Is the Possibility of US Default Too Much of a Reality for Markets to Handle?

News

|

Posted 17/05/2023

|

7328

While the US debt ceiling crisis has dominated the mainstream news cycle, the anxiety surrounding it appears to have somewhat confused financial markets globally.

We discussed how gold could save the US debt ceiling default earlier in the week here. This week we will discuss how the financial markets and investors alike are currently perceiving the chaos.

Firstly, US Equities remain confident that both political parties will come to an appropriate resolution, as the S&P 500 is holding on to its 7% rally for the year, while the Nasdaq remains up an astonishing 22%.

Most interestingly however, gold is yet to have any significant upside swing as of late, stalling around $3000 AUD the past two weeks.

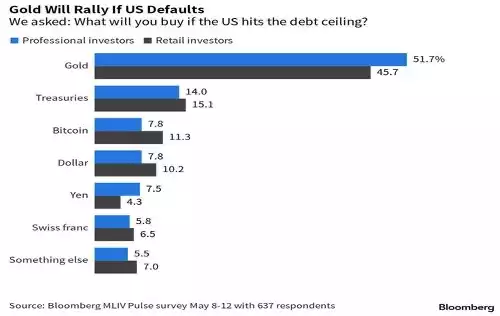

Gold’s recent price action directly contradicts the opinions of both professional and retail investors, which shows in the event of US hitting their debt ceiling, Gold is by far the number one asset of choice.

Unlike gold and equities, some financial assets are more appropriately pricing in the elevated US default risk.

Treasury bills due around the infamous ‘X date’ have shown some angst, with yields on one-month instruments up 200 basis points.

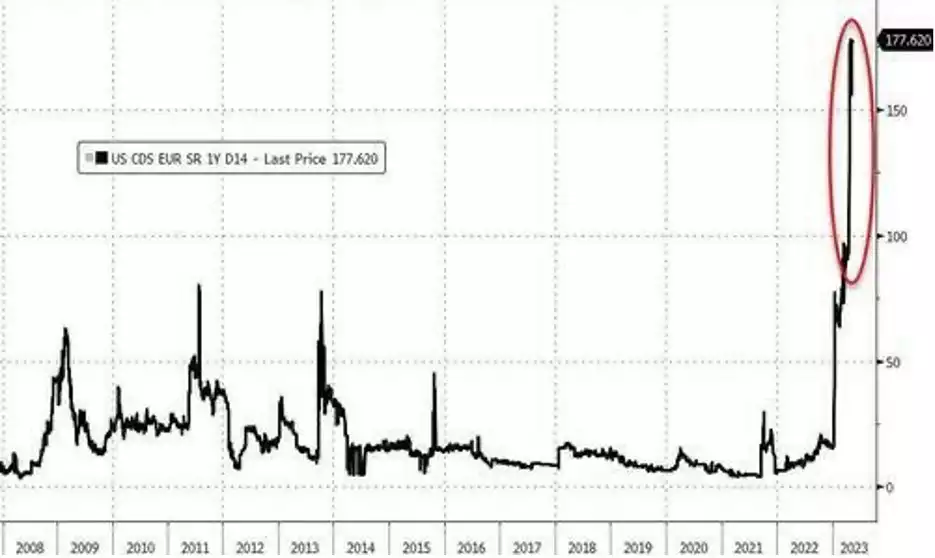

Credit default swaps are also increasingly bearish, pricing in a 3% chance of US default, which of course would easily be the most catastrophic event in financial market history since the Great Depression

While the 3% default chance might not initially seem overly troubling, compared to the last two debt ceiling scuffles in 2011 and 2013, the 2023 Debt Ceiling crisis is by far the most significant.

While the current consensus might be uncertain about the possibility of a US default, Jamie Dimon, CEO of JPMorgan Chase (the largest bank in America), told Bloomberg he’s preparing for the worst, as he’s holding a weekly war room meeting with other major banks to discuss a potential US default and how the banks should respond.

Dimon described the wide range of economic and financial impacts that his weekly ‘war room’ had been discussing, including “contracts, collateral, clearing houses, clients” – effectively every element of the financial system.

If the CEO of the top US Bank is planning for a worst case scenario, maybe financial markets should more appropriately price in the possibility of US default, and maybe we ourselves should be planning for that worst case scenario any way we can too.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************