Huge Spike in Fed Bank Bailout Program a Worrying Sign for the Banking System

News

|

Posted 29/11/2023

|

5213

Total outstanding loans in the Bank Term Funding Program (BTFP) jumped over $5 billion this past month. You will recall the BTFP was the Fed’s bank bailout program when they started failing earlier this year.

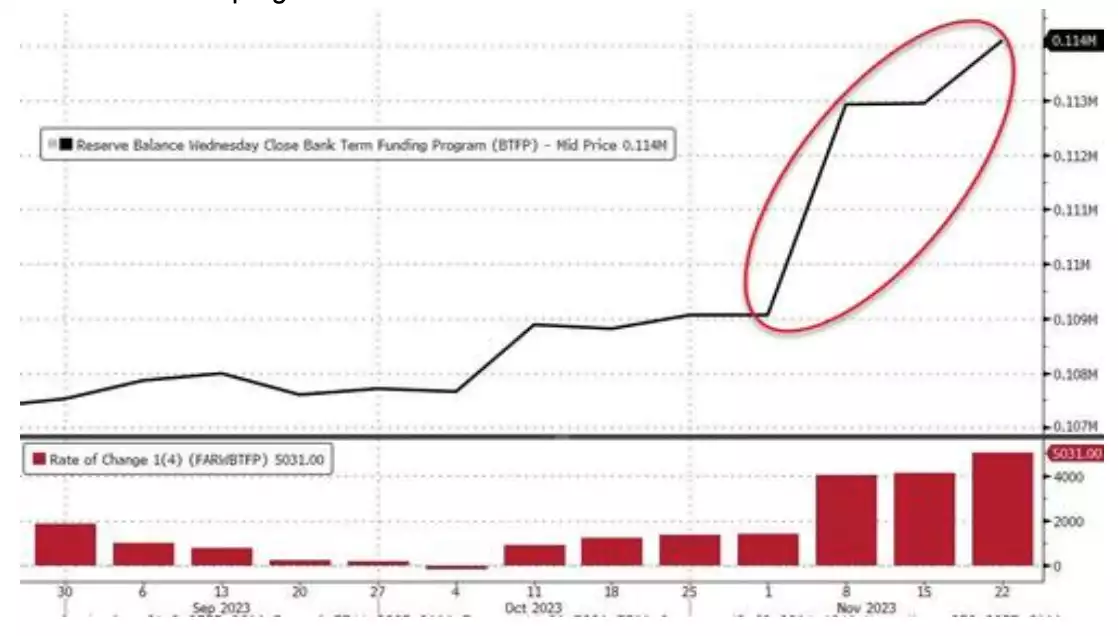

This surge is notable during the first week of the month, where banks borrowed $3.87 billion through the Bank Term Funding Program (BTFP). Another notable increase in borrowing occurred between November 15 and November 22. As of November 22, the total outstanding loans in the BTFP reached $114.1 billion.

The chart below shows a stabilisation of borrowing in August, followed by a sudden spike in November. This suggests ongoing instability in the banking sector, as banks continued to utilise the bailout program.

The BTFP was originally established in response to the collapse of Silicon Valley Bank and Signature Bank, aiming to provide banks with easy access to capital to meet depositors' needs.

According to a Federal Reserve statement, “the BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

In other words, the BTFP allows banks to borrow against eligible collateral like US Treasuries, agency debt, mortgage-backed securities, and other qualifying assets, offering loans up to one year in duration. This enables banks to borrow against the face value of their assets, providing liquidity against high-quality securities and avoiding the need to quickly sell securities during stressful periods.

The Federal Reserve's decision to increase interest rates to counter inflation had a significant impact on the bond market. The rapid rise in interest rates resulted in a decline in bond prices, leaving many banks appearing undercapitalised on paper. According to the Federal Deposit Insurance Corp, unrealised losses reached $620 billion at the end of the previous year.

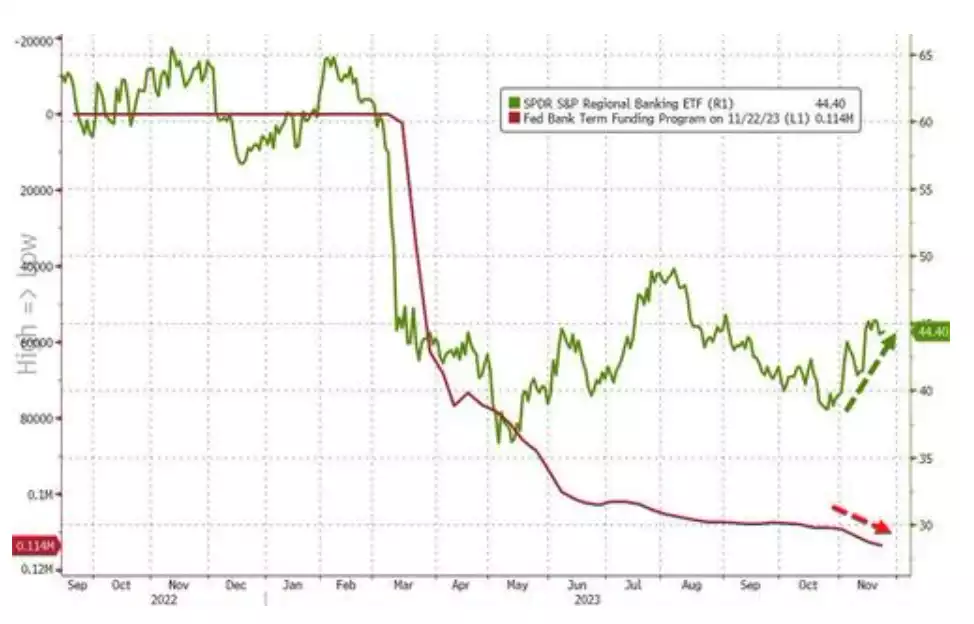

The BTFP serves as a solution for undercapitalised banks facing losses due to the bond market decline, allowing them to borrow at the face value of their bond portfolios. Despite a subsequent bond market rally and increased bond values, banks continued to draw from the bailout program, indicating underlying issues in the banking system.

While the $114 billion outstanding in the BTFP is relatively small compared to the $22.8 trillion in commercial bank assets held by US banks, concerns arise about persistent problems within the banking system. The ongoing reliance on bailout borrowing, even with improvements in the bond market, suggests underlying challenges.

This situation is viewed as a consequence of the Federal Reserve's decision to raise interest rates to address inflation. The low-interest-rate environment that characterised the economy contributed to a bubble economy with widespread debt across corporations, consumers, and the federal government. The banking crisis earlier in the year was an initial manifestation of issues resulting from rising interest rates, with potential repercussions expected in other sectors, such as commercial real estate.

While recent rate hikes by the Fed may be implicated in these challenges, the root problem extends back several years. After the Great Recession, the Federal Reserve pursued policies that encouraged borrowing to stimulate the economy, including cutting rates to zero and implementing multiple rounds of quantitative easing. The attempt to normalise rates in 2018 was followed by a return to easy money policies during the pandemic, leading to monetary inflation and subsequent price inflation. Although the Fed's rate hikes appear to have tempered price inflation, the financial system remains strained, with the bailout program serving as a temporary solution that does not address the fundamental issue of the economy and financial system's reliance on easy money.

In essence, the Fed's bailout program has functioned as a temporary fix for the financial crisis, but the underlying challenges related to the impact of rising interest rates on an economy addicted to easy money persist unaddressed. It is only a matter of time before other issues emerge, highlighting the fragility of the current economic and financial landscape.