Iran to Halt Global Oil?

News

|

Posted 23/06/2025

|

4350

Iran’s parliament just endorsed a motion urging the closure of the Strait of Hormuz, which could halt one of the world’s most vital energy corridors. This comes after US air strikes on Iranian nuclear facilities. The dramatic response may soon be put into action by the Supreme National Security Council.

Roughly 30 per cent of global "seaborne crude" and a fifth of liquefied-natural-gas exports move through the small channel. A note circulated late Sunday by a major Wall Street bank suggested that a prolonged closure could propel Brent toward US$120–130 per barrel, levels not seen since 2022’s supply-shock highs.

What Does Polymarket Think?

Odds on crypto-based prediction platform Polymarket for a shutdown “by July” have quadrupled since last week, hitting 60 per cent after news of the parliamentary vote broke.

Tanker-tracking data compiled by shipbrokers show at least one UK-flagged vessel reversing course south of the strait overnight, a sign that some operators are adopting a wait-and-see stance despite traffic still flowing.

Washington Warns Against Close

Washington, which struck Fordow, Natanz and Esfahan with bunker-buster munitions on 22 June, has publicly warned Tehran that any attempt to choke the waterway would face a “determined international response.” US Secretary of State Marco Rubio has also urged Beijing (currently Iran’s largest crude customer) to pressure Tehran against the move, describing closure as “economic self-harm” for Iran.

Analysts stress that Iran exports up to 2 million barrels per day, much of it to China via disguised tanker routes. Cutting its own lifeline would inflict immediate pain in the form of lost oil revenue. Despite this, hard-liners in Iran argue that demonstrating leverage in Hormuz is a powerful counter to the US military.

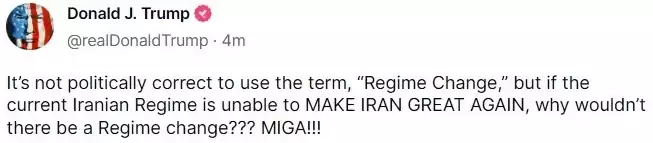

Regime Change

Now Trump, who made it seem like he was going to simply drop a few bunker busters and exit, is posting about regime change in Iran. He has moved from not getting involved, to getting completely involved and pushing for a change of government. If this trend continues, one might expect gold to move higher and put greater pressure on the Fed to insulate the US economy with easy money sooner rather than later.