Is it “UP ONLY” now for Platinum?

News

|

Posted 03/03/2023

|

11906

With the platinum spot price falling US$40 (4.5%) last Friday, before bouncing right back up on Monday, speculators and investors may well see that dramatic bounce-back as confirmation that a bottom is in. Since hitting US$1,100/oz in the first week of 2023, platinum has been cascading down. The question is, what are the major supply v demand fundamentals looking like?

Major car manufacturers are investing in hydrogen powered infrastructure. Air Liquide and TotalEnergies have penned an agreement that will see a new network of more than 100 hydrogen refuelling stations pop up on major European roads in France and Germany. The focus is on heavy duty logistics vehicles which are slated to be the first major movers as companies would make a decision on a whole-fleet basis to make the switch.

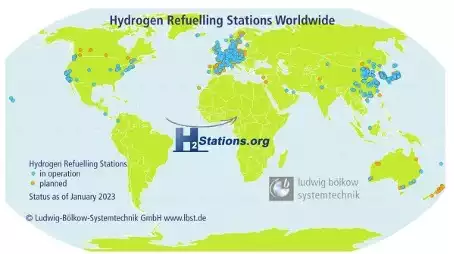

According to H2stations.org, 814 hydrogen refuelling stations across 37 countries were in operation worldwide as at the end of 2022. The majority of these – 455 – were operational in Asia, with Japan leading the way with 165, followed by South Korea with 149. The number of hydrogen stations in China is estimated at 138. As we’ve written previously, Toyota, Japan’s largest vehicle manufacturer, have chosen hydrogen over EV as their way forward.

By the end of 2022, Europe had 254 hydrogen stations. 105 located in Germany. France (44), UK (17), Netherlands (17) and Switzerland (14) were also nascent participants. North America added 11 new hydrogen refuelling stations last year. With 70 operating stations in California alone, the state continues to be the centre of gravity on the continent.

Closer to home, mining megalith Fortescue (ASX:FMG) is set to replace its existing fleet of ten diesel coaches in the Pilbara with hydrogen fuel-cell powered coaches. The green hydrogen supply will be produced onsite with the recently completed 60 megawatt Chinchester Solar Gas Hybrid Project. The refuelling station was constructed as a joint venture with Alinta Energy, showing that the tide is turning in the sector towards hydrogen. It will take time however, with the transition only expected to come into full force in 2027. More broadly Fortescue are aiming to be carbon neutral by 2030, off a carbon footprint reportedly greater than France… and leaning heavily on hydrogen to do so. That is just one example.

With all of this extra hydrogen infrastructure making its way into transport and logistics world wide, there is a guaranteed pipeline of increased demand for platinum which is an irreplaceable component of the fuel cells.

The significant promise on the demand side over the next decade is clear. On the supply side, South Africa mines approximately 70% of the world’s platinum according to Metals Focus, and the African nation has now been experiencing intermittent blackouts for a year already, with the electricity crush expected to continue for at least another two years.

Anglo American Platinum, Sibanye-Stillwater and Impala Platinum have all reported finding it increasingly harder to run deep and aging mine shafts.

“If things don’t get better soon then we are likely to have a worse period this year than last,” Impala spokesperson Johan Theron said in an interview. “If it gets worse it will get to a point when you have certain days where we will stop sending people underground.”

Platinum producers output was, 6% below projections, on average in 2022, the worst production performance in more than 20 years. With Eskom, the state-owned energy provider, reporting more than 200 days of blackouts last year, the fact that the reduction in production wasn’t much worse really boggles the mind. As a result of the black outs, all of the major mining companies needed to scale down their operations when power was out or intermittent. Then try to play catch up when power supplies were stable - often during the night and weekends. All of this costs more as staff demand, and realistically are entitled to, more compensation in worsening conditions.

Sibanye Stillwater spokesperson James Wellsted pointed to the potential of some marginal projects needing to be shut down if blackouts get worse.

With fundamentals continuing to look strong, and short term supply drying up, last week's price crash may well be a pivoting point in platinum.

Last month we published a video outlining some platinum price scenarios for 2023. Check it out and make sure to subscribe to our YouTube channel to stay updated throughout the year.