IMF – Worst Recession Since Great Depression

News

|

Posted 15/04/2020

|

22711

Last night the IMF released its first World Economic Outlook report since the virus took hold. Calling this the Great Lockdown, they predict this recession will be the steepest in almost a century and worse still if it extends beyond their arguably optimistic baseline of the virus crisis fading in the second half of this year.

In the first report since their January projections of a 3.3% global expansion and telling G20 finance chiefs in February that “global growth appears to be bottoming out.”, the turnaround is nothing short of spectacular. Their baseline sees a 3% contraction globally in 2020, the worst since the Great Depression and dwarfing the 0.1% contraction in 2009 during the GFC. They further map out the scenarios of it hanging around longer than the first half of this year, returning next year and a combination of both. That would see a further, and unprecedented, 3% off this year (-6% in total) and the ‘protraction and return’ scenario wiping an incredible and unfathomable 8% off next year too.

While they are predicting a 5.8% bounce next year on their baseline scenario they warn that risks are tilted to the downside and even with that large rebound it is by no means a “V shaped” recovery, as the “cumulative loss in global GDP this year and next could be about $9 trillion -- bigger than the economies of Japan and Germany combined” would not see a return to trend.

Advanced economies will be hit the most, collectively down 6.1% with Emerging Market economies down 1% and China and India sharply dropping but still printing positive 1.2% and 1.9% as they grow on internal consumption of a massive and ‘emerging’ population. On the baseline (only) scenario that sees the US shrink 5.9%, EU one of the hardest hit at -7.5%, and Australia at -6.7%. From the IMF:

“Many countries face a multi-layered crisis comprising a health shock, domestic economic disruptions, plummeting external demand, capital-flow reversals and a collapse in commodity prices…..Risks of a worse outcome predominate.”

The IMF also released their Global Financial Stability Report noting unsurprisingly the virus crisis “presents a very serious threat to the stability of the global financial system” and that whilst markets seem to think all the stimulus and perceived virus curve flattening means everything’s awesome again, they remind the herd that “there is still a risk of a further tightening in financial conditions” that could “expose cracks in the system”. That means even more stimulus.

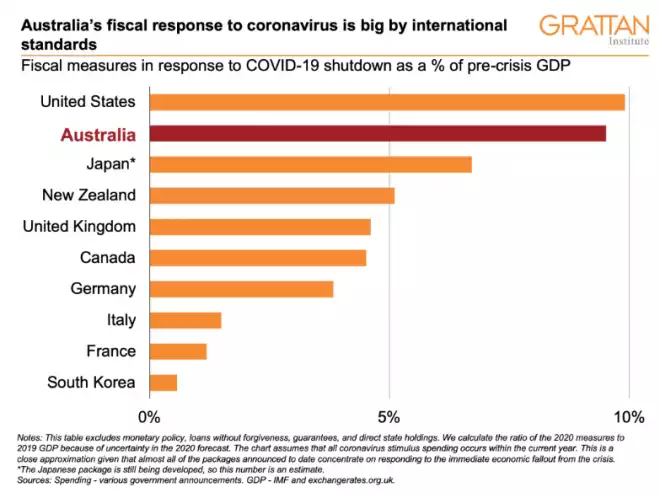

Australia’s government has gone harder than any country barring the US’s 9.9% of GDP packages.

At $7,700 for every Australian the scale is indeed incredible. The problem remains that it simply isn’t enough to stop the IMF’s projected 6.7% recession, and even then creates a massive deficit for the next generation to somehow deal with.

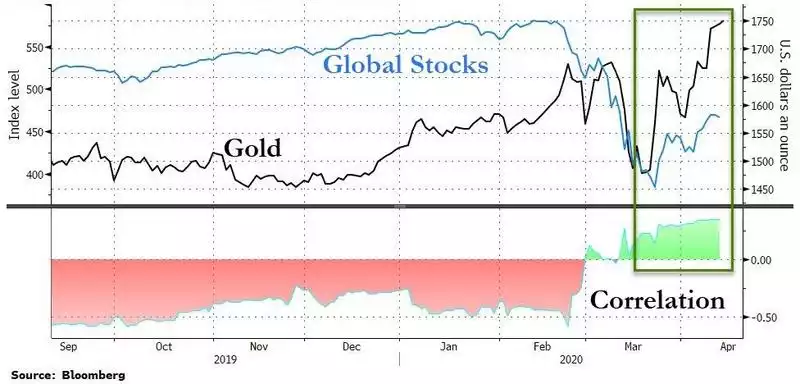

That sharemarkets are rallying amid such numbers is baffling on fundamentals but predictable on human (sheeple) emotion. It should be no surprise then that gold is accompanying the rally despite the usual lack of correlation. Gold just smashed through US$1750, its highest since 2013 after the ‘sell everything’ liquidity squeeze last month. The chart below clearly maps this about face in correlation.

Just as in previous liquidation events gold fell with shares. In most previous instances shares and gold bounced but shares then went on the next leg down whilst gold continued to rally. On the IMF’s numbers and the fact the bounce is on artificial stimulus, that looks likely again but possibly on a much grander scale.