Infamous “Big Short” Burry – Places $1.6b Bet US Market about to Tank

News

|

Posted 16/08/2023

|

4786

Chances are, we're all familiar with "The Big Short," whether through the film or the book.

Similarly, most of us are likely familiar with Michael Burry, the finance genius who made a bold move by betting against the US housing market by persuading investment banks to provide him with credit default swaps linked to risky subprime mortgages.

Now, he's back in the spotlight, this time targeting the US equity market.

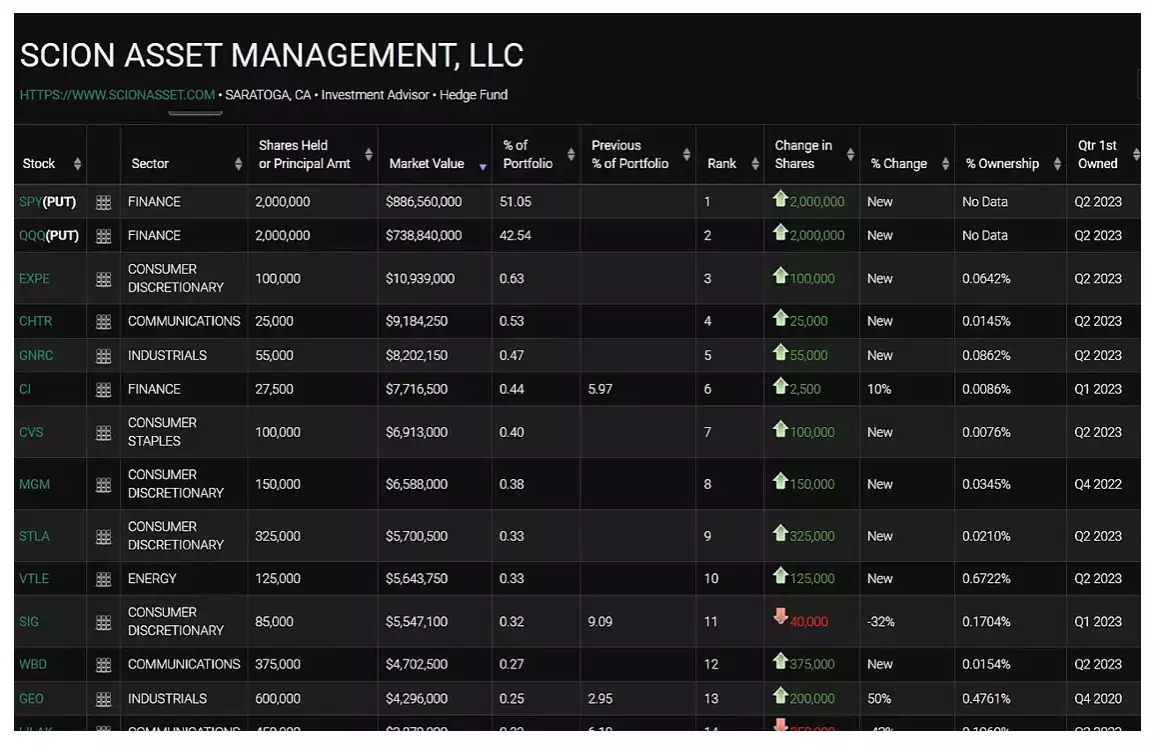

According to recent documents filed with the SEC (Securities and Exchange Commission), Burry has actively taken on put options involving two ETFs that mirror the performance of the S&P 500 and the Nasdaq 100. The combined value of these options adds up to an impressive $1.6 billion.

The question of whether Burry's actions are a "BIG SHORT" or a "BIG HEDGE" is up for interpretation. However, the central theme remains the same: he's placing a bet against the current state of the market.

Burry is known as a value investor, someone who excels at spotting overpriced stocks and sectors and then making short trades to capitalize on their decline.

Interestingly, Burry's talent for short-selling actually precedes his well-known bet against the subprime market in the US.

As author Michael Lewis recounts in "The Big Short":

"Back in 2001, while the S&P 500 dropped by 11.88%, Scion, under Burry's guidance, surged by 55%. The following year, as the S&P 500 fell again, this time by 22.1%, Scion once more outperformed with a 16% increase. In 2003, despite the stock market's recovery with a 28.69% rise, Burry still managed a remarkable 50% return. By the end of 2004, his assets under management had reached a hefty $600 million, and he was even forced to turn down additional investments."

Then came his most impressive achievement – Burry's calculated bet against the US housing market resulted in a personal profit of around $100 million and hefty returns of $700 million for his investors.

However, perfection wasn't always on his side. While the exact timing of his short positions being exercised remains uncertain, he boldly announced in 2022 that he had taken substantial short positions in anticipation of an impending drop in earnings. As history has shown, that thesis has not quite panned out yet.

As disclosed in a 13F filing with the U.S. Securities and Exchange Commission, Burry acquired put options worth $890 million for SPDR S&P 500 ETF and $740 million for INVESCO QQQ ETF.

Twitter reacted with amazement, labeling this move a $1.6 billion short.

Though the apparent value of these positions, based on the underlying trading prices as of June 30, amounts to $1.6 billion, the exact details of when these contracts were initiated, the strike prices set, and the premiums paid remain undisclosed.

Irrespective of the specifics, Burry's evident concern about the market is palpable, and his actions echo that sentiment. If his foresight proves accurate once again, we might find ourselves witnessing another debilitating economic crisis.

On an ‘unrelated note’…. Both the S&P500 and NASDAQ fell 1.15% overnight..

As a reminder, gold doubled over the GFC whilst shares halved.