India soaks up physical silver as the COMEX bleed continues

News

|

Posted 25/08/2022

|

12630

Indian silver imports are now projected to top 8,200 tonnes in 2022 on an annualised basis. This represents approximately 25% of all silver produced globally from mines. Through July, Indian imports have surged to 5,100 tonnes. According to the Ministry of Commerce and Industry, this was the highest January-July figure in at least a decade and more than the country imported in 2020 and 2021 combined.

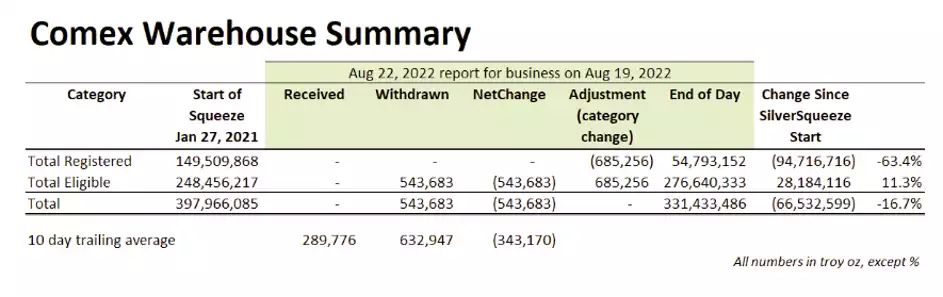

This comes as physical reserves reported by the COMEX continue to dwindle and the spot price slides back beneath US$19. There are two types of vaults at the COMEX, ‘Eligible’ and ‘Registered’ holdings. All bars need conform to the COMEX’s exchange requirements: weighing within 10% plus or minus of 1000 troy ounces, the weight, purity and refiner clearly stamped on the bar. Eligible holdings already belong to a bank, or a family office or another company. Registered bars are the bars that are available for future’s contracts holders to take for delivery. Since the Silver Squeeze of early 2021, registered ounces available are now down 63.4% at just under 55 million ounces.

Open interest stands at 145,047 contracts (735million ounces). That is 219% of all eligible and registered, and 1,324% of registered.

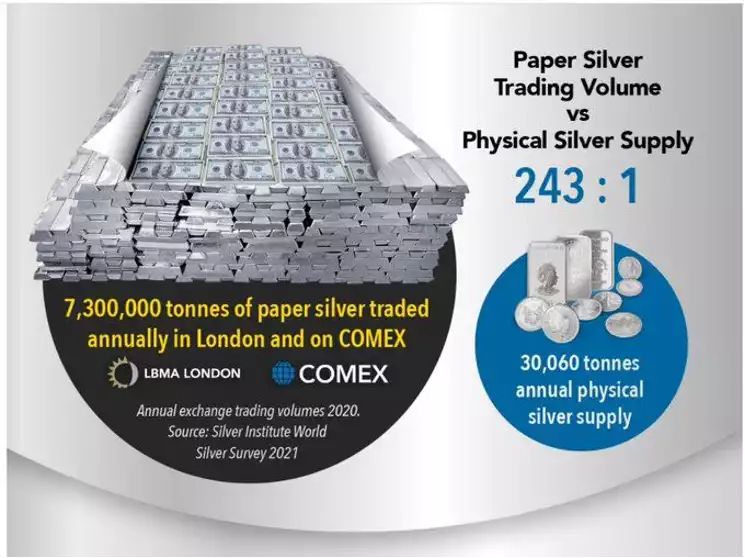

Eligible holdings can and do become Registered at the stroke of pen, or keyboard as it were. These changes are reflected in the “Adjustment (category change)”. However, many commentators rightly point out that the Eligible holdings could easily sell into Registered if the price were right, or if they were strongly armed by the COMEX into selling. Simplistically the COMEX is only 55 million ounces away from a technical default and having to close out contracts with cash settlements, though the reality is most do, and indeed prefer, this anyway. It’s not uncommon for more than 500 million derivative ounces to trade hands in a single day.

1000oz eligible bars leaving the COMEX

As the registered holdings continue to dwindle, the silver price has slid back beneath US$20 after coming up for air earlier this month. Silver is now clearly back in the “buy zone” for many precious metals purchasers. With the Gold-to-Silver Ratio back over 90, silver continues to lag. The big question is, is this combination of overwhelming physical demand at these lowering prices setting us up for the perfect storm for silver?

In this afternoon’s Gold & Silver Standard Insights we are excited to welcome Nikos Kavalis. Nikos is a founding partner of Metals Focus who do all the research and author the World Gold Council quarterly demand reports we always summarise and likewise the same reports for The Silver Institute. He has nearly 19 years’ experience working as a metals analyst/strategist. Prior to starting Metals Focus, Nikos worked as a commodity strategist for the Royal Bank of Scotland in London and a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics. We look forward to hearing his insights into this hot topic.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************