Hot Sticky Mess – What’s happening with NZ?

News

|

Posted 23/11/2022

|

11413

Our neighbour New Zealand is currently highlighting the issues Australia may see get worse if we don’t heed the precedent. We discuss the battle between government and central bank, inflation and a housing market falling after all that stimulus…

What’s happening in NZ

The wheels are falling off – the Adern government is not only losing popularity, dropping from 33% to 30% in August. Last night the former NZ deputy prime minister Winston Peters severed ties with Arderns’ government, promising to never support the government while she is in charge.

The RBNZ faces a tough but inevitable decision today as they do their job to reduce inflation with the only ammunition they have, while the NZ policy settings exacerbate inflation and cause a wage and currency driven inflation spiral – a hot sticky mess.

RBNZ decision day

The RNBZ will announce their interest rate decision, with the current market surveys suggesting 75bps hike on Wednesday, markets currently priced in 64.8bps worth of a hike.

Recent data doesn’t paint a clear story; last week’s PPI numbers were worse than expected and showed marked contraction, however last month’s CPI (which was after the RBNZ’s last meeting) showed an increase in consumer inflation of 2.2% for the third quarter (1.5% expected and 1.7% prior).

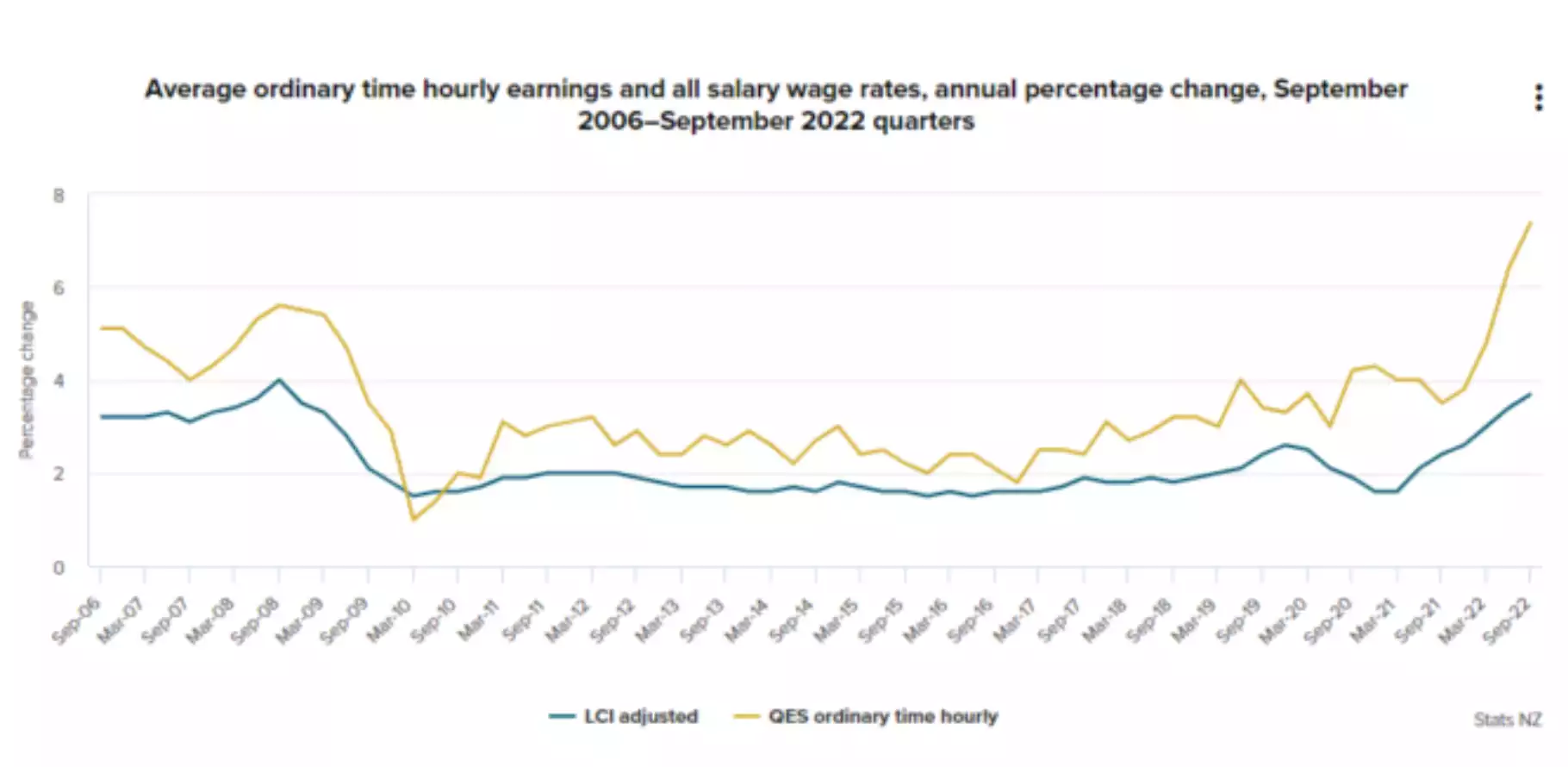

The RBNZ is facing a huge inflation push from unprecedented wage growth, with the September quarter wage growth coming in at 2.6%. NZ businesses have no option but to pass these rises in the product selling price exacerbating inflation.

Policies Exacerbating NZ Issues

The RNBZ now seems to be facing a wage-push inflation spiral, with the government’s immigration policy causing massive labour shortages and large wage increases. This is after their Covid 19 response, much like Australia and the rest of the world was to flood the economy with cheap credit – however NZ lived a mostly undisturbed covid life, with minimal lockdowns (outside of Auckland), this meant the demand shock was larger than most other countries and inflation has been far greater.

Currently the 2-year NZ swap rate is sitting above the US by about 0.3%, however as the world inflation begins to slow, in NZ there has been no respite, so in 12 months this differential will be above 1% pushing the NZ dollar higher and therefore further inflation.

Mortgage Stress

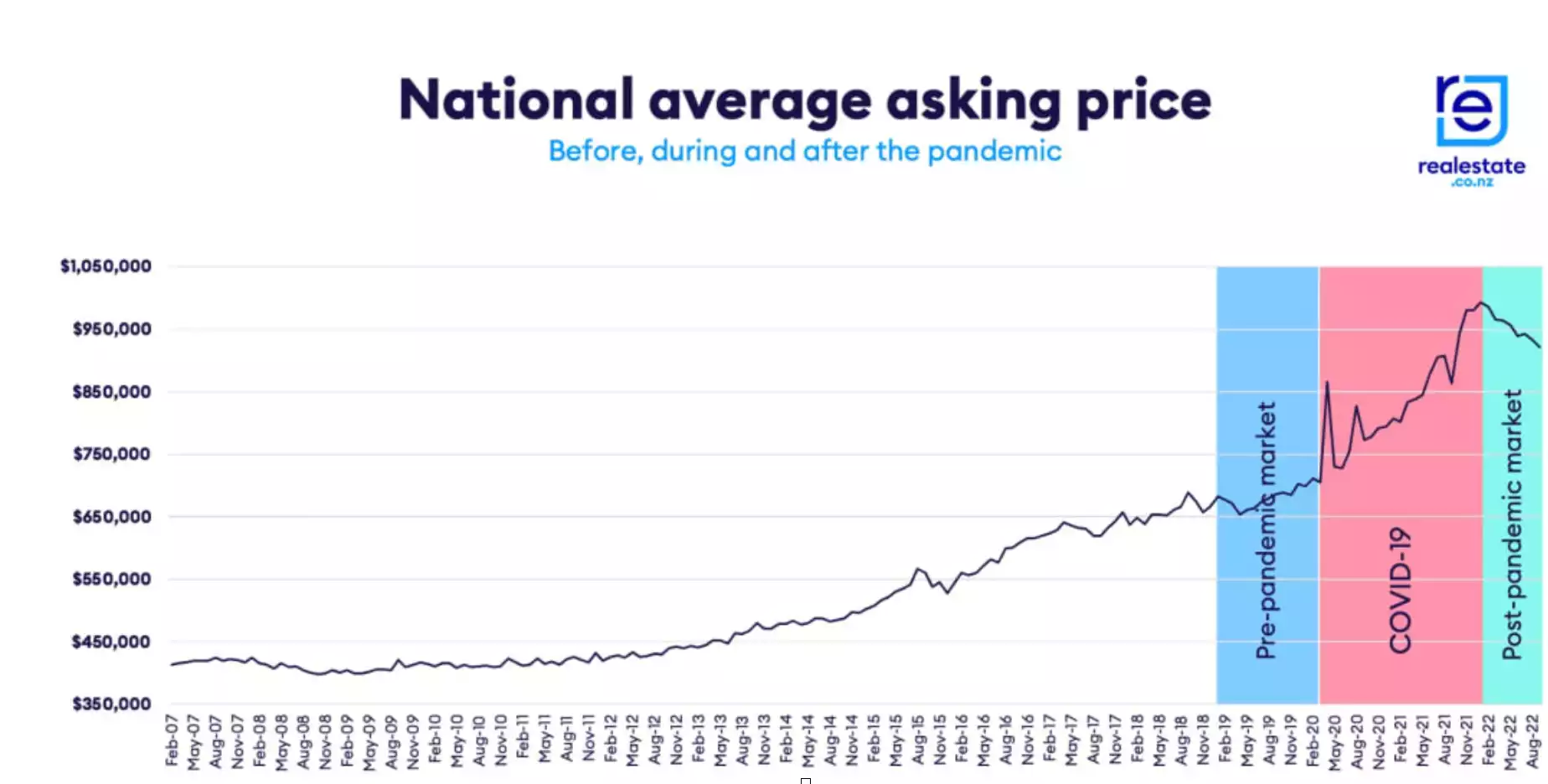

NZ mortgage rates are now at 6.99%, with the RBNZ cash rate at 3.5% - to put this in perspective the last time rates were this high in NZ was around 2008, as the world entered the GFC. As we’ve looked at previously, NZ had the highest, unprecedented house price growth over covid due to their island safe haven status. Further delving into this, in 2009 the average NZ home was around $430,000 and towards the end of the covid growth cycle peaked at over $1,000,000 – 230% growth. During this time average wages only grew around 2% per annum or c35% over the same period. More recently NZ has seen a large tick up in wage growth at around 5%– but this is due to labour shortages, a worldwide phenomenon mainly driven by the long visa processing times, unlike similar countries like Australia who has eased this bottleneck to help labor shortages. These will be reduced over time putting downward pressure once again on wages.

So what does this mean. New Zealanders are paying mortgages 230% higher than 2009 with 35% higher wages – hard to imagine – and this is about to get worst with the expected 50-75Bp interest rate decision from the RBNZ today.

More recently house prices have started to understandably decrease, dropping 9.7% in 2022. At this rate this will soon trap many buyers in negative equity.

*Source: realestate.co.nz

Hot sticky inflation mess

NZ appears to be one of the hottest inflation markets in the world… and due to fiscal settings of the Ardern government it is creating a hot sticky inflation mess.

Once again – without governments working WITH their central banks and setting fiscal policies to relieve pressures – central banks will continue to fire their monetary guns decimating businesses and individuals alike. House prices have started to decline at a rapid rate and mortgage stress is on the rise, as real wage growth is nearly 200% behind house price growth. With the RNBZ already raising interest rates 2.75% this year and an expected 0.75% today – at an average mortgage of $360,000 this has increased repayments by $825 per month. Today’s decision will increase them by an additional $225, totaling $1050 per month.

Australia faces similar pressures with our RBA much slower to act than RBNZ allowing us to observe what happens with the action/reaction precedent of NZ. Whether we follow the same road remains to be seen and ultimately again comes down to whether Chalmers and Lowe act in unison or in a tug-of-war with our economy and housing market in between.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************