IGWT 3 – The Turn of Monetary Architecture

News

|

Posted 15/04/2019

|

8022

Continuing our 6 part series summarising the “In Gold We Trust” teaser we look at the demonstrable shift in the architecture of global money. Not a new topic to regular readers, the global de-(US)dollarisation is very real and telling.

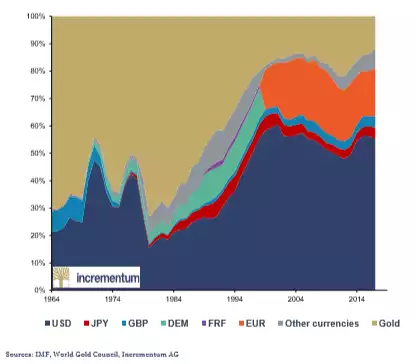

The chart below shows the proportion of global currency reserves held in USD is under threat.

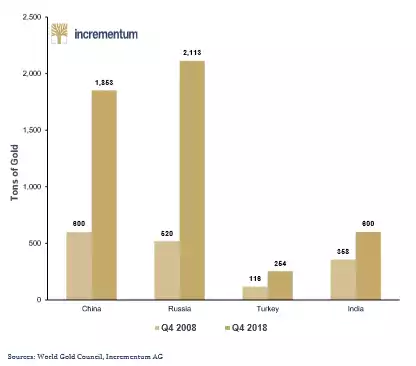

“In recent years the “axis of gold”* countries have questioned the US-dominated global economic order. Their distrust is reflected in the steady expansion of their gold reserves. China, Russia, and Turkey in particular have boosted their central bank gold holdings substantially since 2007, by 209% (China), 307% (Russia), and 118% (Turkey). India has boosted by 68%. The increase in gold reserves should be seen as strong evidence of growing distrust in the dominance of the US dollar and the global monetary and credit system associated with it.”

Why gold? Jim Rickards insightfully asks the same:

“If it’s not money, what does the US have 8,000 tons? Why does the IMF have 3,000 tons? Why has Russia tripled its gold reserves in the last 10 years? Why is China buying every piece of gold that’s not nailed down at the largest mining production in the world, and zero exports.”

China’s Yuan (CNY) is not freely traded enough to be a serious threat for now to the US but, as Gavekals Charles Gave notes:

“The Chinese want to de-dollarize. But they want also to keep their capital account closed. There is a very astute solution the Chinese have found: China says ‘If you have too many CNY because you have been selling a lot of oil to China, you can keep your CNY in your reserves, fine with us. Or we can give you gold instead of CNY.”

So again, why gold? Quite simply because its properties, particularly in a world awash with newly printed fiat currencies, make it one of the worlds few real forms of money.

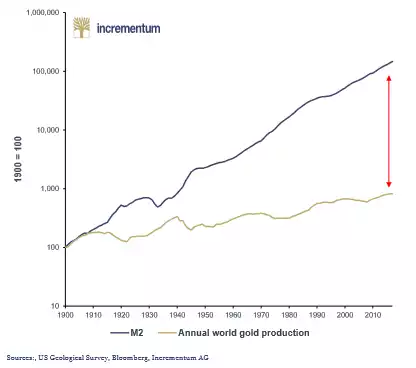

Those properties are principally its scarcity and hence 6000 years of reliably storing value. Annual mine production has consistently averaged around 1.6% per year since 1900. Compare that below to the expansion of global M2 money supply that’s around 180 times faster:

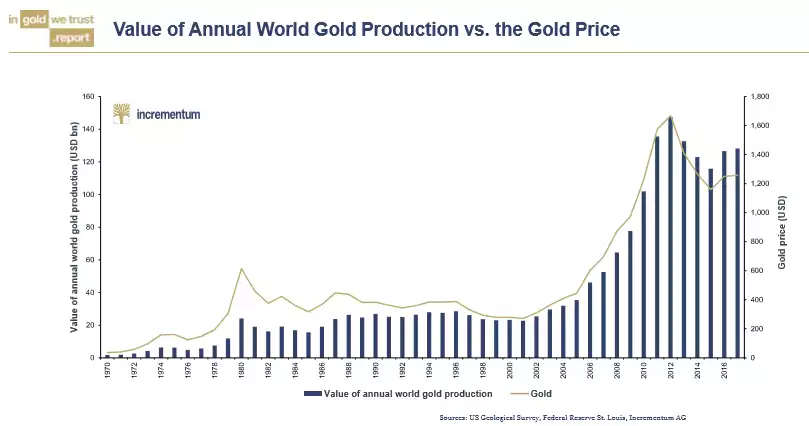

By contrast gold has a stock-to-flow ratio (total existing supply v annual production) of approximately 64 years. The chart below too is telling in the current dip of the value of gold v supply. Will this continue? Is it different this time?

Ray Dalio, head of the world’s biggest hedge fund Bridgewater, was quite vocal last week about capitalism failing the human race. Whilst his arguments are targeted at the social divide it has caused of the haves and have nots, the fundamental failing is human greed and self interest. Ironically why socialism never works is because of the same reason. Gold has stood the test of time as money because it removes the option to simply create more to fill one’s pockets. It can’t be printed at will. You need to mine around 2 tonne of rock to get just 1 gram of gold and, per above, we only ever manage to extract around 1.6% more each year.