Houston, Your Dollar Has a Problem – Signs of USD Failure

News

|

Posted 26/05/2023

|

10323

Gold and Silver’s rally since November last year has been in lock-step with the decline in the USD. That’s not a huge surprise as the 2 often enjoy an inverse correlation. However, since the debt ceiling debacle got taken seriously around mid May the USD, some would argue counterintuitively, has been bid whilst US Treasuries have lost that safe haven bid given they are the centre of that very default risk. The other safe haven, gold, has battled the strengthening USD and safe haven trade with the USD winning, sending gold lower from its USD2050 high in early May. However, debt ceiling aside, the USD appears in secular decline. Beyond price there are multiple indicators that this is not a short term trend.

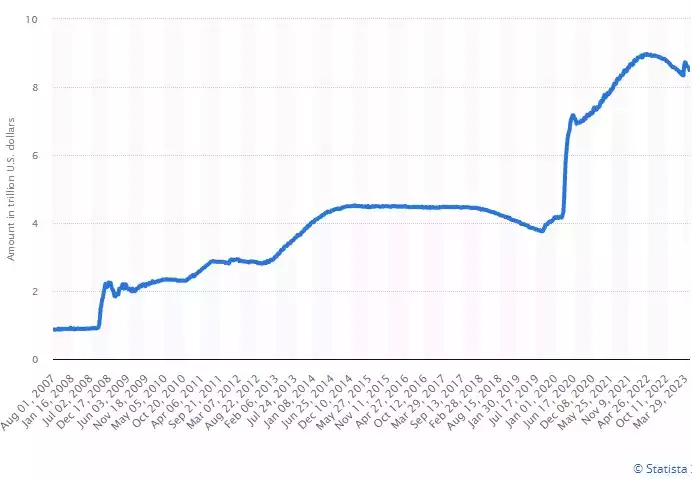

Where gold gets its inherent value is its scarcity. Its supply grows at barely 2% per year. The USD on the other hand has been printed / expanded since the GFC and more particularly COVID at a staggering rate. The chart below shows that the US Fed has created over US$8 trillion out of thin air (well debt actually). You will note before the GFC they had created a little over $800 billion over the near century since they were created in 1913. So in just 16 years they have expanded supply of USD by around 800%... Those mathematician readers will note 800% is a little larger than gold’s annual 2% increase…

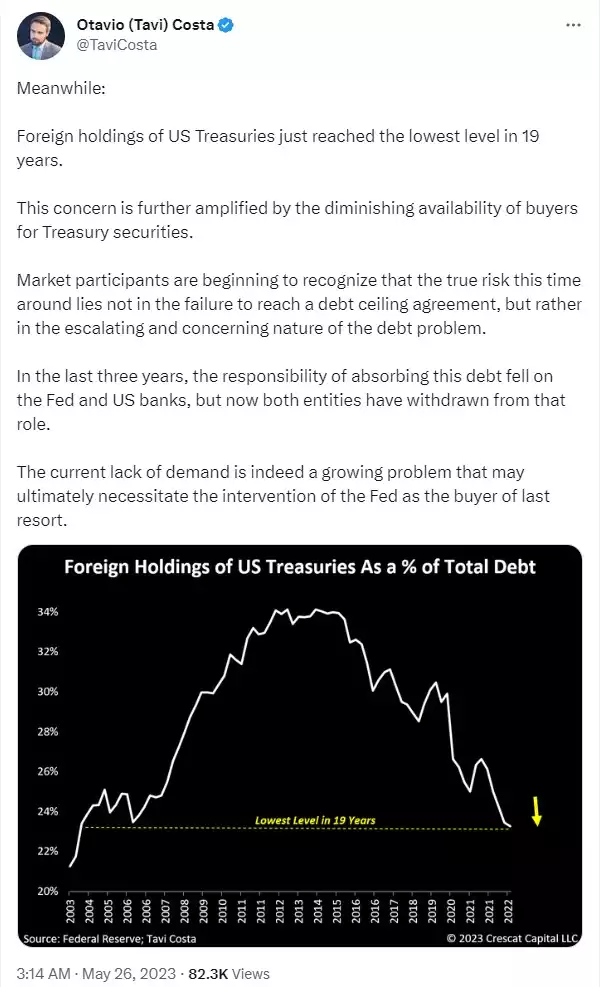

Crescat Capital’s Tavi Costa just tweeted that this is clearly about to start again…

We think this is absolutely bang on. Why is everyone talking about the ceiling being the problem when it’s the debt itself that is very very clearly the problem!? If a heroin addict is out of money, is the debate about whether to give him more money to buy more, or his heroin problem?

The US has a debt problem and its only way of dealing with it is to print more USD to service it (interest payments are now bigger than their massive defence budget), but perversely increasing the debt in the process. Hence why Ponzi scheme is often used to describe the situation. It should be no surprise then that this could lead to a confidence problem in the USD itself as the world’s reserve currency. Confidence, remember, is ALL that underpins ANY Fiat currency as Fiat currency is backed by nothing but confidence in the government promising (cross their heart, hope to die, white rabbit) to fulfill that promise.

As George Bernard Shaw famously quipped..

"You have to choose [as a voter] between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold."

But for all the calls for the immediate and spectacular end of the mighty USD hegemony, the reality is probably a more drawn out process rather than an ‘event’. Bloomberg macro strategist Simon White wrote to this phenomenon this week.

“Dollar demand for trade, FX reserves and cross-border credit has remained weak despite lower prices, underscoring that the US currency’s hegemony has peaked.

It’s become fashionable of late to predict the demise of the dollar. The US’s weaponization of its currency and the rise of China has led many to write the USD’s epitaph.

But as Oscar Wilde remarked, the truth is rarely pure and never simple. The dollar is going through a transition, but it is one that will be gradual. It is not about to be, or likely to be any time soon, supplanted by another currency. But there are mounting signs its luminescence has peaked, and we are moving toward a more multi-polar world.

When we say the dollar’s hegemony has peaked, we should be clear about what we mean. Hegemony is not about price, it is about the dollar’s place in the global financial and economic system. With the currency accounting for 40% of export invoicing, 45% of cross-border bank claims, 60% of FX reserves and 90% of FX transactions, it will take years before it’s dominance is seriously challenged.

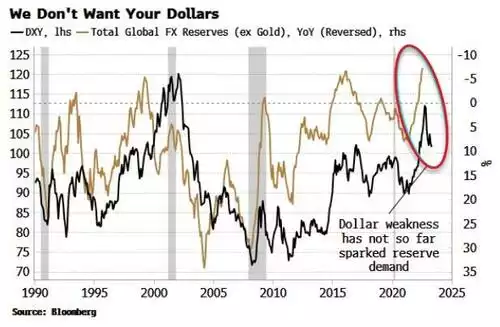

Nonetheless, that process looks to have started, as following four charts demonstrate. In short, demand for the dollar is not rising as it normally would in response to the currency’s near-10% decline since October.

The first chart shows this clearly.

Typically, declines in the dollar coincide with greater demand for FX reserves, as other countries try to limit their currency’s appreciation. But this has singularly failed to happen so far in this cycle. That corroborates the narrative of especially EM countries desiring to lessen their exposure to dollars should they ever face Russia’s fate and see their reserves frozen.

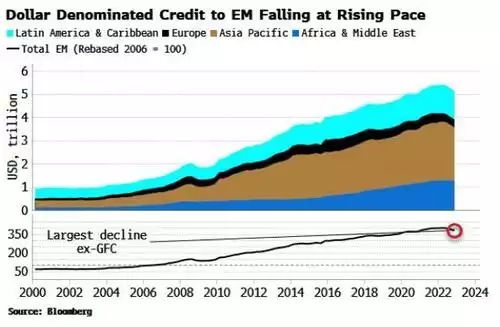

This is emphasized in the next chart of dollar-denominated credit to EMs. After decades of steadily increasing, it is now falling at the fastest annual rate yet seen outside of the GFC.

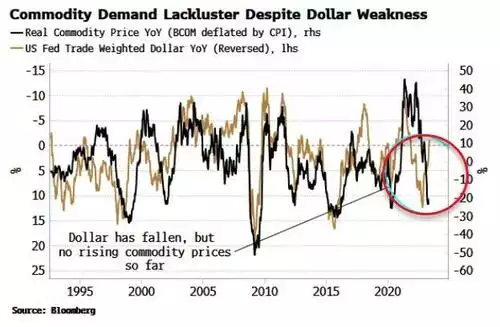

We are also seeing dollar aversion in commodities. Almost all major commodities are traded in US dollars. Therefore its gains and losses tend to depress or stimulate demand for commodities and thus impact their price.

But the recent fall in the dollar has not stimulated any extra demand for commodities or led to higher prices. This is not to say commodity prices will not rise - the key message is that they have not already done so.

Of course, depressed commodity prices may also have to do with the state of global demand, but world growth is not especially weak at the moment, while liquidity indicators suggest we are on the cusp of a global cyclical upturn.

Either way, this chimes with the narrative that countries such as China, India, Russia, Saudi Arabia and others are moving away from a dollar-centric trading system (with, for instance, ruble-yuan trade increasing eightfold since early 2022).”

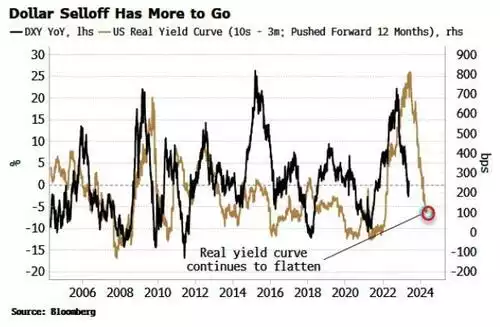

“From a tactical standpoint, the dollar is likely to remain in a medium-term downtrend (notwithstanding debt-ceiling shenanigans which are currently giving a bid to the currency, and position-covering risk from speculators’ net short).

That downtrend can be seen in the real yield curve, one of the best leading indicators for the dollar. This gave a strong indication it was about to peak in October. The curve continues to trend lower suggesting the dollar should keep doing likewise. Several other reliable leading indicators for the currency give the same message.

Whether continued dollar weakness will eventually kick-start demand for dollar-denominated reserves, credit and commodities remains to be seen. But the lack of reaction so far is telling.

It will not be easy for any other currency to step into the dollar’s big shoes. Deep and liquid capital markets, an absence of capital controls, and a willingness to accommodate the rest-of-the-world’s imbalances are prerequisites for global-reserve status. No other country or region is currently in a position to do that.

But it is becoming clear that even though the US currency will retain its dominance for a while yet, the international order is changing, and the dollar’s role within it.”

That fall in real yields is, for the same reason, constructive for the gold price too. Again, indicating this debt ceiling blip is likely to reverse and gold continue its rise. We discussed gold and real yields in greater depth recently here.

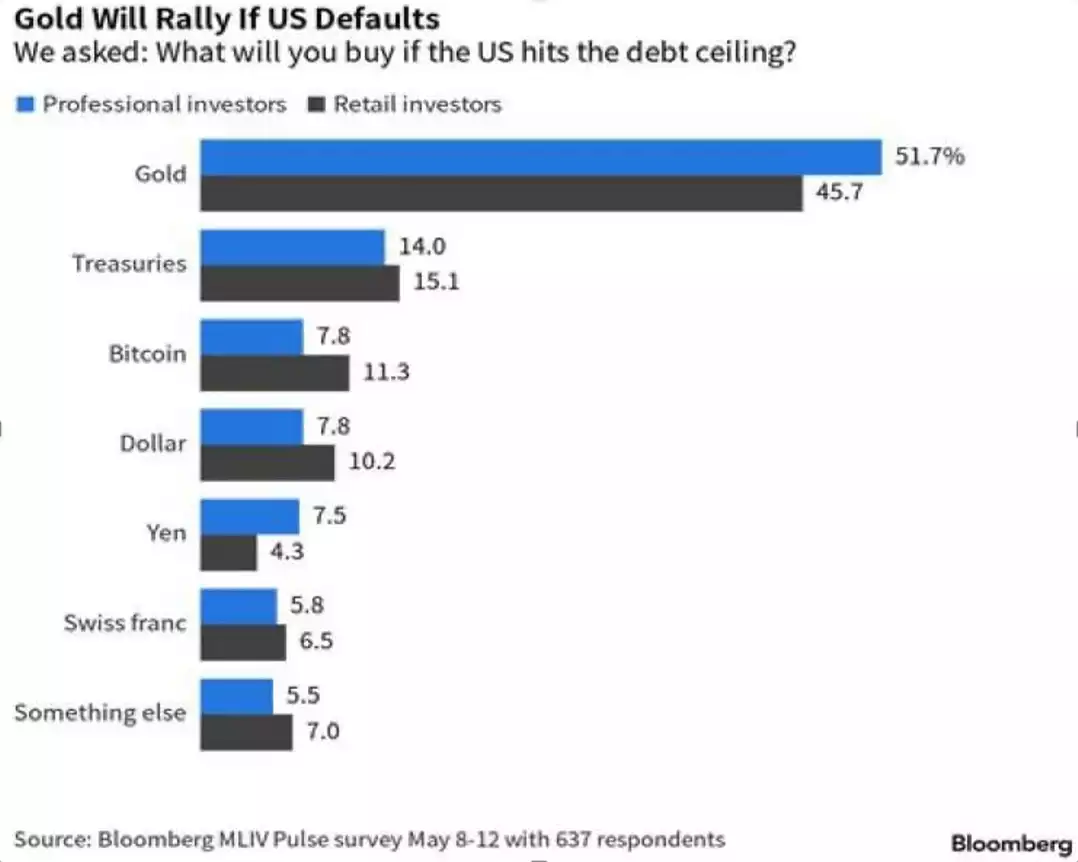

Of course if the debt ceiling is not resolved, this ‘blip’ will reverse in spectacular fashion and likely see a massive move up in gold. The current corrective pause in the gold price (albeit the falling AUD masking most of it for Aussies) is therefore of no surprise and the fundamentals appear to remain incredibly constructive for more gains to come.