How Long Until the Elusive $2000/kg?

News

|

Posted 24/07/2025

|

2470

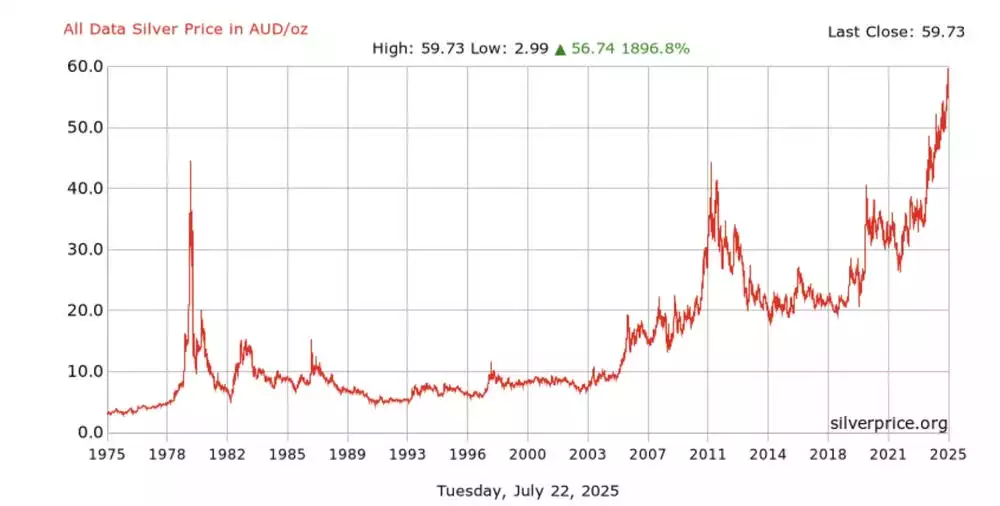

Australian silver continues its steady ascent, although gains have been moderated by a strengthening Australian dollar. Yesterday morning, silver hit a new all-time high of AU$60.07/oz on the spot market. The much-anticipated AU$2,000/kg milestone will be reached once silver hits $62.20/oz.

In USD terms, silver still sits below its historic high of $50.35 on January 18, 1980, and $49.50 on April 28, 2011; suggesting room for further upside, particularly if rising investor interest and growing industrial demand continue to deepen the structural deficit.

So, what needs to shift for this milestone to be met, silver or the Australian dollar?

USD Silver

Silver in USD terms remains just below key psychological resistance. As it edges closer to the $40/oz mark, it’s worth remembering that in both previous instances silver touched this level; a sharp rally to $50 followed. The question isn't if, but when, the $40 threshold breaks.

Unlike previous surges, recent gains haven't yet sparked the same level of investor enthusiasm. But with silver's 70% industrial demand, even modest investor inflows can move the market significantly, given its relatively small size. The current structural deficit—driven by demand from AI, EVs, and solar technologies—continues to widen, and any fresh capital inflows are likely to accelerate price gains.

As Rhona O'Connell, StoneX Head of Market Analysis for EMEA & Asia, recently told Kitco:

“Whether or not silver really takes off above $40 remains to be seen, but it is worth noting that quite often what happens is we get a breakout in silver and we get a huge rush forward. Silver is a very volatile momentum-driven market. So that is worth paying attention to.”

AUD Silver

Aussie silver is less straightforward. Movements in the silver price are either offset or amplified by AUD/USD fluctuations.

Both the Federal Reserve and the RBA have held off on rate cuts, and so far, that caution appears justified. In Australia, the RBA has cited a strong labour market as its reason to hold. However, this month’s unexpected jump in unemployment has shifted expectations—markets are now pricing in a 91% chance of an August rate cut.

The US outlook is murkier. Fed Chair Jerome Powell appears inclined to hold, wary of tariff-related uncertainty, even as consumer sentiment continues to deteriorate. Yet political pressure from Trump, including threats to remove Powell, has weakened the USD despite the Fed’s cautious stance.

If the RBA cuts before the Fed, we may see the AUD fall further—providing tailwinds for AUD silver prices. In fact, thanks to long-term AUD weakness, silver is already at record highs in local terms, while the USD equivalent remains below its peak.

With all signs pointing towards continued strength, the long-awaited $2,000/kg mark may now be just days or weeks away. Only time will tell.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=fur0fM_UCnY