How Inflation Funds Our Governments

News

|

Posted 22/01/2025

|

2509

The current U.S. Government debt is $36.22 Trillion ($36,220,000,000,000) which is about 123% of their entire Gross Domestic Product (GDP). In 2024, the U.S. government paid a record setting $1,126 billion just in interest payments on this debt - while the entire defence budget during this time, was $841 billion – making the interest payments on government debt 1.33 x the military defence budget of the nation.

So how are they managing this over the long term - and where does it lead everyday people?

While governments talk a lot about fighting inflation (especially around election time) in reality, a highly indebted government is highly dependent on inflation, over the long term, to reduce the value of their debt. We have always been told that 2% a year is considered “healthy” - however healthy for whom?

With banks in Australia yielding an average of 3.3% interest on term deposits over the last 20 years - and the average inflation rate over this time at 4.88% - the hardworking, diligently saving Australian with term deposits building up year after year, has lost their purchasing power over the long term.

Inflation is simply an increase in the money supply (liquidity). As the supply of dollars increases, all else being equal, the value per dollar unit falls. For a government in debt, to remain solvent, without cutting spending, the interest rate that the Central Bank sets (which affects both, our bank interest - and the interest paid on Government debt) must be lower than the inflation rate (or the rate at which the currency loses value) - as this is also the rate at which the currency denominated government debt loses its value.

Over a long timeframe this allows governments to keep spending (as cutting spending is political suicide) while increasing government debt and not going bankrupt. Therefore, inflation is simply a form of stealing from hard working people (who save their money in dollars), to fund the government’s desire to stay in power.

Over the long term, interest earned by bank deposits, will always underperform against the inflation rate, and will result in purchasing power reducing. The simple solution to this is to hold wealth in hard assets, which hold their value over the long term, rather than in currency, which loses value due to unlimited supply.

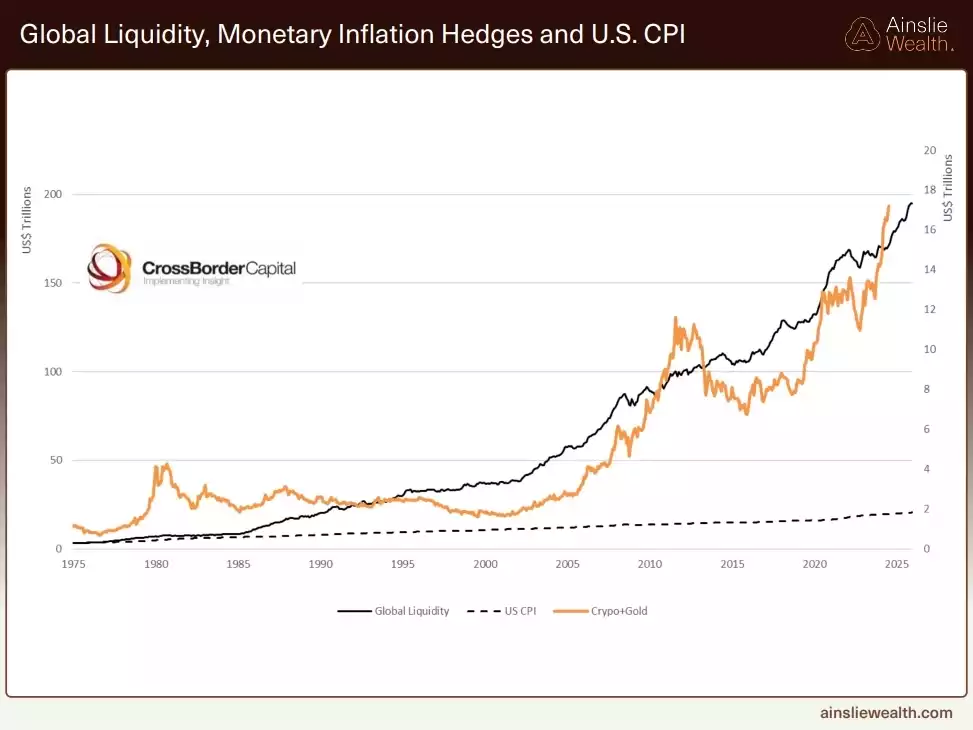

This is reflected in the difference between consumer price inflation and asset inflation.

The chart above shows the increase in global liquidity (dollar supply) moving in line with the value of gold - this represents asset inflation. The gap between consumer inflation and asset inflation (dotted and solid black lines) is a visual representation of the wealth gap - widening over time. Those who hold assets maintain their purchasing power, while the vast majority who hold dollars, lose purchasing power - to fund their governments.

While the Australian dollar has unlimited supply, it also takes no energy to produce - so it has no intrinsic value. Because of this it is technically not “money”, we refer to it instead as “fiat currency” (fiat - from Latin, “by decree”) - i.e. - only has the value assigned to it by authority.

Gold on the other hand has the essential properties of money (uniform, divisible, portable, energy to produce, limited in supply) and with thousands of years of financial history, it has held its value consistently.

What 1oz of gold purchased in Roman times in terms of goods, is very similar to what 1oz of gold will purchase today. The Roman currency, however, was inflated away to the point where the army no longer accepted it as payment, to defend the empire.

Entire civilisations, their currencies, and their banks have come and gone - but gold being the money God assigned to us is eternal, reliable and consistent. While a bank deposit does not protect against the loss of purchasing power due to inflation - gold has done this for thousands of years. While most save in term deposits, the astute savers will save in gold and silver instead.

The average interest on a bank deposit over the last 20 years has been 3.3% and the average inflation rate has been 4.88% - gold has returned an average return of 10.5% over this time.

While the additional 7.2% annual return helps maintain one’s purchasing power against inflation, the long-term compounding effect of this is enormous, understated, and can sometimes be difficult to imagine. Let’s look at some numbers to reflect the long-term impact of saving in gold vs saving in a bank term deposit.

|

Initial Investment

|

Monthly DCA

|

Years

|

Final Value Gold

|

Final Value Savings account

|

Difference

|

|

$2,000

|

$200

|

5

|

$18,922

|

$15,430

|

$3,492

|

|

$2,000

|

$200

|

10

|

$46,801

|

$31,281

|

$15,520

|

|

$2,000

|

$200

|

20

|

$168,396

|

$72,068

|

$96,328

|

|

$2,000

|

$200

|

30

|

$498,414

|

$128,885

|

$369,529

|

|

$2,000

|

$200

|

40

|

$1,394,110

|

$208,030

|

$1,186,080

|

|

$4,000

|

$400

|

5

|

$37,845

|

$30,860

|

$6,985

|

|

$4,000

|

$400

|

10

|

$93,602

|

$62,562

|

$31,040

|

|

$4,000

|

$400

|

20

|

$336,792

|

$144,137

|

$192,655

|

|

$4,000

|

$400

|

30

|

$996,828

|

$257,771

|

$739,057

|

|

$4,000

|

$400

|

40

|

$2,788,220

|

$416,060

|

$2,372,160

|

|

$6,000

|

$600

|

5

|

$56,767

|

$46,290

|

$10,477

|

|

$6,000

|

$600

|

10

|

$140,404

|

$93,843

|

$46,561

|

|

$6,000

|

$600

|

20

|

$505,188

|

$216,206

|

$288,982

|

|

$6,000

|

$600

|

30

|

$1,495,243

|

$386,657

|

$1,108,586

|

|

$6,000

|

$600

|

40

|

$4,182,331

|

$624,091

|

$3,558,240

|

We can clearly see a significant long-term impact of saving in a hard asset like gold. Ainslie Saver is a simple solution to save in gold and silver over the long term - helping facilitate the numbers shown in the table above.

It appears that the central banks, influenced by the governments drowning in debt, want and need inflation over the long term. As all other forms of tax have proven insufficient to fund our government’s spending addiction, it is the hidden form of tax, i.e. inflation, which is proving to fulfil their fix - but how long does this last and where does it lead?

Over centuries, this strategy has led to currency collapse or hyperinflation.

“Paper money eventually returns to its intrinsic value, zero” - Voltaire.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=qQ1PHPDvLsk