JPMorgan Says – Buy Gold On Uncertainty About Future Inflation

News

|

Posted 25/09/2013

|

4151

JPMorgan Says – Buy Gold On Uncertainty About Future Inflation

The FOMC shocked markets by deciding not to slow its large-scale asset purchase program, after all the signals it had sent out in previous months that it would do so. While increasing policy risk, JPMorgan notes, this puts the asset-reflation trades back on the table. In their view, the main driver of gold’s performance over the past five years has been QE. As QE continued and inflation expectations remained subdued, the demand for an inflation hedge subsided, ETF positions were unwound and gold prices fell. However, JPMorgan now believes, as a result of the Fed’s volte-face on tapering, uncertainty about future inflation may pick up and suggests a long position in gold. Of course, the question is – are they buying or is this a last ditch effort to drain what little remaining gold they have in their vault to their hapless clients?

JPMorgan On Gold:

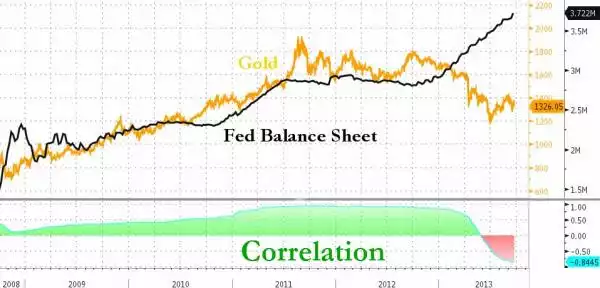

This week’s surprise by the Fed in not tapering their asset purchases led to a 5% rally in precious metals. In our view, the main driver of gold’s performance over the past five years has been QE. Following the 2008 crisis, the unprecedented expansion of central bank balance sheets led to fears of inflation further down the road and resulted in very strong demand for gold, a large amount of which came via ETFs.

As QE continued and inflation expectations remained subdued, this demand for an inflation hedge subsided, ETF positions were unwound and gold prices fell. Along with precious metals rallying, inflation breakevens widened following the Fed announcement, another indication that uncertainty around future inflation may pick up as a result of the Fed’s volte-face on tapering.

Additionally, positions are much cleaner now, following the unwinding of ETF positions, and physical demand from retail buyers in Asia has been very strong.

We open a long position in gold.

In one dramatic move, Mr. Bernanke has reversed this steady march to a rule-based policy and has brought discretion and flexibility back. The Fed may argue it never really gave up discretion, but we think the market nevertheless saw increased rigidity and thus a greater risk of policy errors.

By bringing back discretion, the economy broadly, rather than just unemployment, has retaken precedence. This has reduced economic uncertainty. To use popular terms, the Bernanke Put and asset reflation are back, while the end-of-easy money trade needs to await better economic data.

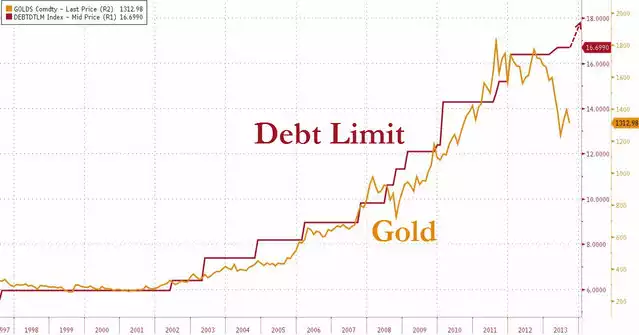

Some other relative-value charts for gold…

The Debt Ceiling appears to have an uncanny relationship with the precious metal - the relationship should be clear why an ever-increasing debt load for the world’s reserve currency would require a rising gold price to keep pace with its endgame-implying collapse…

And the world's central banks are printing - not just the Fed – and the world’s central banks know that they need some anchor of value for their balance sheets. The ratio of global central bank balance sheets to the price of gold (i.e. how much gold is required to support the balance sheets of the world’s money-printers) appears to be at an extreme.

In other words, for the ’stable’ relationship between central bank balance sheets and gold to recouple, Gold would nee to be back to around $1800 an ounce; but given the Fed’s U-turn and no sign of stopping at the BoJ (or PBOC for that matter) and we suspect Draghi about to try to unleash a collateral-free LTRO3, the price of gold will have to be considerably higher before the world’s central banks are ‘backed’ again.