Its not just supply chains! Why inflation is at both ends

News

|

Posted 03/12/2021

|

12464

As we wrote on Wednesday, even Fed Chair Jerome ‘Transitory’ Powell is conceding this inflation set up is anything but transitory. The problem is they are still citing ‘supply chain issues’ as the key driver but the evidence on the demand side is just as compelling.

Global Macro Monitor had this to say:

“Fed Chair Jerome Powell finally admitted yesterday, at least, implicitly, there is too much stimulus demand (in the macro context) in the global economy and the Fed will have to accelerate its tapering.

The following charts clearly illustrate the U.S. economy is overheating and is a major contributing factor to inflation. Nominal retail sales and core capital good shipments remain 15 percent above and years ahead of their pre-COVID trend. Think of the trend line as the supply curve.”

Add to these the well documented supply chain issues and you can quickly see why Powell did such a backflip this week.

In that same article we wrote earlier this week, we presented Global Macro Insider’s Julian Brigden’s views on where this goes. In coming to his conclusions Brigden also presented the same set up of inflationary pressures well beyond the supply side.

“Policymakers’ inflation credibility is wearing thin. In March, Jay Powell said, “You’ll see firms reluctant to raise prices.” He’s been dead wrong. The Beige Book recently reported, “Several districts indicated that businesses anticipate significant hikes in their selling prices in the months ahead”.

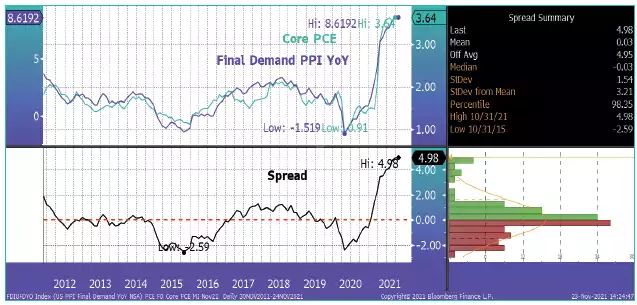

If the spread between PPI and Core PCE reverts to normal levels, core is going a lot higher before this is over!

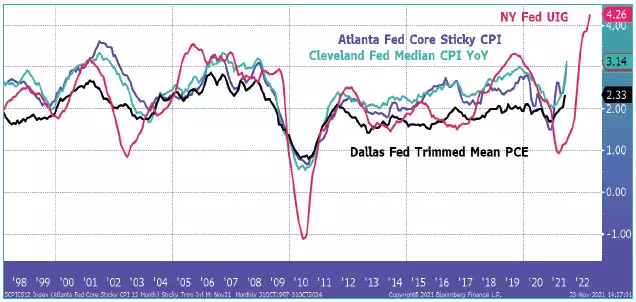

“JP [Jerome Powell] also blamed “a narrow group of foods and services” for the “spike of inflation”. Yet, when we look at the narrow metrics of inflation which are beloved by the doves, they simply lag the NY Fed’s Underlying Inflation Gauge (UIG).

UIG is specifically designed to measure a broad set of prices. It is at 25-yr highs…”

On balance when one looks at all of the above, the ‘policy mistake’ many analysts feared for some months now looks almost certain. Too little too late. Whilst the Fed have flagged they may expedite the taper of QE in their next meeting, they are silent on raising rates.

And its not just a US thing…

The same ‘policy mistake’ fears are playing out for our own RBA. As of yesterday we now have all 4 major banks ignoring the RBA’s 0.1% cash rate and you can no longer get a sub 2% loan. From the ABC:

“NAB on Thursday closed the door on the major banks offering sub-2 per cent mortgages through their main brands.

It raised its fixed rates for the third time in less than six weeks, with some mortgages going up by 0.5 of a percentage point.

That saw NAB's cheapest one-year fixed mortgage rise from 1.99 per cent to 2.49 per cent.

The one-year fixed rate was playing some catch up to longer-term fixed mortgages, which NAB had already increased twice over recent weeks.

The move leaves the lowest one and two-year big bank fixed mortgage rates at 2.24 per cent.

RateCity's Sally Tindall said the major banks had "succumbed to funding pressures" as market interest rates rose sharply globally over recent months.

She said she did not expect that trend to stop.”

In other words, even if the central banks keep it too easy too long, the bond market will decide and then history’s largest global debt pile is staring down the barrel of rising interest rates. Climb as they may, they will remain negative in real terms after subtracting this high inflation. Its hard to imagine a more perfect macro environment for gold.