How to Invest in Gold for Beginners - An Introduction to Precious Metals

Resources

|

Posted 21/09/2023

|

3850

Investing in physical gold bullion is a popular and wise choice for many people looking to secure their financial future and diversify their portfolio.

Gold has been a valuable and sought-after commodity for thousands of years, serving as a store of value and a hedge against economic uncertainty. Whether you are a beginner or an experienced investor, gold is a worthy option to consider.

In this guide, we will provide an overview of the benefits of investing in gold and the different ways you can do so, helping you to buy physical gold with confidence.

Why invest in gold bullion?

Gold has been a valuable asset for thousands of years, serving as a store of value and a hedge against economic uncertainty. Some of the key benefits of investing in gold include:

1. Diversification:

Physical gold is not correlated with shares or bonds, making it a great option to diversify your portfolio and reduce your overall risk.

2. Hedge against inflation:

As the supply of money increases, the value of money decreases, leading to inflation. Gold, on the other hand, has a limited supply, making it a great option to hedge against inflation.

3. Safe haven:

Gold is considered a safe haven asset, meaning that its value tends to increase during times of economic uncertainty and market volatility. Its safety also comes courtesy of having no counterparty risk. Physical gold, unlike gold futures, gold stocks or gold miners, have no counter-party risk.

4. Liquidity:

Gold is a widely recognised and highly liquid asset, making it easy to trade gold in small or large amounts.

5. Long-term value:

Pure gold has held its value over time, and its value is expected to increase over the long term, making it a great option for those looking to invest for the future.

Gold Coins vs Gold Bars

Gold bars and gold coins are both popular forms of investing in a precious metal. While both have their advantages and disadvantages, the choice between the two ultimately comes down to personal preference and investment goals.

Gold bars are typically larger and more economical than gold coins, making them a popular choice for large-scale investors. They are also easier to store, as they take up less space than an equivalent weight in coins.

On the other hand, gold coins are highly recognisable and more easily traded, as they are universally recognised and accepted. Some investors are attracted to the legal tender status Australian and other world mint coins have. They also offer greater versatility, as they come in a range of sizes, making them suitable for both small and large investments. Furthermore, gold coins often have historical or collectible value, which can increase their value over time.

If investing in gold for your SMSF there are additional ATO rules if you buy gold coins that you may want to consider, that are not applicable to gold bars.

When choosing between gold bars and gold coins, it is important to consider factors such as your investment goals, budget, and storage options. Whether you prefer the stability and economies of scale offered by gold bars, or the versatility and recognition of gold coins, investing in either physical asset can help diversify your investment portfolio and protect against economic uncertainty.

Getting Started With Investing In Gold

Investing in gold has never been easier than it is today with Ainslie Bullion! Our physical commodity options offer a secure and stable option for those looking to diversify their portfolio. With three simple steps, you can become a gold investor today.

Step 1: Choose your investment

With a wide variety of gold bars and gold coins in different weights and sizes, Ainslie Bullion has everything you need to find the perfect fit for your gold investments.

Browse our selection of bullion products and view the gold price on our website, or visit one of our showrooms to see our products in person. Our knowledgeable and friendly consultants will be happy to help you choose the right investment option for you. You can view images and videos of our products on our website and see each gold bullion item in person at one of our showrooms.

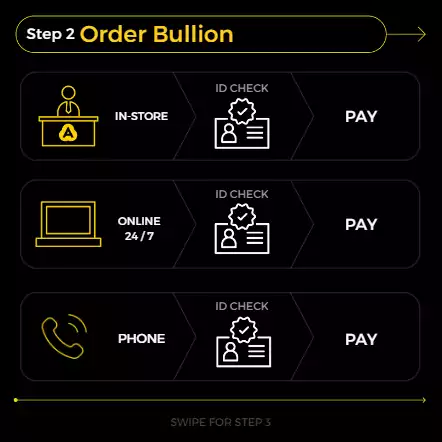

Step 2: Buy Your Bullion

Purchasing gold with Ainslie Bullion is easy! You can do it online, over the phone, or in-store using your preferred payment method. We can accommodate your gold investment through the payment of cash or bank transfer . Our website allows you to view the gold price and assess past performance before placing an order.

If you prefer to place your order over the phone, one of our consultants will assist you and send you an invoice for the full amount. In-store purchases can be made with cash, card or PayID, and you can take immediate delivery after payment. Visiting our store is a recommendation for first-time investors as it gives them a chance to see the store and handle all of the physical gold options.

The comfortability of a face-to-face consultation can help to ease any nerves for first-timers, as well as giving them a chance to verbalise their investment strategy.

Keep in mind there may be some ID requirements that need to be met before the collection or delivery of your gold bullion.

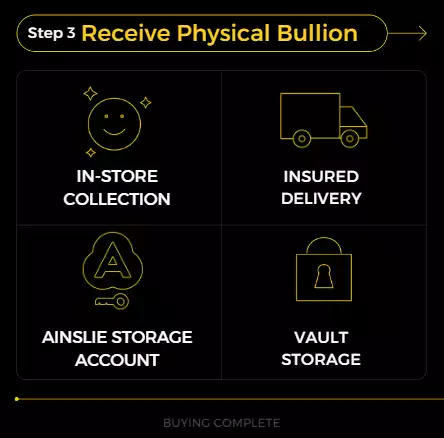

Step 3: Pay and Receive Your Bullion

For all gold investors, we accept a 10% deposit for online orders and secure the remaining 90% payment through our website's safe payment methods. Alternatively, we offer PayID as a fast and secure payment option for you to pay the full balance immediately.

For in-store purchases, you can take immediate delivery after payment. For phone orders, we'll send you an invoice for the full amount, and you can make your payment via bank transfer. Once your order is fully paid, we'll hold it for pickup within 30 days or securely and discreetly pack and deliver it to your address fully insured.

You can also opt for the 'remote control' convenience of a secure and fully insured Ainslie Storage Account. Alternatively, you can store your bullion in your own safe with our partner vaults, Reserve Vault and The Melbourne Vault.

Our delivery options ensure the safety and security of your investments, and we'll inform you when your items are available in the vault. Our aim is to make buying physical gold easy and comfortable for new and experienced investors.

Experience a new way of owning physical gold with Ainslie's Gold and Silver Backed Tokens - Gold Standard (AUS) and Silver Standard (AGS)

Gold & Silver Standard's Gold Standard (AUS) and Silver Standard (AGS) tokens are the perfect blend of traditional bullion investment and the security, ease of storage and transferability afforded by modern blockchain technology.

Built by Ainslie, each token is backed 100% by real gold bullion and silver bullion stored, insured and audited in our secure partner vaults. With the convenience of a crypto token, buying gold and selling gold has never been more liquid.

Many investors look to buy gold indirectly, this provides them with a convenient opportunity to have some gold exposure in their portfolio, while not needing to buy the actual physical precious metal.

Begin your journey in the gold industry with confidence, and trust Ainslie as your source for physical bullion investment. If you have any further questions about owning precious metals such as gold bullion bars and coins, we're here to help!