It's Not Over Yet: Shock CPI Move Might Force RBA Into Action

News

|

Posted 27/06/2024

|

1705

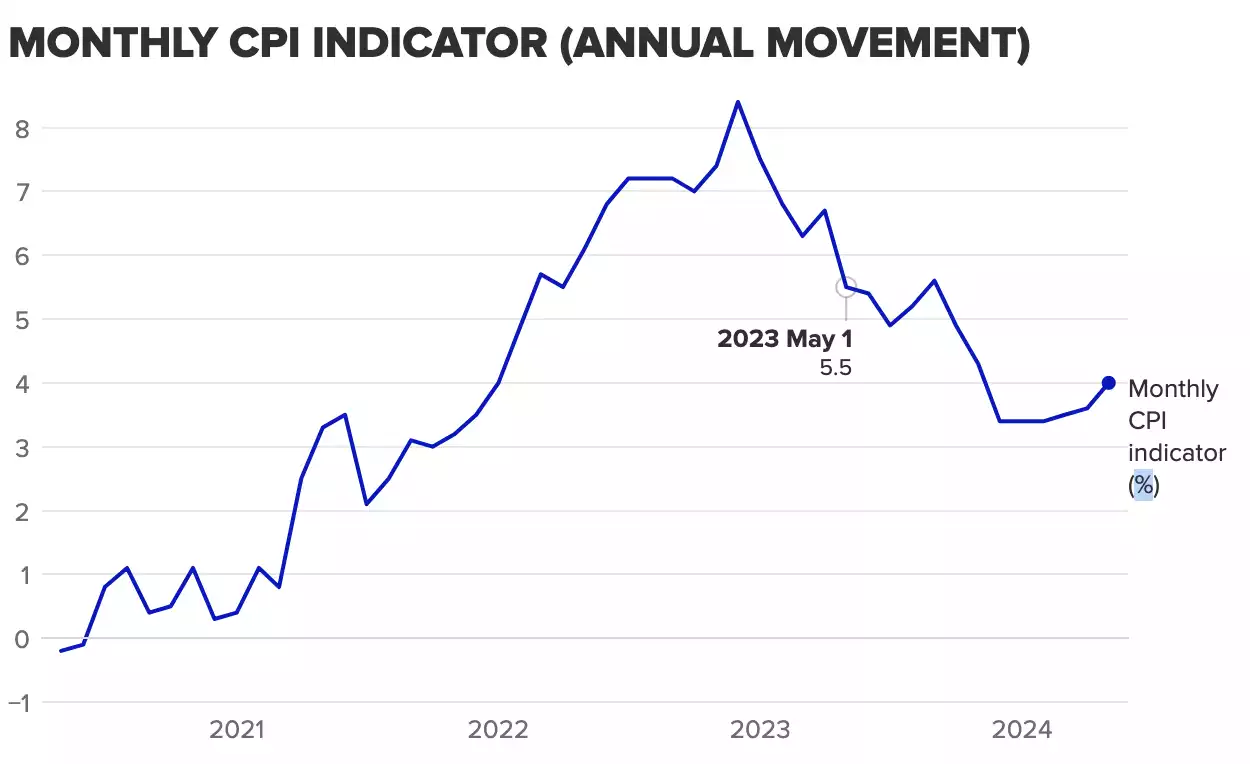

Australia's inflation rate took an unexpected turn yesterday, surging to its highest level in 2024, significantly increasing the pressure on the Reserve Bank of Australia (RBA) to consider yet another interest rate hike.

Consumer prices rose 4% in May compared to a year earlier, according to the Australian Bureau of Statistics (ABS), surpassing the 3.6% rate recorded in April and most importantly, surpassing economists' expectations of 3.8%.

As a result of the inflation report, the Australian dollar rose by about US$0.20 to almost US$0.667, as investors adjusted their interest rate expectations. ASX Stocks also initially dropped 0.3 percentage points before closing down about 0.75% for the day.

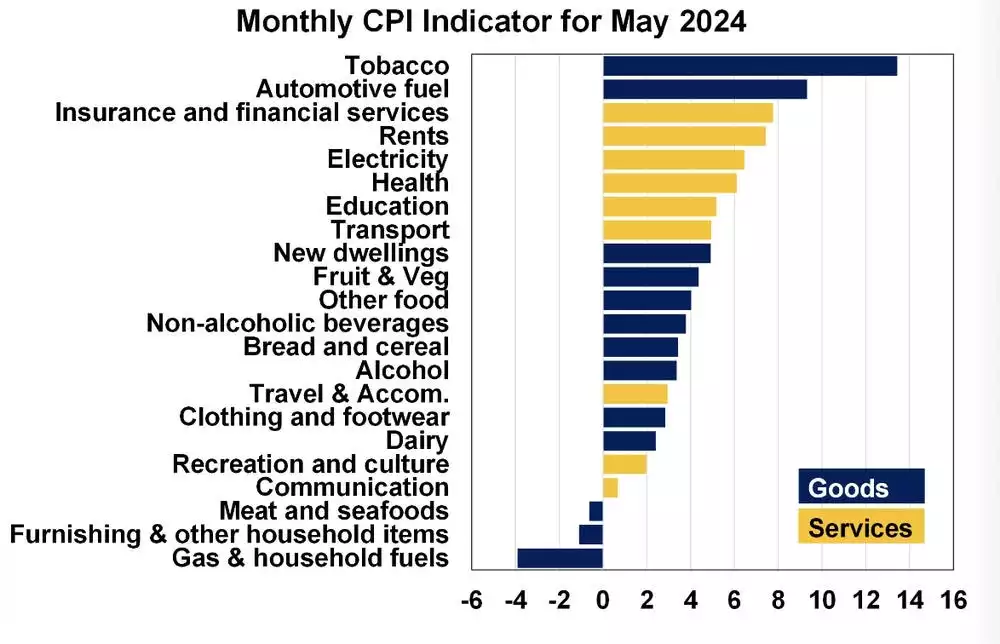

The surprise jump in inflation was driven by rising automotive fuel prices, which were up 9.3% year-over-year despite a 5.1% decrease during the month. Electricity prices also surged 6.5% from a year ago, accelerating from April's 4.2% pace, and would have been 14.5% higher without federal and state rebates. Housing costs rose 5.2%, with rents increasing by 7.4% due to low vacancy rates in many cities.

Of particular concern is the trimmed mean measure of inflation, which aims to remove any outlier price movements closely monitored by the RBA, which increased to 4.4% in May from 4.1% in April. This acceleration suggests that inflationary pressures are becoming more entrenched in our day to day lives and are not merely transitory.

David Bassanese, chief economist at Betashares, described the inflation figures as a "shocker," adding that the result places "enormous pressure on the Reserve Bank to raise interest rates in August." He emphasised that prolonged high inflation risks embedding into inflation expectations and ongoing wage and price-setting behaviour, which again is becoming evident in that previously mentioned trimmed mean measure.

The RBA has repeatedly signalled it will not hesitate to raise its key interest rate for the 14th time in this cycle if it loses confidence that inflation will fall back within its 2%-3% target by the end of next year. The federal budget, released earlier this month, forecast price increases could slow to 3% or less by the end of 2024, relying on energy rebates and other measures to lower the consumer price index (CPI).

Deutsche Bank economist Phil O'Donaghoe expects it will decide to raise the cash rate by a quarter of a percentage point to 4.6 per cent at that meeting.

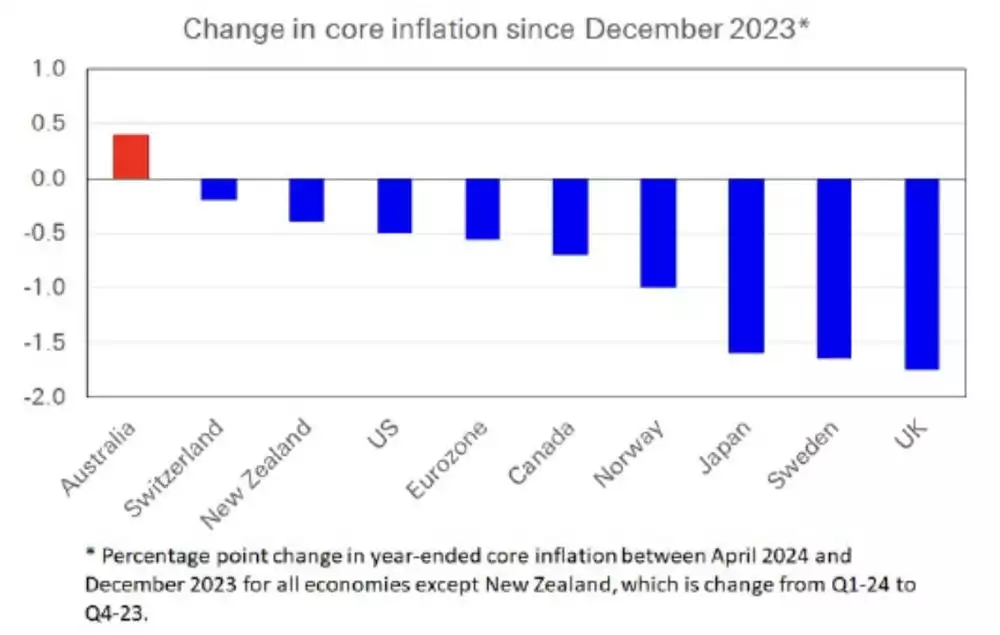

"Underlying inflation is intolerably high in Australia," he argued.

"In fact, Australia is the only G10 country where underlying inflation has increased since December."

Steve Mickenbecker of Canstar also expressed concern, stating that the inflation rise was "staggering" and predicting that the RBA would likely raise rates at its August meeting due to the high risk of entrenched inflation expectations. He pointed out that a 0.25 percentage point increase would add $100 to the monthly repayment on a $600,000 loan over 30 years.

Prior to the latest inflation figures, most major commercial banks, except ANZ, predicted the RBA would cut its cash rate in November. However, ANZ now forecasts the first rate cut won’t happen until February 2025, which clearly displays the ongoing challenges Australia is facing in curbing inflation and stabilising its economy.