Junk Bonds Record & Gold Coiled Spring

News

|

Posted 11/02/2021

|

9052

Gold rose last night despite weaker than expected inflation data out of the US which saw the USD continue its slide and bond yields dip even further as expectations of even more monetary stimulus were essentially locked in.

The Core CPI print missed market expectations of a 0.2% rise for January by remaining unchanged. Coincidentally Fed chairman Powell released a statement yesterday warning of a faltering recovery stating:

“Despite the surprising speed of recovery early on, we are still very far from a strong labor market whose benefits are broadly shared,” and stating they will continue ‘patiently’ printing or in Fed-speak “a patiently accommodative monetary-policy stance" and again reiterating that Biden has to help with fiscal stimulus stating "It will require a society-wide commitment, with contributions from across government and the private sector,"

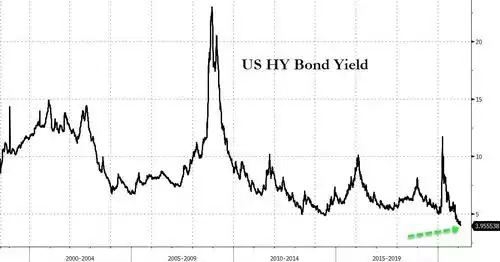

One such commitment from the private sector could be blindly buying up junk bonds at an unprecedented rate to drive down yields on even the poorest rated debt instruments. Well, they are happy to oblige… Ironically called High Yield bonds or more colloquially ‘junk bonds’, the money pouring into them has seen yields drop below 4% for the first time in history.

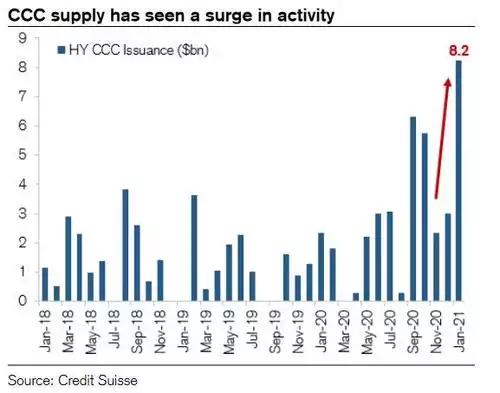

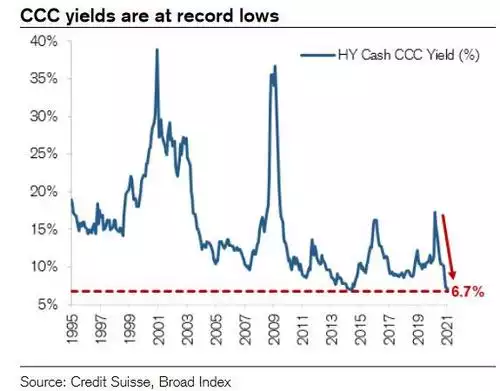

Even the junkiest of junk, the CCC rated bonds are exploding in both price (and hence low yield) and issuance. So to be clear, despite a LOT more supply (as you can see in the 1st chart below) the yields have hit a new all time low (from the 2nd chart) and buyers are happy with all that risk for just a 6.7% return…

These are indeed extraordinary times. In yesterday’s article (which we’d put in the must read category) we listed all the ‘record’ positionings in financial markets right now. The king of paper financial assets is the US Treasury bond. The chart below is worth revisiting as a reminder that we have never in 670 years of history seen the interest bearable on a reserve government issued bond lower… ever..

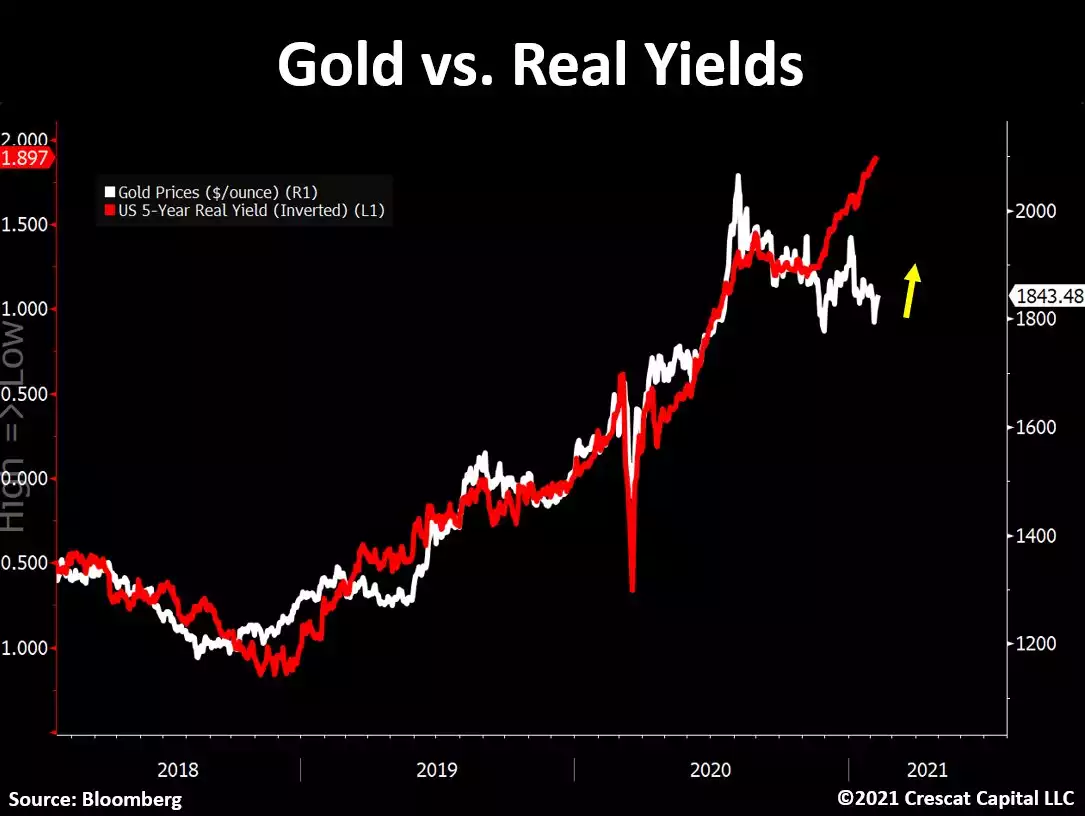

And so, despite still currently low inflation (FOR NOW) we have real interest rates (nominal less inflation) surging deeper into negative territory. Historically gold has enjoyed a strong inverted correlation with real interest rates. Gold investors have been scratching their heads since the top in August last year at a market chopping generally downwards amid all these seemingly fundamental drivers for the gold price. Likewise bond yields had been on the increase until recently reversing. The everything’s awesome risk-on trade was king. However the chart below illustrates clearly the coiled spring that is the gold price when charted against those real interest rates: