How Gold Could Save the US Debt Ceiling Default

News

|

Posted 15/05/2023

|

9682

As the US is staring at the debt ceiling limit like a deer in the headlights, few know there is an easy fix involving gold and fewer on what that means for the world’s oldest money.

Unless you live under a rock, all eyes are on the US as it is possibly just 2 weeks away from hitting its debt ceiling. We last spoke to this here and discussed it on Insights here. The public focus and understanding of the US Fiat Ponzi scheme is gradually widening as such an event spotlight has more and more people listening to their guts as their guts scream ‘something’s not right here…’. The fact that the US now spend more on interest payments on their $23 trillion debt than their massive defense budget speaks volumes. But whilst the odds of them actually not raising the ceiling are very low, the impact of them not doing so is so catastrophic that one can’t be complacent. Those ‘odds’ are now sitting at 4% in the market, the highest on record. The implications are also the highest on record.

However, there is a relatively simple fix. The US Treasury reportedly (though never impartially verified) holds over 8,000 tonne of gold in reserves. In 1934 they revalued it to $35/oz to create more of their then gold backed currency. In 1953 President Eisenhower, faced with the same problem as now but congress missing the deadline, was forced to raise the price of gold held in reserves to “42 and 2/9 dollars per ounce” or $42.22.oz to prevent default. Now to be clear, the market spot value of gold right now sits at USD2011/oz; far different to $42.22…

And so, the US Treasury could simply, right now without any Congressional vote, issue the Fed a new valuation of its gold at, say $2000/oz, and instantly unlock just over $500 billion of ‘new money’ without raising the net debt. Called ‘mark to market’, businesses do this all the time.

$500 billion of course buys a little time but you will note is still relatively small compared to the $23 trillion owed and a government routinely booking annual deficits of over twice that. Herein lies the core issue. To use such a mechanism highlights the concept of real money to an increasingly ‘aware’ public and the reality of Fiat currency which, by definition is ‘money’ backed by nothing but the word of (and faith in) the government. Faced with the choice of holding said real money, gold, versus US Treasury bonds which are staring at default and hence no longer the ‘risk free asset’ once their basic value proposition, you can see why this is such a big deal and why the government doesn’t want to lose control of the narrative and certainly highlight gold’s real value to the public.

One of gold’s key value propositions is the fact that such an extraordinarily low percentage of investors hold the physical product, something like 0.5%. The total investable amount of gold in the world is around $1.5 trillion. Events such as this, whilst 4% is still such very low odds, could see just a fraction of the $350 trillion of other assts move into that physical gold space.

Unlike Treasuries and USD, more gold cannot simply be created out of thin air, it’s supply expands by just 2% per year and a big chunk of that is snavelled up by central banks (as we have seen record amounts in the last year) leaving even less. Demand is increasing and that is before any such ‘event’. Economics 101 defines the direct relationship between supply, demand and price.

As a closing thought, imagine what gold would need to be revalued to so as to offset all this credit based, Fiat system largesse?

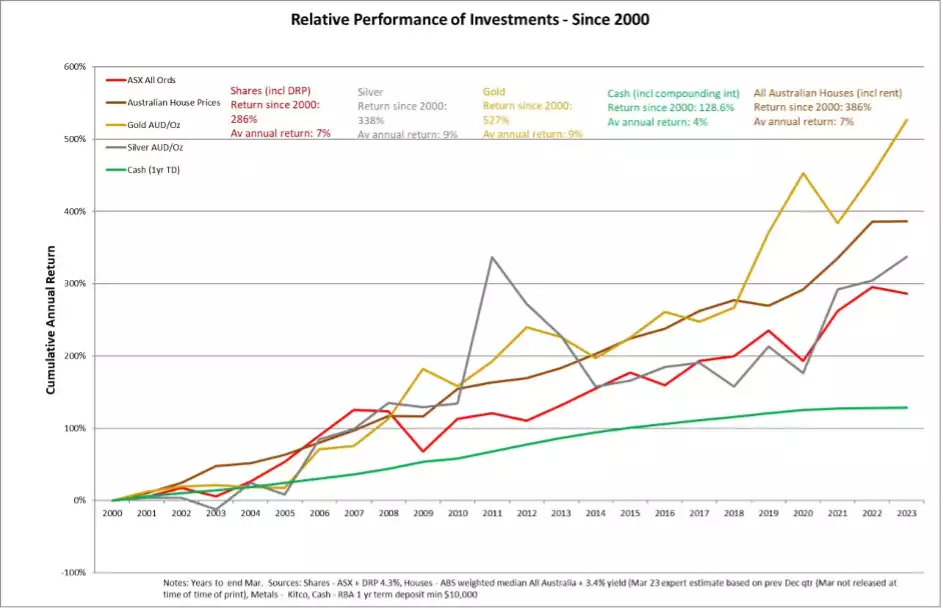

Finally, much of the above may feel like gold, as ‘insurance’, may be a ‘boring’ performer in normal times, if such times now exist. There are of course the detractors that scream ‘gold doesn’t yield and therefore is not an investment’. The chart below shows the relative performance of gold and silver against the ASX200 including dividend reinvestment plans, Aussie median houses including rent, and cash in a 1yr term deposit with compounding interest. In other words, apples for apples as ‘yield’ taken out of the equation. If your eyes aren’t great, the yellow line at the top is gold. Your ‘insurance’ outperformed your risk assets since the turn of this century. And that is before whatever the end outcome of this credit cycle is…