January 30th Rate Cut?

News

|

Posted 07/01/2026

|

1234

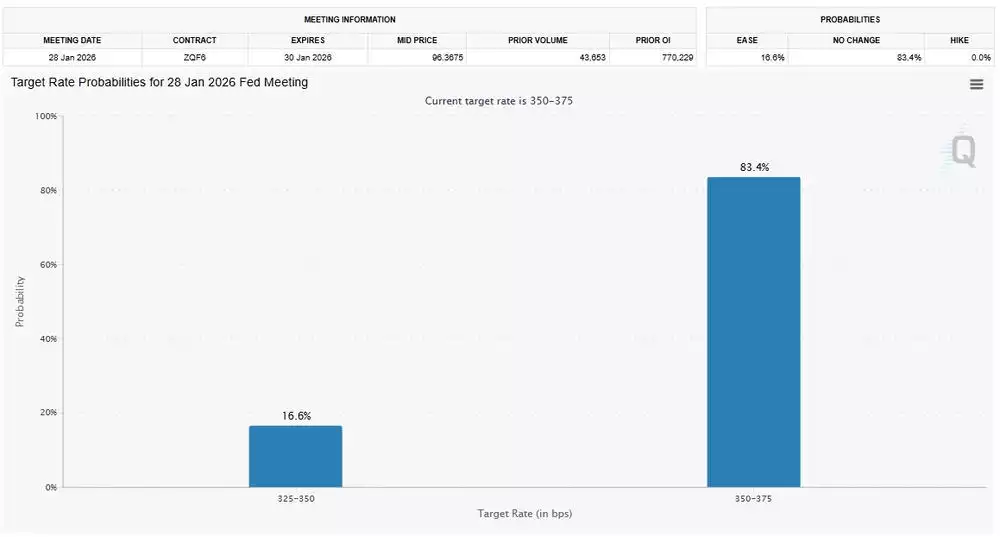

The market is currently pricing in no US rate cut at the Fed’s late-January meeting.

US 10-year bond yields broadly support this view, having remained stubbornly elevated since the last round of rate cuts.

However, as shown above, yields have now broken down from support and are currently back-testing the apex of the wedge. From a technical perspective, this behaviour is often seen ahead of a more decisive breakdown.

Should US 10-year yields roll over from here, the Fed would have greater scope to cut rates. Monetary policy decisions are heavily influenced by conditions in the bond market, particularly in aggregate. With inflation easing and unemployment trending higher, the Fed would have a clear narrative to justify a cut.

Key inflation and labour data:

- Truflation US CPI inflation: 1.95%

- Truflation US PCE inflation: 1.96%

The US unemployment rate rose to 4.6% in November 2025, up from 4.2% a year earlier and the highest reading since late 2021.

With inflation falling and unemployment rising, the Fed appears to be waiting for confirmation from the bond market before acting. If yields continue to move lower, rate-cut probabilities for the January meeting are likely to reprice quickly towards cuts.

A shift towards pricing in rate cuts would be supportive for both hard assets and risk assets, while weighing on the US dollar.

The DXY has already begun to roll over, and a weaker dollar typically acts as a tailwind for both risk assets and hard assets.

While these dynamics are constructive in the near term, the broader macro backdrop is becoming increasingly challenging for equities and property. We are moving deeper into the latter stages of both the 18.6-year land cycle and the longer-term 80-year socio-economic cycle.

Historically, transitions between major macro cycles have favoured precious metals over the long run, as capital rotates away from speculative, highly leveraged assets and towards decentralised stores of value that have endured multiple economic regimes over thousands of years.