Investors Flocking To BTC As Inflation Hedge

News

|

Posted 05/08/2020

|

11804

Bitcoin's price surge has triggered a retail trading boom with exchanges around the world reporting record-high bitcoin trading volume and one cryptocurrency hedge fund chief executive saying fear of missing out, sometimes known as FOMO, is drawing "people who are late to the party."

"In cryptocurrency, we often see 'momentum' plays," Joe DiPasquale, the CEO of crypto hedge fund BitBull Capital.

"Bitcoin is currently in a break-out phase, just as it was in the first six months of 2019 when it increased in value by 189%," DiPasquale added, pointing to growing interest in bitcoin from Wall Street and among payment firms.

DiPasquale anticipates the bitcoin price to hit $15,000 before the end of the year, which would put bitcoin within touching distance of its $20,000 all-time high.

Bitcoin climbed to around $20,000 in late 2017 before crashing back to around $3,000 a year later, with its huge retail investor-led rally fueled by an explosion of media interest in bitcoin and its underlying blockchain technology.

Bitcoin's sudden jump higher this week resulted in a rush of traffic to bitcoin exchanges as eager investors attempted to catch the upswing, invoking memories of the 2017 bitcoin gold rush.

Coinbase, the largest U.S. bitcoin and cryptocurrency exchange with 35 million users around the world, has seen a three-fold increase in bitcoin trading volume this week.

Meanwhile, BinanceUS, the 10-month old American arm of Binance, the world's largest cryptocurrency exchange by volume, reported bitcoin trading this week hit an all-time high on its platform.

Elsewhere, smaller bitcoin companies have also seen a surge of interest.

"[This week] blew away anything we've seen," Cory Klippsten, tech investor and founder of bitcoin buying app Swan Bitcoin, said via Telegram, adding the four-month-old startup "did about a third of our all-time revenue in five days."

However, Klippsten doesn't think we're back at the FOMO stage yet—although he concedes: "The expectations of so many [bitcoin investors] that we're in the early stages of another meteoric rise may be self-fulfilling."

Like many bitcoin price watchers, Klippsten sees bitcoin's cut to supply in May, when the number of new bitcoin coming onto the market was halved, coupled with the U.S. Federal Reserve's massive stimulus measures in the wake of coronavirus-induced lockdowns as bullish for the bitcoin price and causing a "price spike for all hard assets"—including gold, which came within striking distance of hitting $2,000 US for the first time this last week.

Klippsten is echoed by analyst Thomas Kuhn, of Quantum Economics.

"We are seeing volatility creeping back into the bitcoin market and there is a question whether it will attract the attention of Robinhood momentum traders but too early to tell if we have seen or will see FOMO yet," Kuhn said, pointing to the recent interest in stocks and shares from causal day traders who have been using low-cost trading apps such as Robinhood to pile into equity markets.

In addition, Montreal-based bitcoin buying service Shakepay has this week reported a "significant" surge in demand.

"Over the last few months, and particularly during the last few weeks, we’ve seen a significant surge in customer registrations and activity on our platform," Shakepay chief executive Jean Amiouny said.

"As the Bank of Canada continues to print money, bitcoin purchases and sales on Shakepay have been growing exponentially, and as of this month we’ve broken over $400 million in digital currency bought and sold."

As more investors look to ‘digital gold’ as an inflation hedge in an increasingly digitised world amidst unprecedented government money printing we know that it won’t take much of an institutional allocation until $50,000 bitcoin is back on the table.

The Fed already has taken monetary policy to a new level of extraordinary this year, pumping nearly $3 trillion of freshly created money into financial markets earlier and pushing its total assets to about $7 trillion. A growing number of investors in both digital-asset and traditional markets believe the flood of dollars could whittle down the U.S. currency's purchasing power.

The dollar index, a gauge of the currency's strength in foreign exchange markets, fell 4% in July, the biggest monthly drop since 2010.

Bank of America analysts wrote Monday in a report that it's becoming a popular trade to bet against the dollar since investors are "worried about the long-term impact of the rapid accumulation of U.S. debt for the U.S. dollar's reserve-currency status."

"As gold, silver, equities, and long bonds reach record high levels, and the U.S. dollar slumps, the king of cryptocurrencies may be back in the spotlight for the foreseeable future," Jeff Dorman, a chief investment officer of the cryptocurrency-focused firm Arca, wrote Monday in a weekly blog, signalling that we might only be at the start of the current bull run.

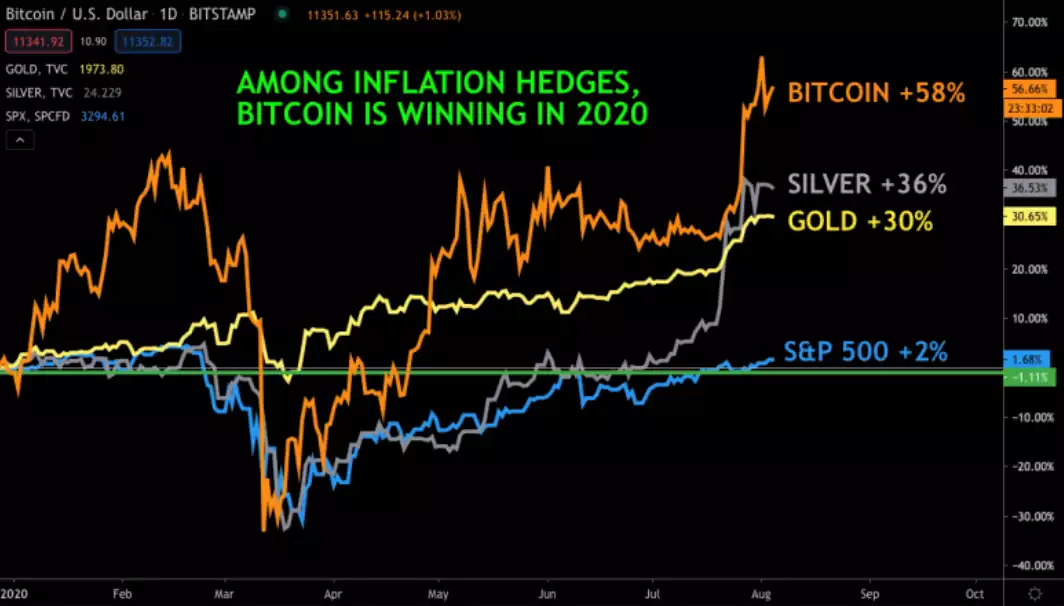

The Fed’s extra loosening of monetary policy could help support prices for bitcoin. Bitcoin prices have already soared 58% this year, beating silver’s 36% and gold’s 30%, not to mention the 2% gain in the S&P 500.