How to Lose Lots of Money Investing

News

|

Posted 22/06/2023

|

9036

Focus on your buy price

You may often hear investors talk about how good their “buy price” was on a particular investment. What they neglect to mention or even think about is their sell price. Experienced investors may tell you that the "sell price is half of the trade". In other words, even if an investor "buys high", they may have the conviction to wait until they get a high percentage gain before selling. Meanwhile, another investor may focus on hunting the bottom, yet have low conviction and sell at a smaller percent gain.

If a sale is half the trade, is it half the value? An investor can feel accomplished for a gold buy at $2400 AUD, even after panic selling at $2300. In this case, the selling price completely overrides the buy price. The investor made a loss. Despite this, the investor can be heavily praised by peers for the fantastic buy price. This basic mistake accounts for immeasurable investor losses.

Ignore market cycles that have occurred since 1913

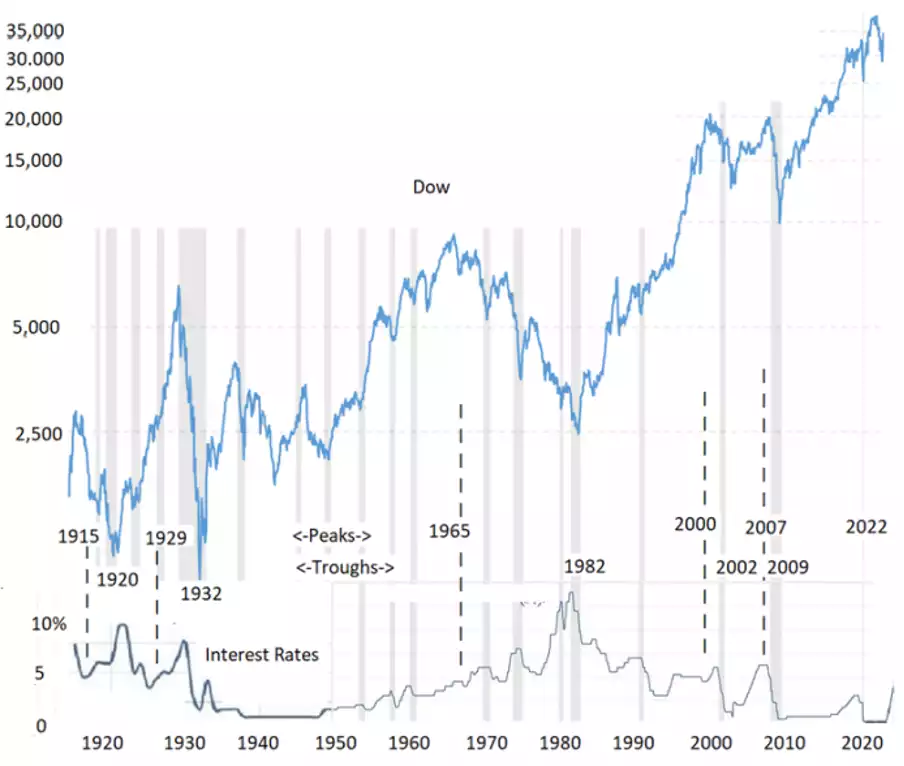

The Dow VS Interest Rates

https://cdn.mises.org/styles/max_full/s3/holly_graph.png?itok=-UBF6KoP

The Dow Jones Index could be considered to be in its 6th cycle of "boom and bust". We are potentially nearing the end of a cycle of rate hikes this year, which also typically coincides with a bust period shortly after.

- 1st: 1913–15 boom and 1915–20 bust

- 2nd: 1920–29 boom and 1929–32 bust

- 3rd: 1950–65 boom and 1965–82 bust

- 4th: 1982–2000 boom and 2000–2002 bust

- 5th: 2002–7 boom and 2007–9 bust

- 6th: 2009 boom, covid crash, continued boom...

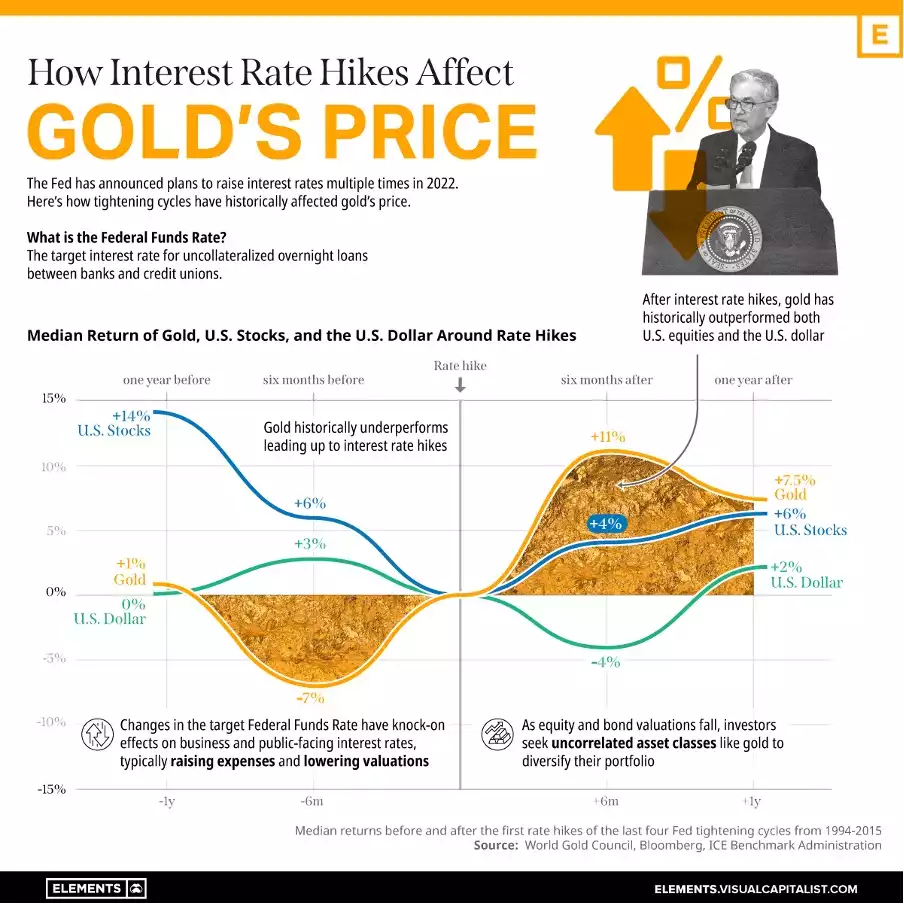

The Fed just hiked again in May and is claiming they may do more. Even if hikes are over, according to the chart below the gold market could enter another bull phase across the next five months.

https://elements.visualcapitalist.com/explained-how-interest-rate-hikes-affect-golds-price/

Going all in

Allocating 100% of risk capital into an investment can lead to several bad results:

- Inability to buy further dips or dollar-cost-average. It's almost impossible to pick the bottom, so options can be a good thing.

- Trading with excess emotion, as all equity is in one place based on one decision. This excess emotion makes it extremely easy to make the mistake mentioned in point #1 - selling at a bad price. Panic selling is easy when everything is on the line.

- Having to liquidate an entire investment for an emergency purchase. In the case of precious metals, this could look like liquidating a kilo of gold to pay for a small expense, rather than having extra money on the side, or at least some smaller increments of gold to sell without completely exiting the main investment.

Going with the crowd

Most people at a crosswalk who are using their phones will happily march through the intersection once they see others doing so in their peripheral vision. The cost of this not working out could be someone's life, not just some risk capital. This illustrates how damaging it is to look at charts and feel the social pull of one's asset moving up or down. Resisting buying a stock market index that is breaking record highs, or doing dollar-cost-averaging as a market continues to sink fights one of our strongest instincts.

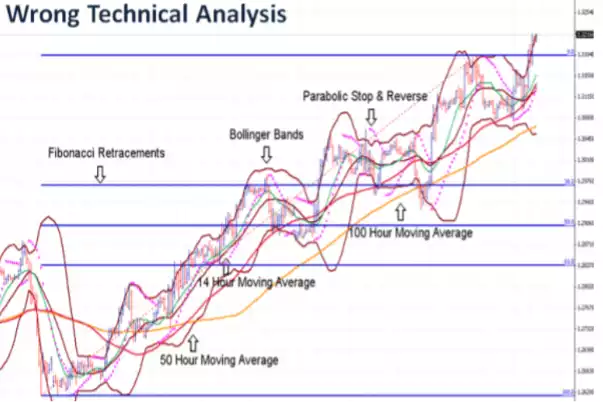

Use more indicators

Institutional investors and retail investors differ greatly in their chart analysis. As Bradley Gilbert explains, he has worked in investment banks for 20 years and has been a chief trader for much of that time. A key point he emphasises is that institutional investors and central banks are responsible for most of the market volumes, and they don’t sit on the computer on a daily basis making proprietary trading decisions and doing so based on a mess of indicators.

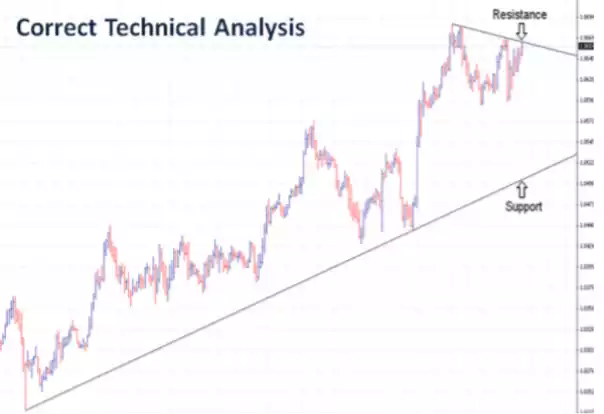

Their charts look more like the one below. They look out for major trends and try to take advantage of movements supported by long-term trends, and strong support and resistance levels.

https://www.fxstreet.com/education/making-money-in-forex-is-easy-201312050000

REMINDER:

You can learn all about investing in gold and silver bullion in our live, interactive presentation, and have your questions answered by our experts in the Q&A session at the end. Sign up here!