JPM Conviction – Paper v Physical Metal

News

|

Posted 09/11/2018

|

10350

Last time we wrote of the allegations of price manipulation in the futures markets (read here before reading on), the convictions of traders was as notable for the absence of anyone from J P Morgan as it was for the convictions themselves.

That all changed this week with the guilty plea of an ex J P Morgan trader, John Edmunds, who admitted to manipulating precious metals markets on behalf of (and with full knowledge of management) J P Morgan between 2009 and 2015. As we outlined in the previous report on convictions, Edmunds admitted to the same spoofing techniques to move the market. Spoof the paper market down and load up on physical metal at a bargain. Simple. Edmunds will not be the last as he is naming his co-conspirator managers and the FBI has confirmed the case is ‘ongoing’.

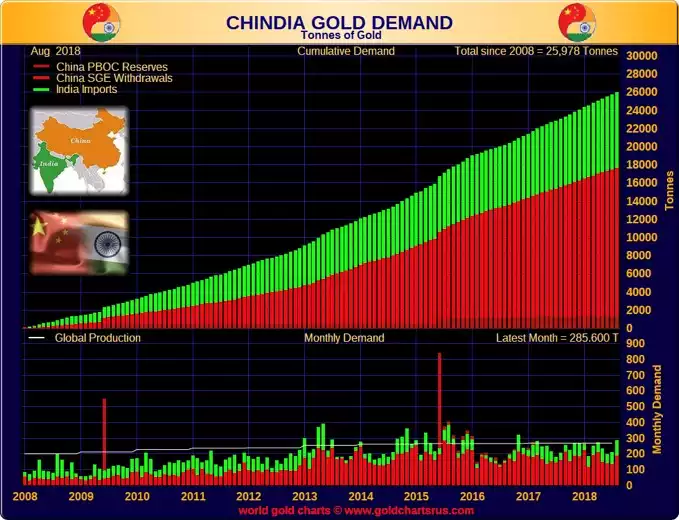

We have maintained for some time that those with patience should see these practices as an opportunity, just as it has been a self executed opportunity for J P Morgan to amass the world’s biggest stockpile of physical silver. With substantive claims that COMEX holds less than a 100th of the physical metal to back the paper claims this house of cards looks perilous to say the least. Whilst silver looks obvious it begs the question then of where has all the gold gone? Regular readers know of the shift of physical gold from the West to the East, but the scale of it may astound even you. The graph below shows the gold imports into China and India.

In just 10 years, 10 years coinciding with the start of the GFC, China and India alone have consumed just shy of 26,000 tonne of gold. For context that is the lion’s share of total global mine production (the white line).

The latest figures from August saw demand of 285 tonne, in excess of mine supply. Let’s look at how it makes its way to the east…

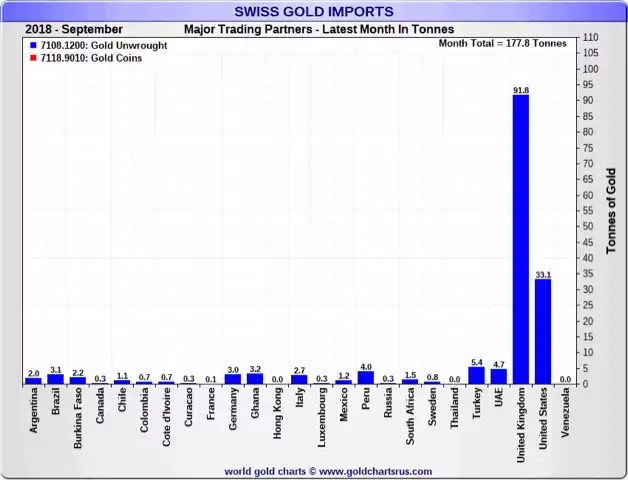

Switzerland remains the world’s biggest gold refiner. Below is the import figures of gold by source for the month of September:

You can see clearly the vast majority comes from the UK, a country that does not mine gold. No prizes for guessing then that this is all coming from bullion banks and many believe depositories for central banks. The latter may be via covert sales or, more likely, leasing that gold with the value equation being receiving a small yield versus losing physical possession for an IOU… Switzerland imports 92 tonne of 400oz gold bars, converts them to the East’s preference of 1kg bars, and duly ships them there.

It’s been a while since we’ve shared it but in the context of the above and also yesterday’s article on the ascendancy of China and demise of the US, it is timely to revisit the following insightful cartoon…