IMF Warn of “Heavy downside risks” As Forecast Dropped Again

News

|

Posted 12/04/2023

|

8215

It’s hard to turn on the radio or read a news site today without hearing of last night’s IMF World Economic Outlook report screaming of more pain ahead for the global economy. Whilst downgrading 2023 growth projections yet again, down 17.6% from 2022, it was clear that there are “heavy downside risks” and a “risk of harder landing” should the fallout from the bank failures continue or more occur. Pierre-Olivier Gourinchas, the IMF’s chief economist said:

“The risks are weighted heavily to the downside, in large part because of the financial turmoil of the last month and a half. That is under control as of now, but we are concerned that this could result in a sharper and a more elevated downturn if financial conditions were to worsen significantly.”

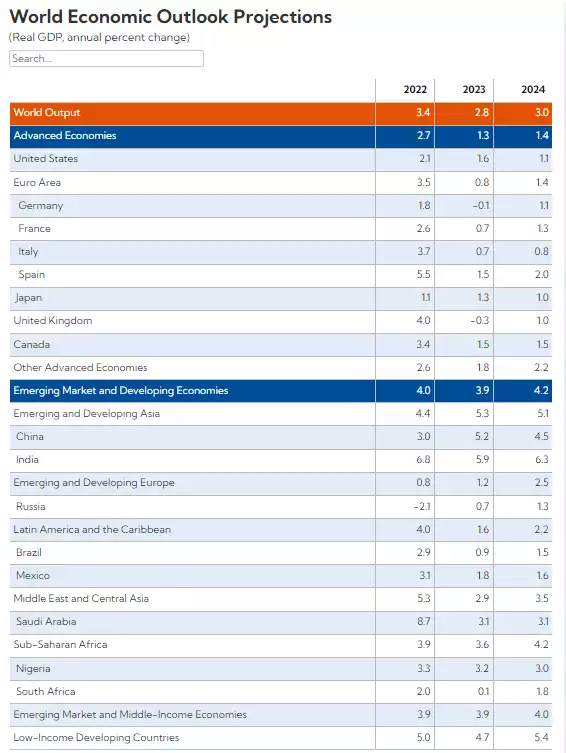

In their likely scenario, advanced economies grow at just 1.3% in 2023 and 1.4% in 2024 whilst emerging markets are forecast at 3.9% and 4.2% respectively, with the global number sitting at 2.8% and 3.0%, The IMF talk about the ‘plausible alternative’ which cuts that to 2.5% in 2023, the lowest since 2001 outside of the pandemic and GFC. The ‘severe downside’ scenario, assigned a 25% probability, is less than 2% global growth (which has only happened 5 times since we left the gold standard) and even worse of just 1% growth assigned a 15% probability.

Whilst not in the table above, they have Australia at just 1.6% in 2023.

The recent banking crisis is clearly front of mind for them and not accepted as a given that it is over. Contagion is clearly in the odds. From Gourinchas again:

“We can all remember the long time between the failure of an individual institution, whether it was Bear Stearns or Countrywide….Every time, this was treated like an isolated incident, until it wasn’t.”

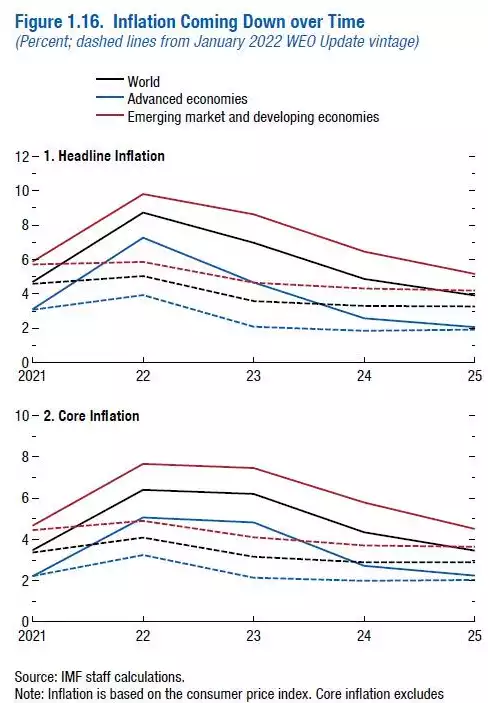

The recent bond market and banking crisis of course were borne of too hard too fast interest rate hikes to tame inflation. As they noted “Inflation is much stickier than anticipated even a few months ago” and “more worrisome is that the sharp [monetary] policy tightening of the past 12 months is starting to have serious side effects for the financial sector.”

They don’t see inflation as ‘fixed’ in any way and indeed are forecasting 7% for 2023, a still ‘sticky’ 4.9% average in 2024, and not returning to target until 2025. Per above, the impacts of responding to that inflation have been felt in both sovereign bond markets and banking sector alike with the IMF noting that “significant vulnerabilities exist both among banks and non-bank financial institutions”.

Tomorrow we see the latest CPI data out of the Mother Ship US economy. From ABC News:

“The US Consumer Price Index is expected to cool to 0.2 per cent in March, and economists are tipping annual inflation to slow from 6 per cent to 5.2 per cent because of the Federal Reserve's string of interest rate rises.

However core inflation, which strips out volatile food and energy prices, is predicted to rise from 5.5 per cent to 5.6 per cent.”

We also will see the minutes from the last Fed meeting tonight. Combined with Fed member William’s last night calling for another hike (when ‘hope’ is for a pause) markets were unstable again.

All eyes will be on those minutes for more clues and that CPI print, so expect more volatility. Regardless, the IMF forecasts which, if history repeats, will be downgraded again, are sending a very very clear stagflationary warning. Higher inflation, lower growth, recession signals everywhere = wind in gold’s sails. Yesterday gold went through both USD2000 and AUD3000 and held overnight, and the Gold Silver Ratio dropped below 80. This could just be the beginning of the next bull run.