Inflation – the “BIG theme for 2021”

News

|

Posted 17/12/2020

|

9178

As we write this Bitcoin has just smashed through the all-time high, up over 10% and through US$21K as well. Silver jumped 3.2% overnight, up over $1 and gold firmed as well. What do all these have in common? They are hard assets that will thrive in a world of central bank and government currency debasing stimulus and the inevitable inflation to follow.

Last night the central bank in charge of the world’s reserve currency kept the pedal to the metal stating that in the medium term COVID still poses “considerable risks” and hence it kept rates at near zero (0%-0.25%) and:

“In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.”

Remember the Fed have a dual mandate of maximum employment and managing inflation. In the past that has been about containing inflation. Since the GFC it has been about increasing inflation. The world now has more debt than ever before. Dangerous amounts of it. That debt can either be paid off through earnings (which not even the most ardent V shaper could believe possible), inflated away or defaulted on. Period.

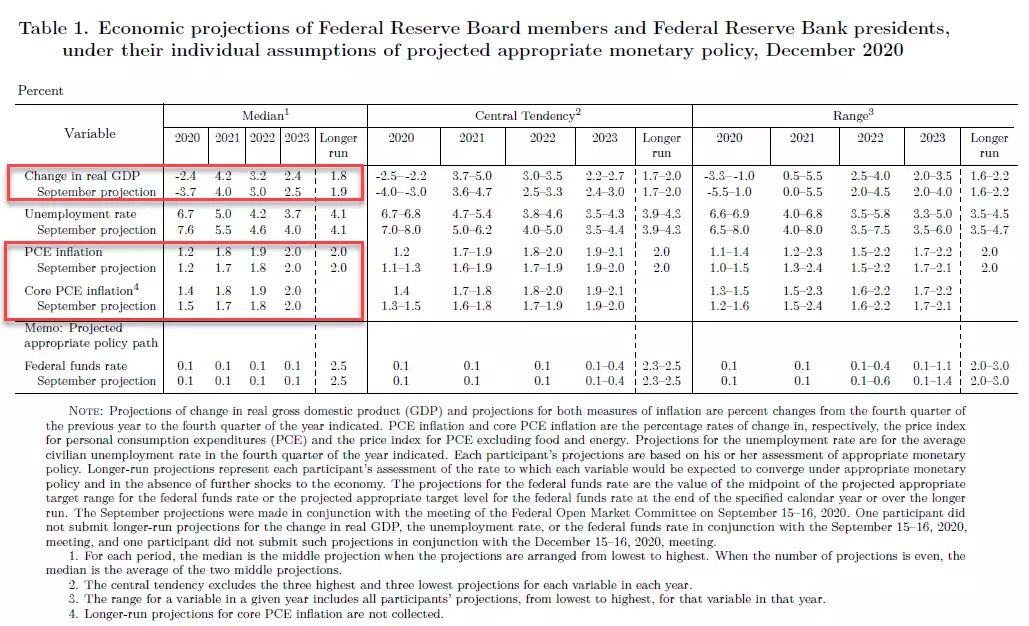

The Fed is now forecasting GDP growth in the US of -2.4% for 2020, 4.2% in 2021, 3.2% in 2022, 2.4% in 2023 and 1.8% in the “longer run”. Moving past the willfully optimistic 2021 figure (they have been perpetually over estimating growth since the GFC), you can see even the optimistic Fed is predicting the weight of this debt is going to drag on GDP going forward. These growth rates won’t scratch the surface of paying off this debt burden.

In terms of ‘inflating it away’, the Fed’s own projections, have us at 1.4% (Core PCE) this year, 1.8% next, 1.9% 2022, and voila… the magic target of 2% in 2023 and every year thereafter. We’re not kidding, this is their own table:

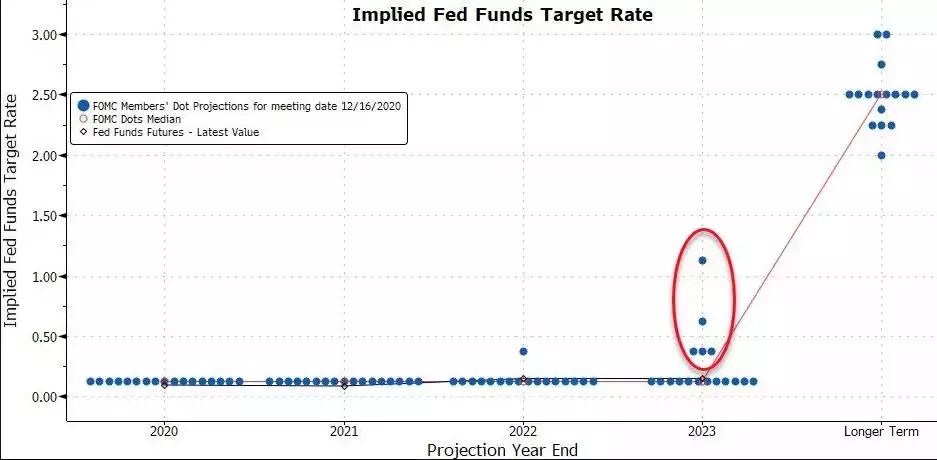

So confident are they in achieving 2% in 2023 that only 5 of the 17 Fed (FOMC) members see them moving from the current 0%-0.25% funds rate in that same year:

How’s that for confidence inspiring….

The big risk here however is that they get the inflation projections wrong, stimulate too long and we get the uncontrolled inflation scenario that has been threatening since this monetary expansion experiment commenced. The big lesson after the GFC was that all the stimulus was targeted at financial assets and hence we have all time high markets and the rich getting richer and the rest left behind. But no inflation. What now is clear is that more of the stimulus is heading to main street not Wall Street.

Phoenix Capital Research just wrote to this inflation situation and it is as fascinating as it is scary. They have uncovered a paper published back in 2001 by the Fed’s researchers which concluded:

“We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…”

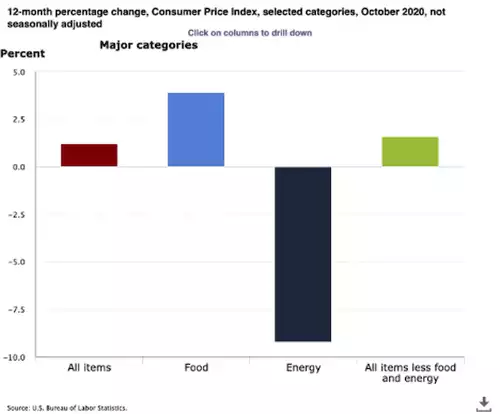

They then look at the latest CPI breakdown from the BLS:

“Notice that FOOD prices have shown the fastest rise out of all other components over the last 12 months, clocking in at 3.9%. The BLS itself states that:

1) All six major grocery store food group indexes are UP over the last year.

2) The increase in prices range from 2.6 percent (fruits and vegetables) to 6.1 percent (meats, poultry fish, and eggs).

3) The index for food away from home rose 3.9 percent over the last year, the largest 12-month increase reported for that index in over a DECADE (since May 2009).”

Ground truthing that at the source, the chart below, VERY reminiscent of the commodities chart we shared yesterday, showing a clear breakout of the decade long bear market in agricultural commodities (ala food):

In their words:

“What you’re looking at is the 10-year bear market in food prices ENDING. This chart is telling us that higher inflation is coming. And coming soon.

This is the BIG theme for 2021 no matter what else may come: more money printing, more inflation, and more explosive moves in inflationary assets.

Those investors who are well positioned to profit from it could see literal fortunes.”

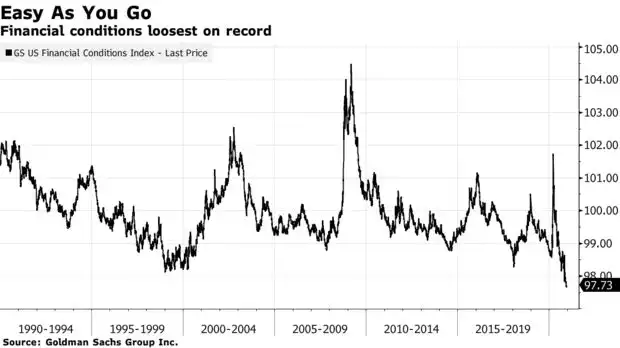

A couple of days ago Goldman Sachs released the latest print of their “Financial Conditions Index” which broadly measures a ‘tighter’ or ‘looser’ environment in the US. It is now at the loosest in history:

Whilst they talk to how good this is for growth in the short term, they warn (via Bloomberg):

“Longer-term, looser lending poses risks, potentially inflating bubbles in stock and other asset prices and enticing borrowers to take on too much leverage. In a blog post on Monday, International Monetary Fund Financial Counselor Tobias Adrian cautioned that policy makers “must weigh the pros of more stimulus today against the cons of higher financial stability risks in the future.””

Get that even slightly wrong and the sheer quantum that has been unleashed can see runaway inflation of epic proportions. The ‘everything is awesome’ crowded sharemarket is drinking the Kool Aid. The astute, looking at every chart at extremes are quietly buying up gold, silver, platinum and Bitcoin before the crowd turn to these relatively tiny markets. Collectively those hard assets have tradeable market caps less than $3 trillion and supply cannot be increased in response to demand. What happens when $100 trillion (as was reached this last week) of global shares, and $200 trillion of other financial and property assets try to get into that little $3 trillion space? Fixed Supply and high demand leaves just one variable in the Economic 101 equation… Price.