India Remonetizes Silver: BRICS to Follow?

News

|

Posted 03/12/2025

|

3382

To the surprise of global financial markets—and vindication for silver stackers—India’s central bank, the Reserve Bank of India (RBI), has quietly reintroduced silver into the global financial system.

From Q2 of 2026 (the beginning of India’s next financial year), Indian banks will be officially authorised to accept silver as collateral for loans. This opens the door to significant new liquidity in Indian markets, backed by a vast reserve of household-held silver that has remained largely untapped. The global implications are considerable, given that silver has been absent from mainstream financial systems for nearly a century.

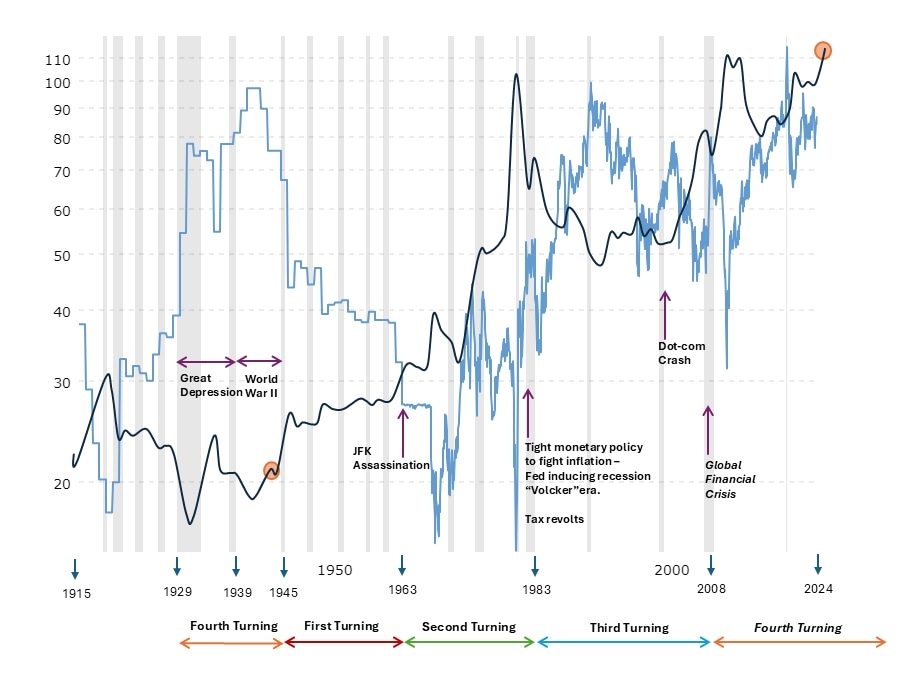

As anticipated in the context of major global financial realignments—shifts consistent with the transition between 80-year socioeconomic cycles known as the “Four Turnings”—a sustained bull run in precious metals is not only likely but historically consistent with the early stages of such cycles.

As shown below, at the start of the current 80-year cycle, the gold-to-silver ratio (light blue) declined from the 80s to the 30s, where it remained for decades. Over that same period, silver (dark blue) experienced a prolonged 35-year price appreciation.

This remonetisation move allows Indian citizens to deposit up to 10 kilograms of silver—coins or jewellery—as collateral for personal or business loans. Banks can lend up to 85% of the silver’s

value, with the collateral required to be returned within seven days of repayment. This structure limits both corruption and the risk of over-rehypothecation.

Estimates suggest 10,000 to 15,000 tonnes of silver are held in Indian homes and temples—worth hundreds of billions of rupees (with 1 AUD equating to approximately 60 rupees). Much of this silver is held by rural and middle-income families who currently face limited access to formal credit.

With India now leading this shift—while BRICS nations continue their move away from US dollar dependence (notably via increased gold utilisation)—a broader BRICS embrace of silver remonetisation is not far-fetched. Countries with substantial silver reserves, such as Russia, China, and Mexico, may follow suit as the foundation of a new monetary era takes shape.

Should this trend expand globally, silver could once again gain legitimacy as parallel money—a tangible, decentralised store of value—within an increasingly digital financial landscape, where US stablecoins and CBDCs are also becoming mainstream.

By anchoring financial systems in physical assets beyond the reach of Western monetary control, sovereign states are asserting greater geopolitical independence—a trend that appears set to accelerate

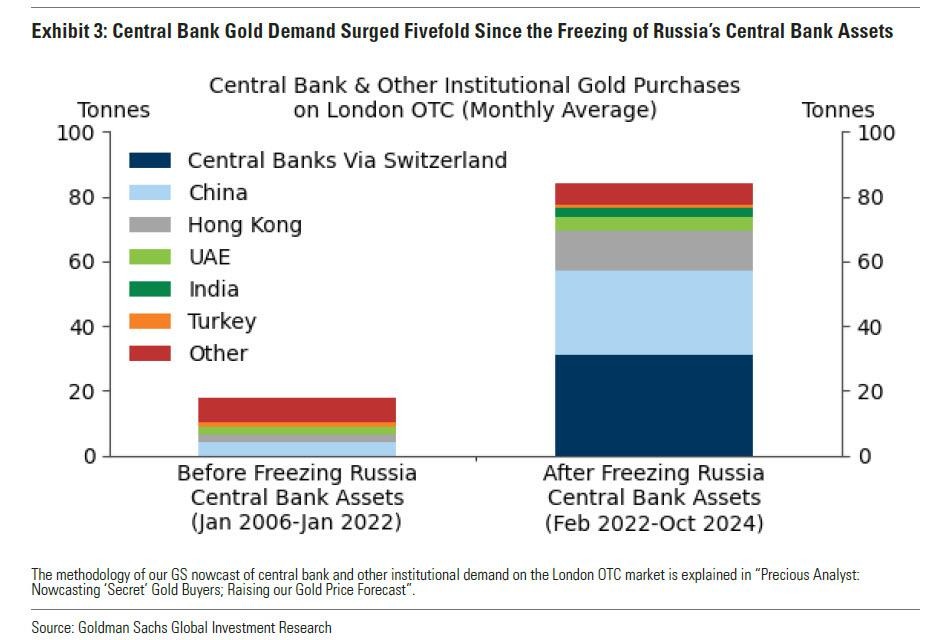

With the global financial system underpinned by over US$38 trillion in debt and mounting sanction risks, it’s little wonder that central banks are now buying more gold than government bonds for the first time in decades.

Could India’s seemingly local credit policy prove a turning point in the evolving multipolar monetary order?

Silver’s re-emergence as money may already be underway.