Is Blackstone the NEXT domino to fall?

News

|

Posted 06/04/2023

|

10831

Will Blackstone, the $239 billion assets under management hedge fund, be the next shoe to drop. The company’s $71 billion real estate income trust (BREIT) has restricted redemptions for anxious investors for the fifth straight month. According to a letter to investors sent out earlier this month, in March Blackstone had requests for 4.5 billion in withdrawals, but only fulfilled $666 million - an ironic number for the bedevilled fund. This was up from the 3.9 billion requested in February.

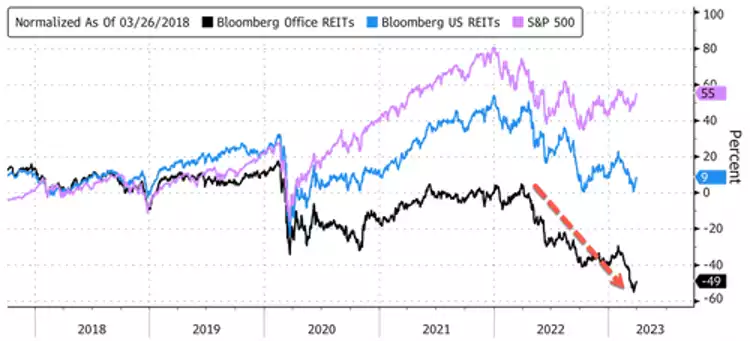

The behemoth of commercial real estate defaulted on a €531 million ($562 million) bond backed by a portfolio of offices and stores owned by Sponda Oy, a Finnish landlord it acquired in 2018. The redemptions were already in full swing at this time though, as the interest rate rises have been tipped by many in capital markets to serve as a wrecking ball for the highly leveraged BREIT sector.

What’s got investors more skittish yet, are the recent executive payouts. This follows an unbelievable 1.27 billion (yes ‘b’) paid out by the group to founder and Chief Executive Officer Steve Schwarzman. One wonders how the company can justify paying out, in the billions, to the boss just before defaulting and only being able to fulfill 15% of redemption requests.

The European Central Bank is warning that the €1 Trillion real estate fund sector poses substantial risks. They are arguing that investments in commercial property could present a major threat to financial stability after growing into bubble territory over the last decade.

“Instability here could therefore have systemic implications for commercial real estate, which could in turn affect the stability of the wider financial system…” reads the ECB in a press release.

The irony is palpable, as zero and negative interest rates have powered this incredible valuation mismatch in the sector. The zero interest rates have enabled funds to buy up, and the work-from-home trend as well as baby boomers leaving the workforce in record numbers has led to a sharp reduction in demand for commercial space.

Is Blackstone yet another Canary in the coal mine for the health of the financial system as a whole? It’s not looking great…

Have you seen the gold and silver price lately?