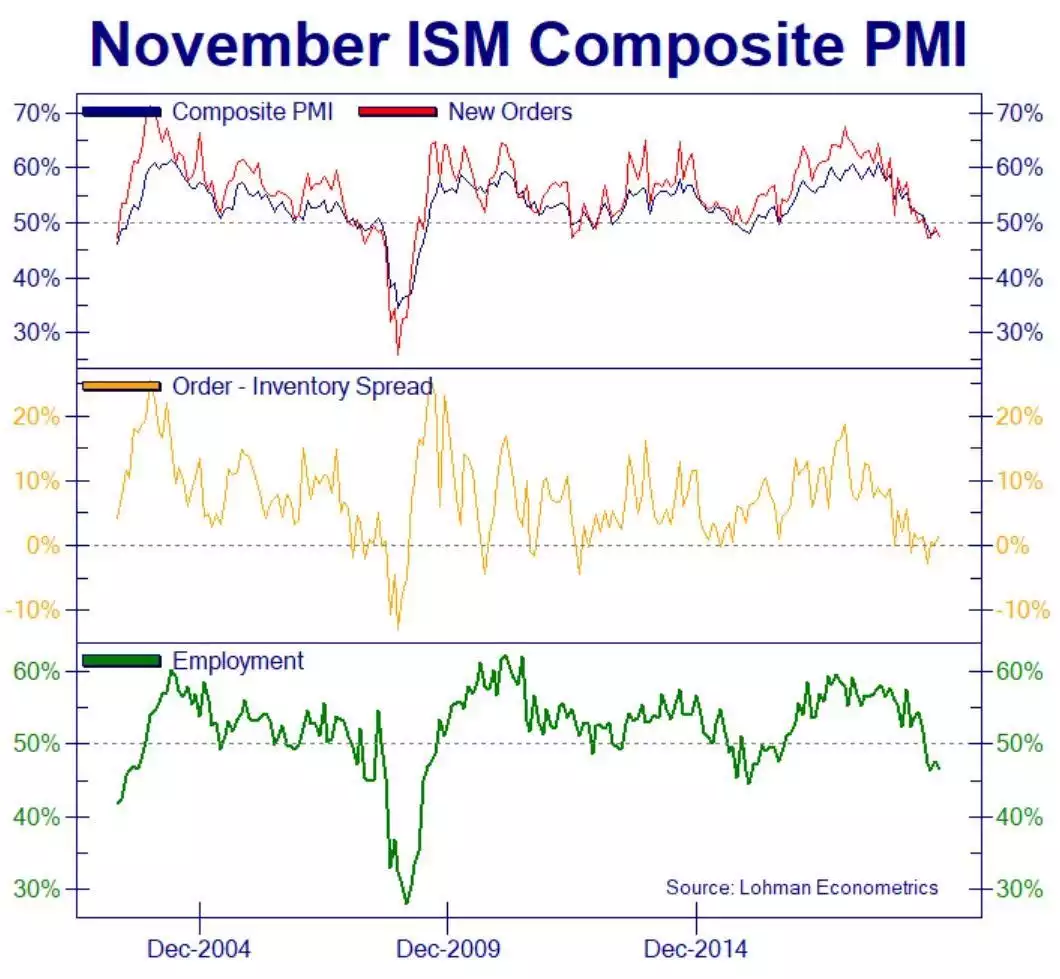

That weak manufacturing sector was again brought to the fore with ISM’s Manufacturing PMI for November missing expectations again and still in contraction:

“Divergence between profits and equity markets are not uncommon, but the scale and length of the current divergence is.

The primary fuel for the stock market run has been easy money and the promise of more easy money. Even though the economy’s performance in 2019 in terms of growth, jobless rate and core inflation was fairly close to the Fed’s forecast policymakers voted to reduce official rates three times instead of the initial plan to raise rates twice. That’s the equivalent of 125 basis points of an easier money stance relative what the financial markets had been expecting. Policymakers have also made a promise not to raise official rates until reported inflation is well above its preferred rate of 2%.

In 1996, Federal Reserve Chairman Alan Greenspan raised the question “how do we know when irrational exuberance has unduly escalated asset values?” Nowadays a similar question can be directed to the Fed - "How do we know when irrational exuberance over the Fed’s policy of easy money has unduly escalated asset values?"

History clearly shows excess liquidity fuels bull markets, but money has to at some point work its way into the real economy, lifting growth and profits. Bubbles form when excess liquidity remains bottled in one segment of finance or single sector of the economy - like during the dot.com and housing bubbles.

Monetary policy can create liquidity, but it can’t direct its flow - and the current flow remains unbalanced between finance and the real economy.”

This speaks in part to the challenge before the Fed (and indeed topically this week our own RBA) of trying to raise inflation to target levels through easy money policy without inflating sharemarkets and property markets (particularly in Australia). The former sees little broader official inflation, rather just enriching those in shares. Harley Bassman who famously created the pre-eminent MOVE Index (kind of like the VIX for US Treasuries) summarised the conundrum beautifully:

"Central Banks can easily create 10% inflation; the challenge is producing 2.0% inflation, which is the equivalent of landing a jumbo jet onto a football field."

The implications for gold are twofold. Get it wrong by continuing to inflate financial markets to the point of a subsequently amplified crash and gold inevitably surges amid safe haven buying. Get it wrong by overshooting and losing control of inflation more broadly, and gold historically surges in high inflation environments.