Honey They Shrunk the Aussie Dollar

News

|

Posted 08/12/2021

|

9753

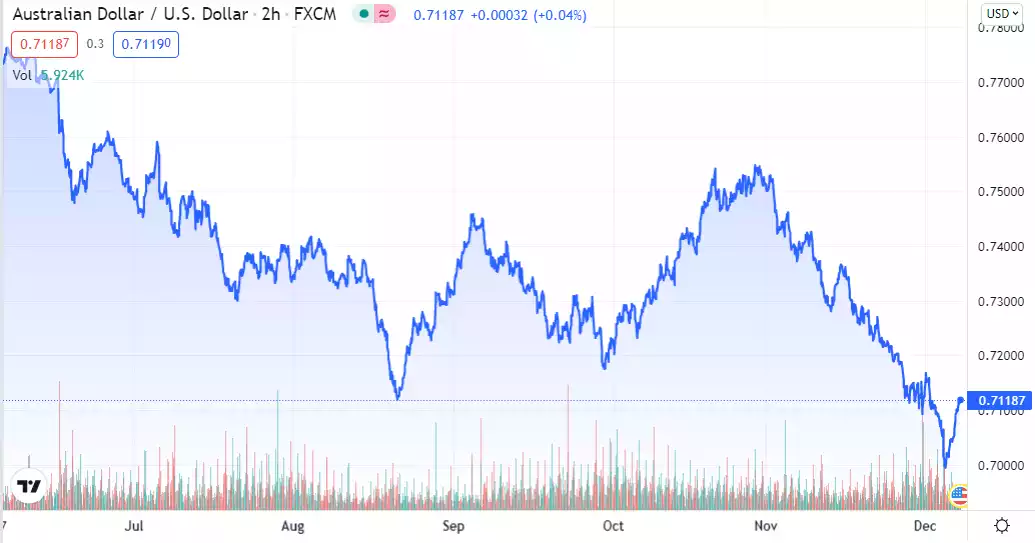

As we wrote earlier this week the AUD has been on a bumpy slide ever since June, and with earnest down to a 60 handle this week from the beginning of November.

Yesterday saw a reversal on the back of the news that China’s central bank cut their RRR (reserve requirement ratio) for banks by 0.5% and so unleashing $188b of liquidity into the market as they try to counter the downward pressures on their economy from their property collapse. Whether that small rebound is sustainable remains to be seen. Whilst supportive of the AUD in the short term, the move highlights the structural economic issues within China, our biggest customer. A deteriorating China is not good for the AUD.

That rising AUD has given Aussies the perception that spot gold has been falling whereas the USD spot price has held reasonably firmly at around $1782 over the same period. There is another consequence of the AUD moves and that is interest rates.

ABC News ran the article last night “How the falling Australian dollar could affect interest rates”:

“So why do we care if the dollar moves?

Because changes in the dollar influence the prices we pay for imported products, and therefore inflation.

That is, the lower the value of the dollar, the more of it we need to buy something made in another country.

"If it falls 10 per cent, then all things being equal, imported prices rise 10 per cent, and they are about 20 per cent of the CPI, so spread over a year, it would add 2 per cent to prices," AMP Capital's Shane Oliver says.

The dollar has been falling, so if it keeps losing ground, it will add to already existing inflationary pressure.

And the higher the level of inflation, the more likely it is that the Reserve Bank will bring forward its first increase in the cash rate.”

Inflation is often called a psychological as much as monetary phenomena. When people believe prices in the future will be higher than they are now, they are more likely to buy their desired goods now not later… inflation. Conversely when people think prices will fall they will wait and pay less in the future….deflation. You can see why central banks hate deflation. It becomes a brake to the economy and if you are custodian of massive debt, you can’t inflate that debt away either. From a strictly monetary standpoint, inflation is simply a factor or more (printed) money chasing the same amount of goods. That has most certainly been the case for financial assets and is now playing out in consumer land too.

In Australia we have the additional issue of low wage growth meaning that inflation, when combined with near zero interest rates, means there is a direct erosion of the ordinary Australian’s wealth. Added to that we have one of the highest personal debt levels in the entire world, and largely courtesy of home loans. Raising rates may be the traditional answer to slowing inflation but what if a large chunk of what’s driving inflation is at the supply side not demand? What happens when you raise rates amid record debt and moribund wage growth? As the ABC article concludes:

“And that's the crucial point. A sustained build-up in inflation will bring forward a Reserve Bank monetary tightening cycle.

The major banks have begun raising the interest rates on their fixed-rate mortgages.

In some case they've worked through three or four tightening cycles in the past few months.

You can see where this is heading, right?

Analysts fear a scenario of a falling dollar contributing to higher sustained inflation which sees the Reserve Bank raising the cash rate much earlier than predicted.

That would push variable rates higher which would further put upwards pressure on fixed rates.

The hope is that all of this coincides with higher economic growth and falling unemployment, but what if it doesn't?”

Just as we discussed last week, gold’s allure as a preserver of wealth shines in such an environment. Money in the bank is literally giving a negative return as inflation far outstrips the tiny interest return you receive (then take of tax and fees etc). As the dollar drops that just gets worse. Conversely, as the AUD drops you get a directly proportional increase in the value of your gold.

As the ABC article rightly concludes, there is no definite answer in this crazy COVID responding world. It’s all about balance, or more pointedly, diversification.

The old adage of not having all your eggs in one basket has never been more important. However in this world dominated and distorted by artificial monetary stimulus it is critical to look more broadly at that basket metaphor. Those distortions have broken some historical financial correlations… and correlation is the key word for balance. You need to look at your portfolio and see if what you think is ‘balanced’ is actually a basket of correlated assets. i.e. if one goes down, they all do. That’s not balance. Gold continues to provide that lack of correlation and importantly too, silver is different again.

The following image paints a thousand words. There is little point in having your wealth in different baskets if they are all in the same truck! This big crazy stimulus fuelled truck is snowballing and the inevitable crash is coming. Don’t have everything in the truck…